Short-Term Disability (Non-Union)

The need to be better prepared for life events that keep us out of work has become more important than ever before. Disability insurance helps replace all or part of income while an employee is unable to work due to a disability or other condition, such as recovering from surgery or childbirth, that is not payable by worker’s compensation. Evergy partners with MetLife to administer this benefit

.

Help replace a portion of your income if you cannot work1

If you lost your ability to earn income, how would you pay for your bills and provide for your family? In the event of a disability, you need coverage that's quickly accessible. Below are the key reasons as to why this benefit is so important:

- May help replace all or a portion of your income when you are unable to work due to sickness, pregnancy, chronic condition or accidental injury.

- Benefit payments are made directly to you and you decide how to spend the money.

- Helps you meet your day-to-day financial obligations so your long-term goals can stay on track.

Did you know disability insurance and workers’ compensation are not the same thing? Workers’ compensation only applies if you are hurt at work. Disability insurance covers you when you’re unable to work because of illness or injury — whether suffered at work or not.

Plan Details

Life has changed, but the need to protect and provide for loved ones has not.

Disability Insurance FAQs

Consider any expenses you may incur in the running of your household, including car payments, mortgage payments, groceries, child care, tuition and more, that would still need to be covered in the event of a disability.

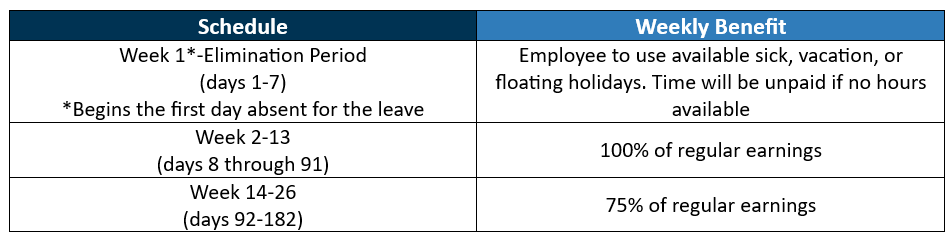

Payments will be made directly to you by Evergy on your regularly scheduled paycheck. Evergy’s Leave Administration team will handle your short-term disability time entry for your approved disability period.

You will be responsible for entering your own paid time for the first 7 days (40 hours) "elimination period"

Enrollment is automatic for all non-union employees. All regular full-time and part-time non-union employees working at least 20 hours per week are eligible for STD on the date of hire.

MetLife offers various ways to submit your claim based on your plan, including online, mail and phone options. Plus, you can track the status of your claim online or on the MetLife US App. Search "MetLife" on iTunes® app Store or Google Play to download the app.

As one of the nation’s leading providers of disability benefits,2 you can count on MetLife to provide you with caring, compassionate and accurate claims service, if and when you experience a disability.

Special Considerations

If you work in a state with state-mandated disability or paid medical leave benefits (“State Benefits”), you should carefully consider whether to enroll for this coverage. In California, Hawaii, Massachusetts, New Jersey, New York, Puerto Rico, Rhode Island, Washington (and Connecticut starting 1/1/22, Oregon starting 1/1/23, and Colorado starting 1/1/24), if eligible, you must apply for State Benefits. Your STD benefit will be reduced by State Benefits or other government benefits that apply. Depending on your compensation, the amount of the State Benefit, and other factors, you may only receive the minimum weekly benefit. Please consider, based on your individual circumstances, whether you need additional coverage beyond the State Benefit.

1 Like most disability income insurance policies, MetLife’s policies contain certain exclusions, waiting periods, reductions, limitations and terms for keeping them in force. Ask your MetLife representative about costs and complete details. For policies issued in New York: These policies provide disability income insurance only. They do NOT provide basic hospital, basic medical or major medical insurance as defined by the New York State Department of Financial Services. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future premiums that MetLife expects to return as benefits when averaged over all people with the applicable policy.

2 LIMRA, U.S. Workplace Disability Insurance Sales and In Force Survey, Year-End 2020.