* Any discussion of taxes is for general informational purposes only and does not purport to be complete or cover every situation. MetLife, its agents and representatives may not give tax advice and this website should not be construed as such. Please seek advice based on your particular circumstances from a qualified tax advisor.

1 Earnings within your GVUL coverage grow income tax-free while the policy stays in force. Money allocated to the variable investment portfolios is subject to market risk, and when redeemed may be worth more or less than your original investment. Please consider your investment time horizon, tax rates, and the effect of fees and expenses, including any premium expense charge, when evaluating the benefit of GVUL tax deferral. See your Prospectus and Certificate for complete information.

2 To the maturity age specified in your certificate. In some program designs, if your employer replaces MetLife GVUL with another group life insurance plan or otherwise terminates the MetLife group contract, your coverage may also be terminated, even after separation from employment or retirement. If you have ported or otherwise continued your coverage after retirement or separation from employment and the plan sponsor later terminates the group policy, cost of insurance rates may increase as a result of such termination.

3 Cost of insurance rates are determined using methodologies that vary by company. These rates can vary and will generally increase with age. Rates for active employees may be different than those available to terminated or retired employees. It’s important to look at all factors when evaluating the overall competitiveness of rates and the value of life insurance coverage.

4 If you choose to apply for increased coverage, the increase may be subject to underwriting. MetLife will review your information and evaluate your request for coverage based upon your answers to the health questions, MetLife’s underwriting rules and other information you authorize us to review. In certain cases, MetLife may request additional information to evaluate your request for coverage.

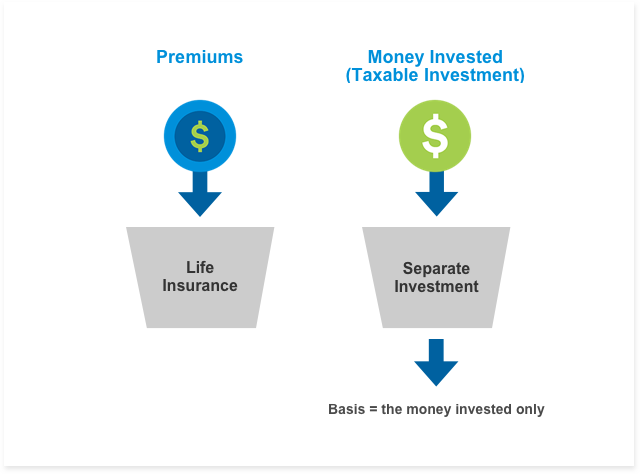

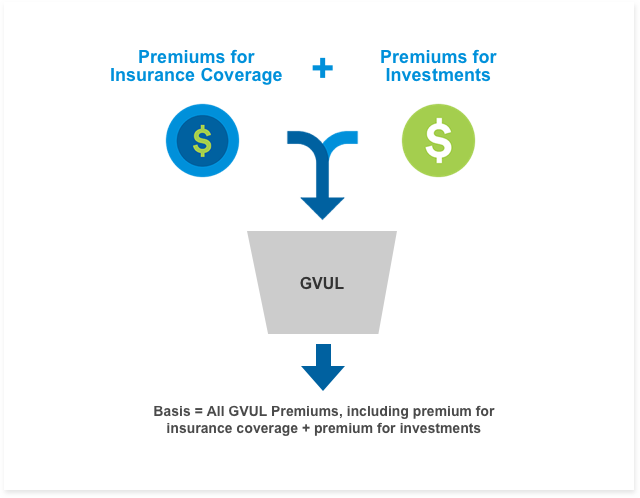

5 In general, participants may withdraw cash value equal to premiums paid without tax consequences. However, if the funding of the certificate exceeds certain limits, it will become a "modified endowment contract" (MEC) and become subject to "earnings first" taxation on withdrawals and loans. An additional 10% penalty for withdrawals and loans taken before age 59½ will also generally apply to MECs. We will notify you if a contribution would cause your certificate to become a MEC. Withdrawals and loans reduce the death benefit and cash value, thereby diminishing the ability of the cash value to serve as a source of funding for cost of insurance charges, which increase as you age. Withdrawals are subject to an administrative fee of 2% of the amount withdrawn, not to exceed $25. Outstanding loan amounts do not participate in the interest credited to the interest-bearing account and can have a permanent effect on certificate values and benefits. Upon surrender, lapse, or case termination, including those circumstances where termination of the group contract results in termination of individual certificates/policies, loans become withdrawals and may become taxable to the certificate owner.

6 Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although they seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

7 The current crediting rate on the interest-bearing account is subject to change without notice but will not fall below the guaranteed minimum in your certificate. Guarantees are subject to the financial strength and claims-paying ability of Metropolitan Life Insurance Company.