Are inflation worries over for small business owners?

Key Takeaways

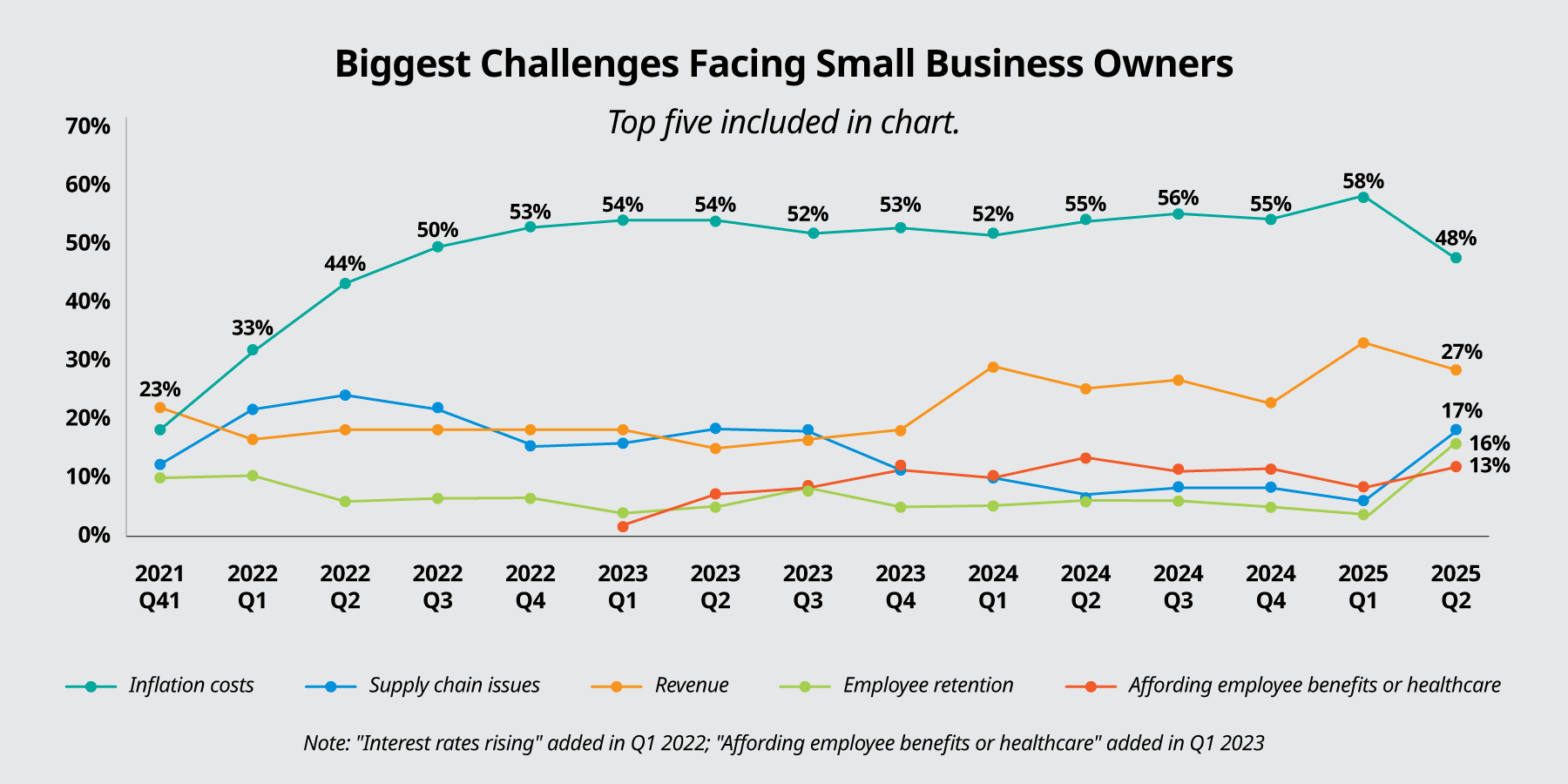

- Inflation as a top concern among small business owners didn’t just fall, it plummeted by double digits to 48% – the first drop below 50% since Q2 2022.1

- But don’t break out the party hats just yet. Some 70% of small business owners say they still feel inflation's impact, and 60% have raised prices in the past year in response.

- And while inflation concerns may have subsided, new challenges are popping up as supply chain, employee morale and compliance anxieties increase.

In the face of ever-present trade tensions, increasing geopolitical instability, and ongoing wars in Ukraine and the Middle East who would have predicted this? Concerns about inflation are down among small businesses. And not by a little. Though it is still a serious issue, our latest Small Business Index report shows that just 48% of small businesses identify inflation as their biggest worry.1 That’s a decline of 10% and a significant reversal from Q1 2025, when concern with inflation reached its highest level since tracking began.

Also, while majorities of small businesses say they remain affected by inflation, the impact isn’t being felt – or responded to – as strongly – as it was at the height of the price surge in 2022. For example:

- This quarter, 70% agree that rising prices have had a significant impact on their business in the past year. While still a significant number, that is down 13% from Q3 2022.

- Similarly, while inflation still impacts pricing strategies and 60% report increasing the prices of their products or services in the past year as a result of inflation, that is down 10% from Q3 2022.

Clearly, the majority of small businesses feel that rising prices have affected them to the extent that they have raised prices for their goods or services in the past year.

It’s also worth noting that concern with inflation varies across industries. Small businesses in the retail (55%) and services (54%) sectors report considerably higher concerns about inflation compared to those in manufacturing (42%) and professional services (41%). Yet even as price worries recede in importance, owners find themselves facing new challenges in a small business landscape that continues to move in surprising directions.

Supply chain anxiety resurfaces...

With the end of Covid, many small businesses thought they had seen the end of the supply chain issues that hindered their ability to serve their customers. And they had – for a while. But the latest SBI indicates an uptick in supply chain concerns.

That’s not surprising. As the persistent rhetoric around tariffs continues to escalate, so does the anxiety of small businesses as they navigate a complex web of variables that impact their ability to serve their customers. A recent article in the business publication Fast Company, reported that “Analyses from the Institute for Supply Management (and other industry sources) confirm that costly fractures are now spreading across America’s supply chains. Small and midsize businesses – responsible for half of U.S. industrial production and three-quarters supply chain industry jobs of jobs – are bearing the brunt of rising costs and ongoing economic uncertainty.”

In the past six months, nearly half of small businesses (47%) report altering their business’ supply chain in or being unable to keep up with customer demand because of supply chain disruptions (30%). While small businesses in the retail and services sectors were more likely to report higher concerns about inflation, small businesses in manufacturing (19%) and retail (22%) are more likely to report supply chain concerns.

...and concern about employee morale grows.

Among the most striking findings of MetLife’s 2025 U.S. Employee Benefit Trends Study2 is that as Gen Z attains numerical dominance in the workforce, there is a corresponding decrease in the number of workers who consider themselves “holistically healthy.” While 52% of Boomers in the report identified this way, only 31% of Gen Z described themselves similarly. Added to that Gen Z will represent about 30% of all employees by 2030 while Boomers will be just 5%.

That, combined with this generation seeing benefits as tangible evidence of their employer’s care, has small business owners increasingly concerned about employee morale and engagement.

The numbers clearly demonstrate how important employee morale is to small business owners. Nine in ten say benefits are important for demonstrating care for employees and their families (93%), increasing employee productivity and engagement (91%), increasing employee morale (91%), decreasing employee stress (90%), and attracting and retaining employees (89%).

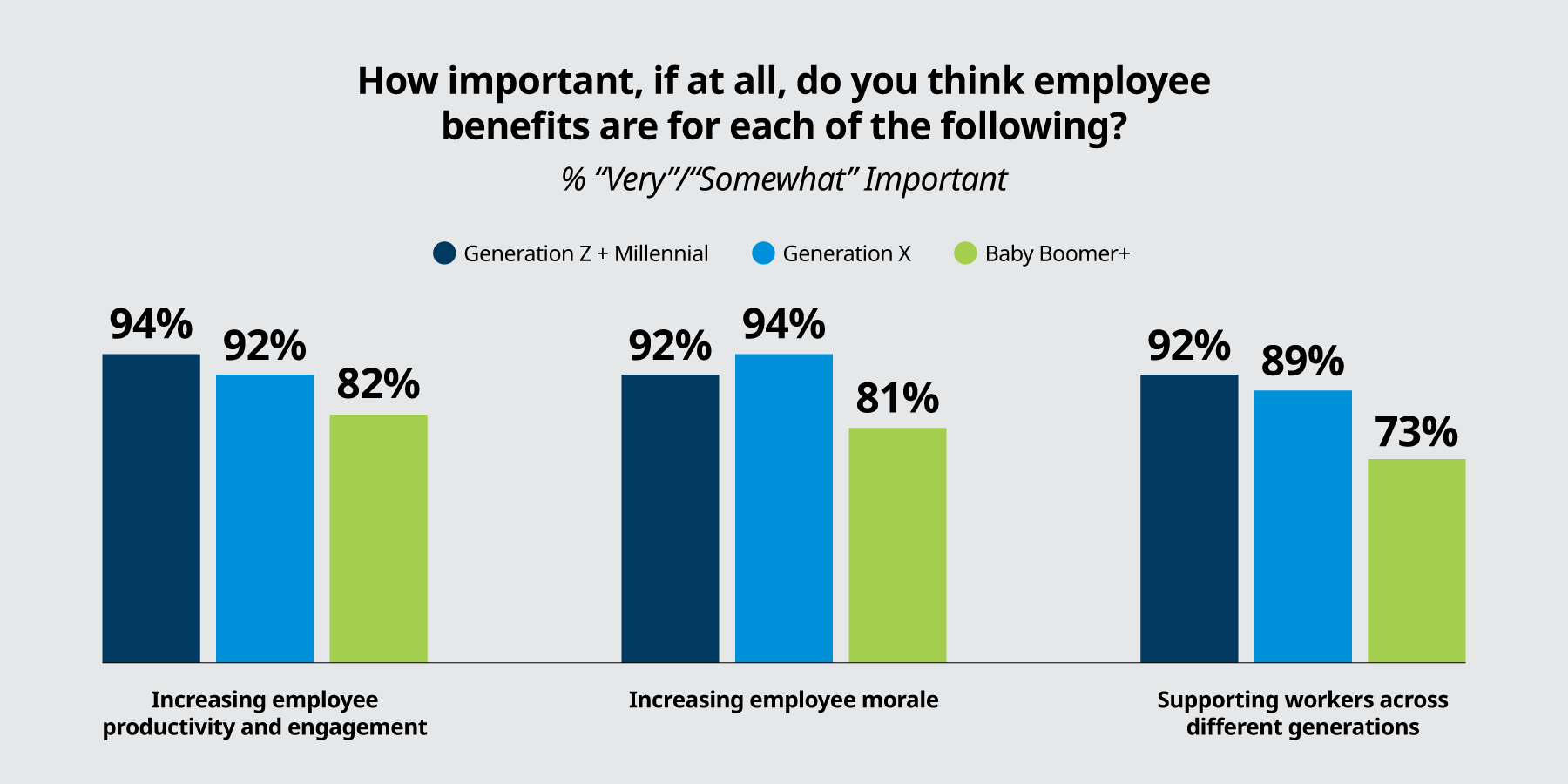

It’s worth noting that the reasons for offering benefits tend to split across generational lines.

Businesses owned by Gen Zers/Millennials and Gen Xers are more likely than those owned by Baby Boomers to say that employee benefits are important for increasing employee productivity, improving organizational morale, and supporting workers across generations.

Even with these differences, at least seven in ten across generations consider benefits important for all of these reasons. Yet challenges remain. The cost of benefits and the challenge of deciding which benefits to offer can be daunting. As competing pressures, growth aspirations and bottom-line realities jockey for position, the question for many small business owners remains: where can solutions be found?

Finding ways to economize in case inflation returns.

One of the most vexing concerns that small businesses have is offering benefits. Limited budgets, rising benefit costs, a lack of resources, and the balancing of mandated and employee-sponsored benefits all exert pressure on employers to find answers.

While worries about inflation have abated for the moment, any unforeseen economic event could once again send prices soaring and bring it back to the forefront. And while health insurance and paid leave top the list of benefits offered, more and more employees are expressing interest in a variety of additional benefit offerings. And it isn’t just a cost issue. Two in three small businesses say figuring out what benefits to offer (66%) and how to offer benefits (67%) to their full-time employees is difficult – and concern is growing.

For small businesses that are competing with larger organizations for talent, finding innovative ways to overcome these challenges is paramount. MetLife offers numerous solutions that can help, including the MetLife Small Market Experience – a nimble, one-stop platform that enables smaller companies to cost-efficiently offer non-medical benefits comparable to those of their Fortune 500 counterparts. While there is no silver bullet that will act as a hedge against future inflationary pressures, finding ways to save on benefits now is a great place for small businesses to start.