The ups and downs and ups of small business expectations

Key Takeaways

- Our latest Small Business Index report is a mixed bag of optimism and anxiety as owners confront an environment in constant flux.1

- Many of the attitudes across the topics covered in the report differ significantly by generation of the business owner.

- Owners are bullish on business health and cash flow, and fewer worry about inflation, but new supply chain and employee morale worries are emerging.

Maybe the best word to describe how small businesses are feeling right now is “conflicted.”

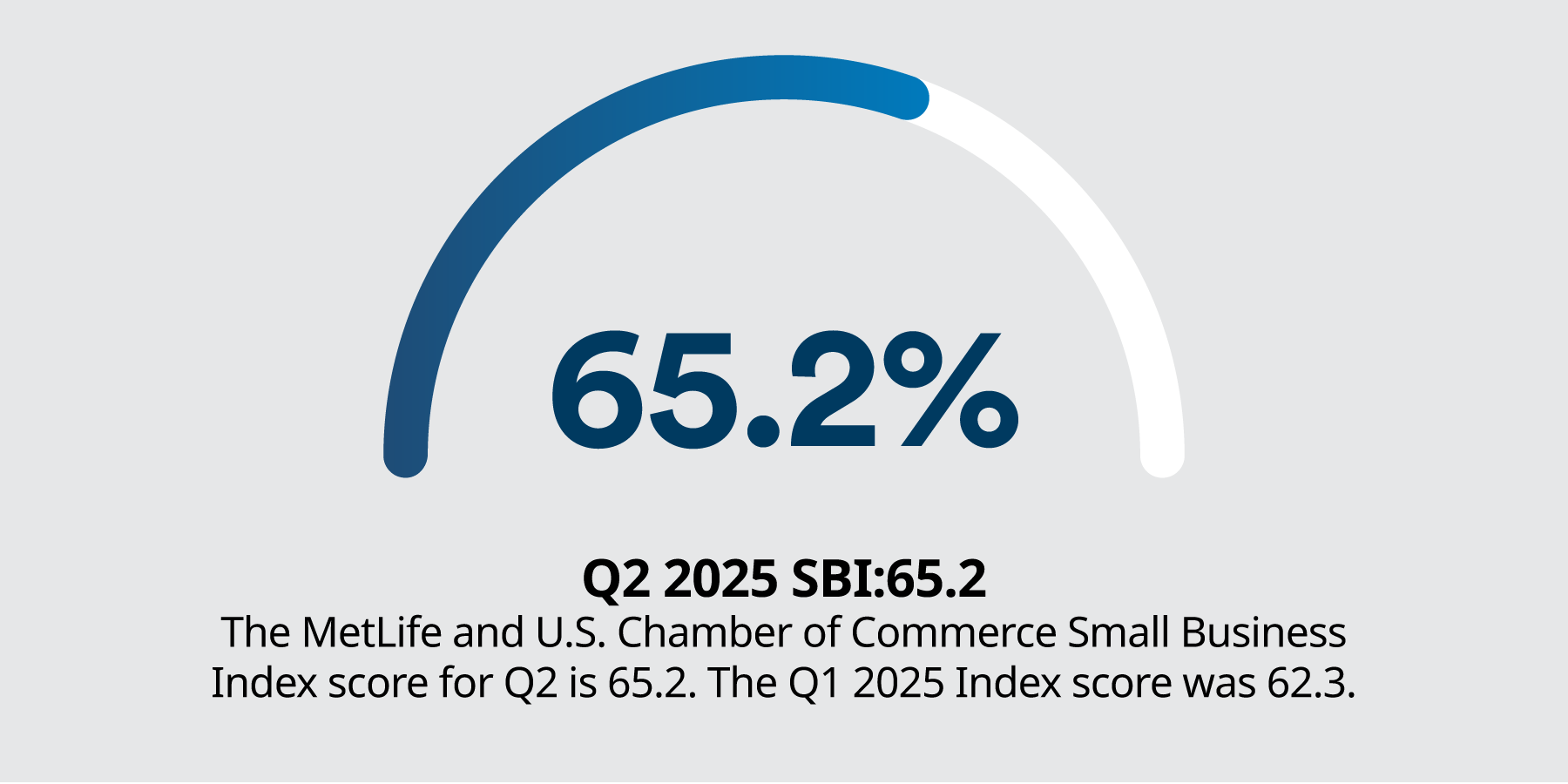

On the one hand, the latest Small Business Index score is this quarter to 65.2 -- up from Q1 but still down from this time last year when it hovered around 70. That number varies from region to region with small businesses in the south significantly more optimistic than other regions. In fact, four in five report that their business is in good health (up 14% just since last quarter).

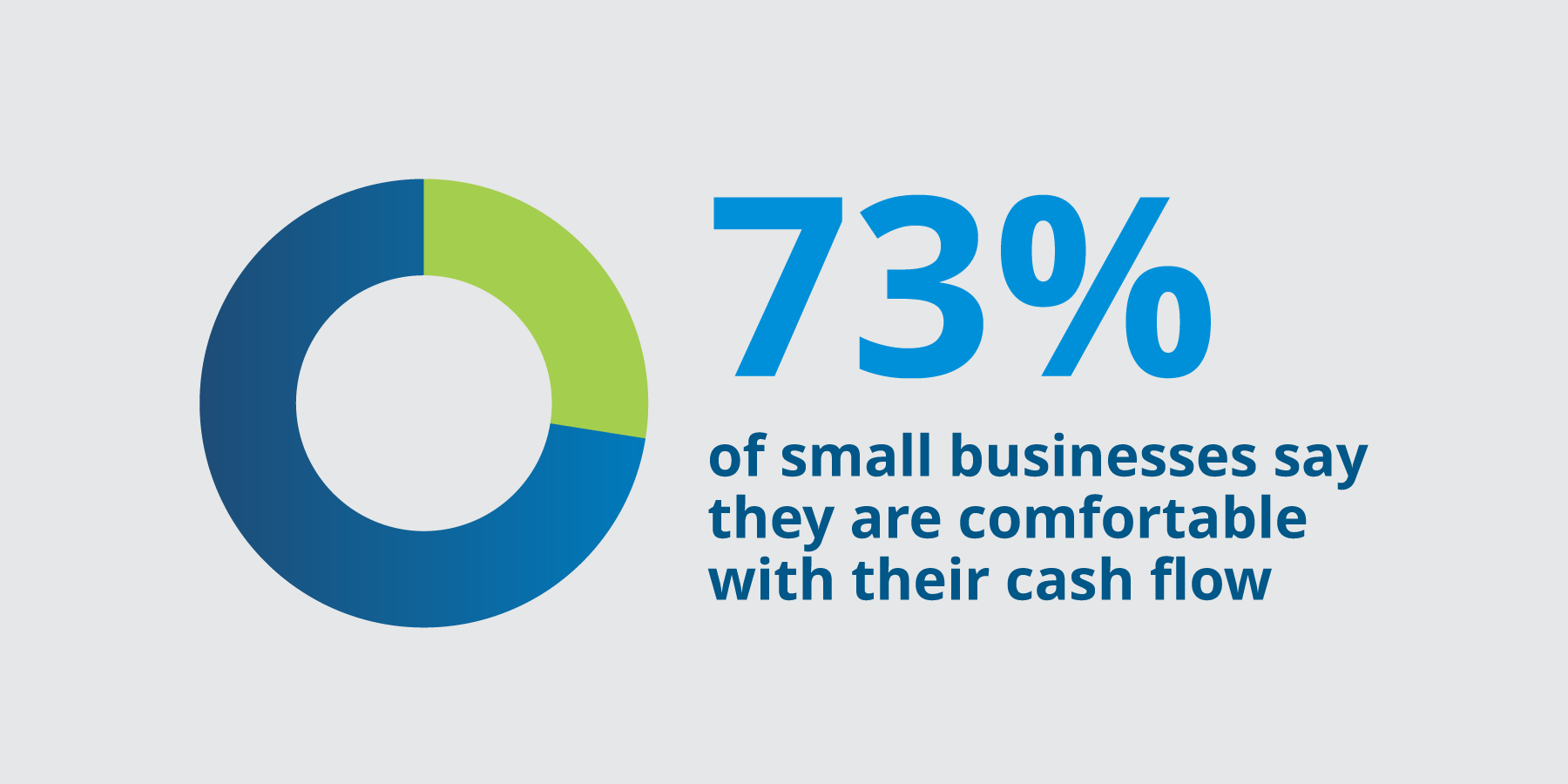

Business health and cash flow optimism are up, with nearly three in four (73%) small businesses saying they are comfortable with their cash flow, seven percentage points higher than quarter (66%). Confidence in business health is on the upswing as well, growing to 69%, up from 63% in the same period. And maybe the biggest news of all is that the number of small businesses citing inflation as a top concern dropped to less than half this quarter – the first time it’s been that low since Q2 2022.

All good news, right? Well, not quite.

Just as some concerns are fading in significance for small businesses, others are making their presence known. A volatile trade environment is reigniting fears that supply chain disruptions will impact business operations. Stiffening competition for talent is forcing many owners to navigate a sometimes-confusing maze of employee benefit options. And how they feel about the economy varies by generation, gender, and sector.

How owners view present and future business conditions.

The mixed signals small business owners are getting from the business environment are reflected in the mixed feelings they’ve exhibited this quarter. The Index rose only modestly as supply chain worries, residual inflation anxiety and national economic uncertainty tamped down any overly enthusiastic expectations. Small business views of what the future holds vary. Slightly more small businesses expect to increase staff in the next year (42%) compared to last quarter (37%). However, while the number that expects to increase revenue (65%) is stable from last quarter, it’s still down compared to this time last year (73% in Q2 2024).

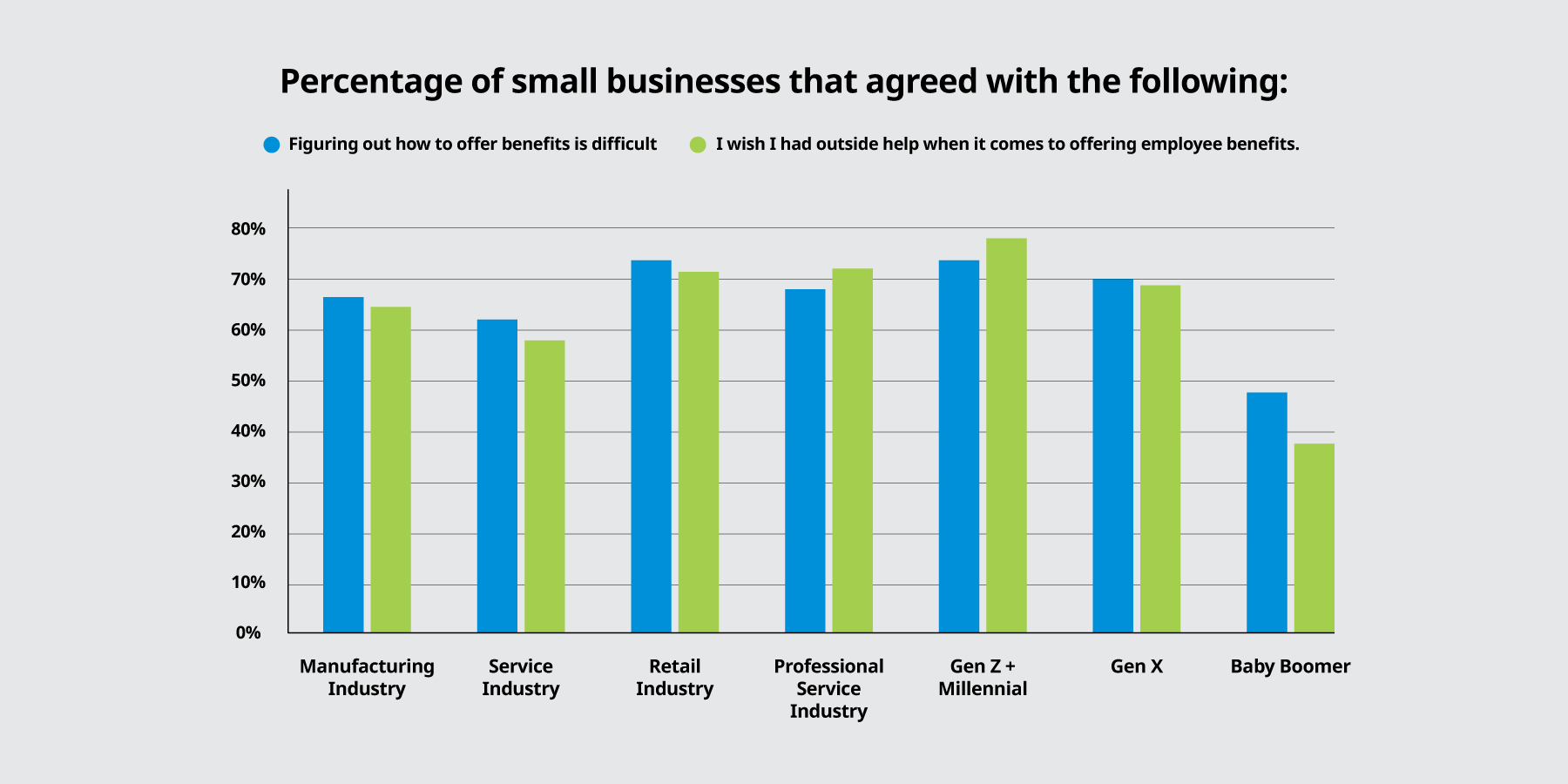

Another upward-trending concern is benefits. They’ve always been important but as a new generation of workers with a heightened interest in them enters the workplace, sorting out the options has taken on new urgency. Most small businesses (66%) say that figuring out what benefits to offer is challenging and a similar percentage (67%) wish they had outside help – a significant increase from two years ago.

Yet, at the same time, owners do have some positive feelings about current business conditions. Nearly three in four (73%) say they are comfortable with their cash flow, up seven percentage points from last quarter. Also, more small businesses have increased staff. Twenty-eight percent say they have hired new employees in the past year, up from both last quarter (20%) and this time last year (22%). And nearly half (47%) of small businesses expect to increase investment in the next year.

How generation, gender and sector impact perceptions and priorities

The ways in which businesses view the national and local economic environment, the importance of benefits and why they should be offered, as well as prospects for the future, differ widely among small business owners. For example:

- The generation of owner, gender of owner, and sector all affect how owners feel about the economy both at the national and local level economy.

- By sector, those in services are significantly less likely than other industries to say that the national economy and their local economy are in good health.

- Male-owned small businesses are more likely than woman-owned to say the national and local economies are in good health, continuing a more than year-long trend.

- Small businesses owned by Gen Zers or Millennials are more likely than those owned by Gen Xers and Baby Boomers to say the U.S. and local economies are in good health.

- Small businesses owned by Baby Boomers and older generations are less likely to report that they are seeing increased competition.

Benefits are another area attracting increased attention from small business owners due to the demands of a new generation of employees. Once again, a stark generational divide characterizes the reasons for offering them, which ones are prioritized, and how much guidance is needed on which ones to offer.

Nearly all small businesses consider offering benefits important for a host of reasons: to show care for employees; to increase employee morale and engagement; and to attract and retain employees. But when examined by generation significant differences begin to emerge:

Younger generations of owners are more likely to say they find benefits important for a variety of reasons, and to desire outside help when it comes to offering employee benefits.

While 78% of Gen Z/Millennial-owned businesses offer benefits to their full-time employees, only 67% of Gen X-owned businesses and just over half of Boomer-owned businesses do.

Across generations, small businesses also vary depending on what benefits they find important and why:

- A strong majority of both Baby Boomer and Gen X businesses are more likely to say health insurance is one of the top two most important benefits for full-time employees.

- In contrast, Gen Z- and Millennial-owned businesses are split between benefits like health insurance (52%), retirement plans (26%), paid sick leave (24%), and life insurance.

- More than older generations, Gen Z/Millennial and Gen X owners tend to say benefits are important to enhance employee productivity and morale and demonstrate support.

Good intentions and employee desires notwithstanding, small businesses report facing a variety of barriers to offering employee benefits. Along with other competing priorities, the cost of employee benefits continues to rise and 37% of owners cite that along with limited budgets as barriers to offering a fuller range of employee benefits. Just one in ten small businesses say there are no barriers at all.

Contending with a murky small business outlook.

Facing a rapidly and continually changing economic landscape in which little is under their direct control, small businesses will be constantly seeking solutions that can help them preemptively deal with the challenges they’ll face. While inflation has diminished as a concern for many business owners, changes in global trade policy, ongoing stock market volatility, supply chain disruptions and any number of other unknown variables could well bring it roaring back.

The question for owners is, what can they do to protect their bottom line? One answer that’s gaining increasing traction is how to handle benefits more cost-efficiently. As the cost of benefits rises and they become increasingly important for attracting and retaining talent, making the most of them to improve talent management outcomes is a business imperative.

MetLife offers numerous solutions that can help, including the MetLife Small Market Experience – a one-stop offering that enables smaller companies to offer non-medical benefits that help them compete with larger organizations for the talent they need to grow. The outlook for small businesses may remain cloudy, but the path forward is clear.