Help Close the Gap

Help close the gap in disability coverage

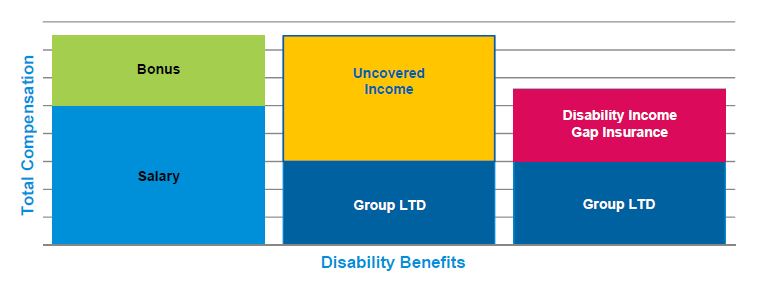

Consider supplementing your disability coverage to help close the gap between your income and financial obligations should you become disabled.

Consider supplementing your disability coverage to help close the gap between your income and financial obligations should you become disabled.

If you became sick or hurt and couldn’t work, how would you meet your financial obligations? Would you be able to live on the portion of your current income that your group LTD covers as illustrated above? While you can’t avoid the risk of being disabled, MetLife DIGI can help you be better prepared. This policy is designed to provide an additional layer of disability coverage in the event a sickness or injury prevents you from working in your regular occupation.

Interested in greater income protection?

For more information or to enroll during your company's enrollment period, visit www.metlife.com/mybenefits. Once you access the site, enter your company's name and register or log in.

You may also call 1-888-671-8152, Monday through Friday, 8am to 6pm EST.

Like most disability income insurance policies, MetLife’s policies contain certain exclusions, waiting periods, reductions, limitations and terms for keeping them in force. MetLife can provide you with costs and complete details.

All policies and riders may not be available in all states, at all issue ages and to all occupational classes. Ask your representative for complete details. Eligibility is subject to underwriting approval.

These policies provide disability income insurance only. For policies issued in New York, they do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Insurance Department. The expected benefit ratio for these policies is at least 50%. This ratio is the portion of future premiums that MetLife expects to return as benefits when averaged over all people with the applicable policy.

Disability income insurance is issued by Metropolitan Life Insurance Company on IDI2000-P/NC-ML, IDI2000-P/GR, AH 7-96-CA and AH 8-96-CA.