Small business balancing act: benefits and the bottom line

Key Takeaways

- A new generation of employees is more concerned about benefits than ever before,1 as small businesses look to meet the demand.

- While many cite “doing the right thing,” retention, and recruitment as motivations for offering benefits, budget constraints and rising costs are challenges.

- Two-thirds of small businesses say choosing which benefits to offer is difficult and want help choosing which to offer.

Trust in American institutions is declining at a shocking rate and is increasingly widespread. A 2024 Pew Research Center report2 cites increasing skepticism about everything from the courts to science and education, to go along with the already rock-bottom confidence in government. As a result, more and more employees are turning to the companies they work for as sources of stability and trust.

The implications for employers overall are profound. Gen Z is rapidly becoming the dominant employee segment in the workplace, and they are bringing a whole new set of concerns and expectations along with them. This includes a marked increased interest in benefits as evidence that the trust they’re putting in their employers is justified.

As if they don’t have enough on their plates already, the growing emphasis on benefits among the new generation of employees is even more of a challenge for small businesses. Among the findings of the Q2 2025 Small Business Index (an ongoing report on the state of small business issued by MetLife and the U.S. Chamber of Commerce) is that confusion about which benefits to offer, rising costs, and the impact of benefits decisions on recruitment and retention makes it even more of a challenge. Let’s take a look at why.

Piecing together the benefits puzzle.

As reported in the MetLife 2025 Employee Benefit Trends Study, employers are increasingly viewed as more trustworthy than other prominent institutions. Trust has emerged as a powerful force for improving talent and business outcomes with benefits seen as tangible proof of a company’s willingness to show support by enriching employee care strategies.

But for many small businesses, figuring out employee benefits can be a real challenge. Nearly all small businesses recognize the importance of employee benefits. Nine in ten say they’re important for demonstrating care for employees and their families, increasing employee productivity, sustaining employee morale, decreasing stress, and driving better talent outcomes.

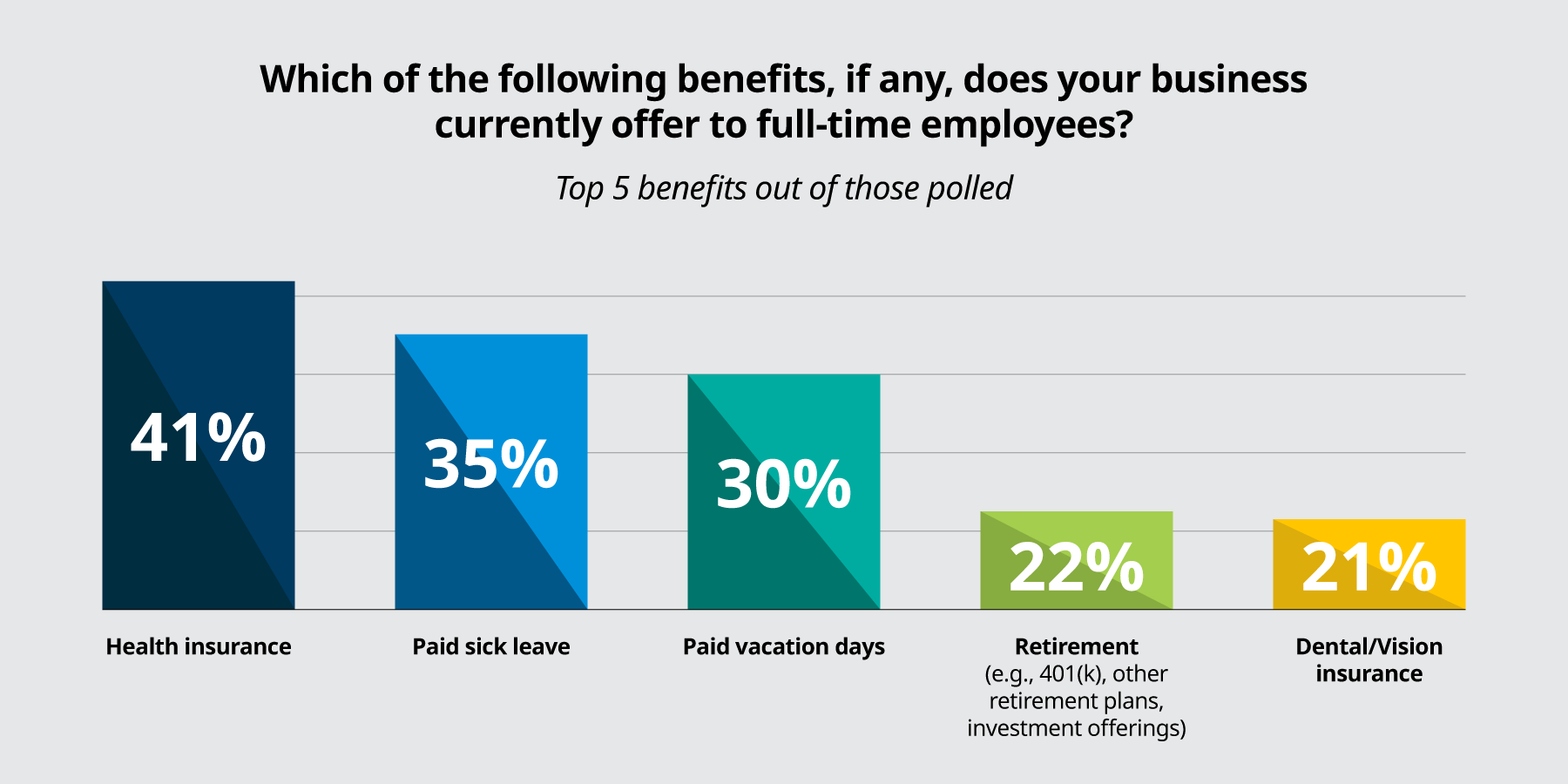

There are significant differences in the type of benefits offered – and whether they’re offered at all – across business size, industry, and the generation of owner. For example, nearly 100% of small businesses with 20-500 employees1 offer at least one benefit to full-time employees, compared to 57% of small businesses with fewer than five employees. Some 85% of manufacturers offer at least one benefit while only 54% of those in services do.

Under the Affordable Care Act, businesses with 50 or more full-time employees are required to offer health insurance

And their “why” is clear. Among small businesses currently offering benefits to full-time employees, nearly half say they started to offer them because it was the right thing to do. Other reasons mentioned include the importance of retaining and recruiting high-quality employees, and because the company’s revenue reached a point where it was economically viable.

However, a closer examination reveals a more complicated picture. Small businesses report facing a variety of barriers to offering benefits, including limited budgets, rising costs, a lack of resources, or striking a balance between mandated benefits and other employee-sponsored benefits. The tradeoffs can be daunting – and a lot of small businesses want help with choosing which benefits to offer.

Navigating a complex benefits landscape.

While many employers feel their employees are satisfied with their business’s current benefit offerings, they realize that may not be true as new workers arrive.

As the 2025 MetLife EBTS reports, the generational changing of the guard underway at many companies will increase the importance of employee care in the years ahead, as Gen Z becomes a more dominant workforce presence. With younger workers reporting lower levels of holistic health than older colleagues, demonstrable trust and support in the form of benefits will be critical.

But many say figuring out what benefits to offer is a challenge – and a growing concern. Some 66% of small businesses say figuring out what benefits to offer and how to offer them to their full-time employees is difficult – a double-digit increase compared to Q1 2023. Similarly, two in three small businesses want outside help when it comes to offering employee benefits.

With no single source to rely on for information to help them make decisions regarding benefit plans, some small businesses turn to Google or other search engines. Others pore over benefit provider websites or solicit the advice of insurance brokers. And employees also have a voice in which benefits their companies choose to offer.

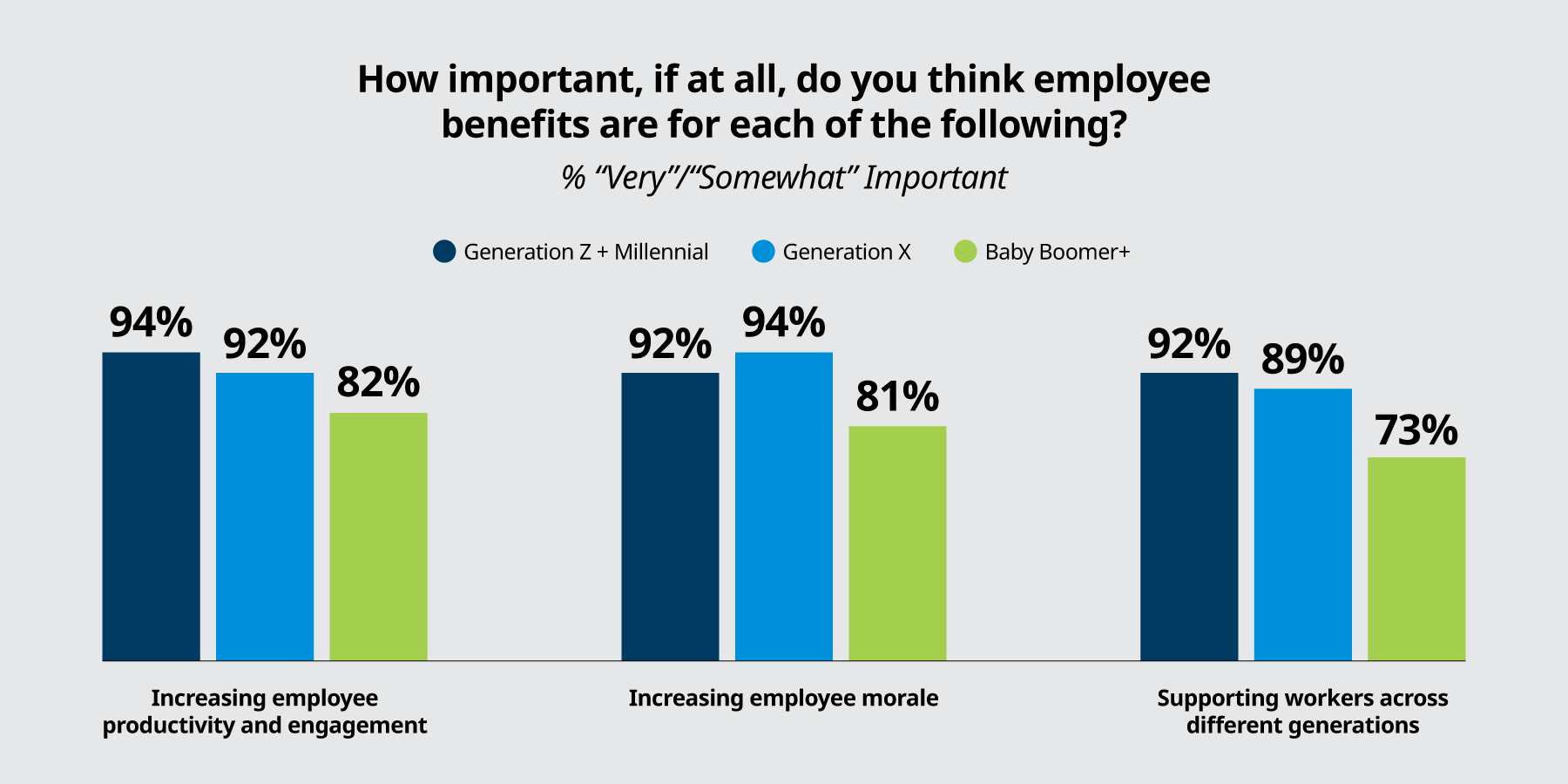

When it comes to reasons for offering benefits, there’s also a clear generational divide. Businesses owned by Gen Z/Millennials and Gen X are more likely than those owned by Baby Boomers and older generations to say that employee benefits are important for increasing employee productivity, morale, and supporting workers across generations. No surprise, then, that younger small business owners are more conflicted about what benefits to offer and are looking for help to decide.

A solution that makes hard choices about benefits easier

Small business owners will continue to face challenging benefits decisions as they try to balance the needs of their companies and the demands of employees. Yet perhaps now more than ever, their continued success will hinge on taking a long-range view and looking at benefits as another way of investing in the growth of their business.

As recent developments in the workplace have made abundantly clear, employer-employee trust is particularly relevant now. Powerful external forces, including socioeconomic uncertainty, geopolitical tensions, and cultural upheaval, have more workers than ever looking to their employers as a source of stability. As small business owners look to validate the trust employees place in them, benefits will play a vital role in providing tangible proof of care. MetLife offers numerous solutions that can help, including the MetLife Small Market Experience – a one-stop offering that enables smaller companies to offer non-medical benefits comparable to those of their Fortune 500 counterparts. The future of more expansive benefits offerings for small business is already here.