Is Paid Family and Medical Leave (PFML) worth it?

Here’s what the data says

Key Takeaways

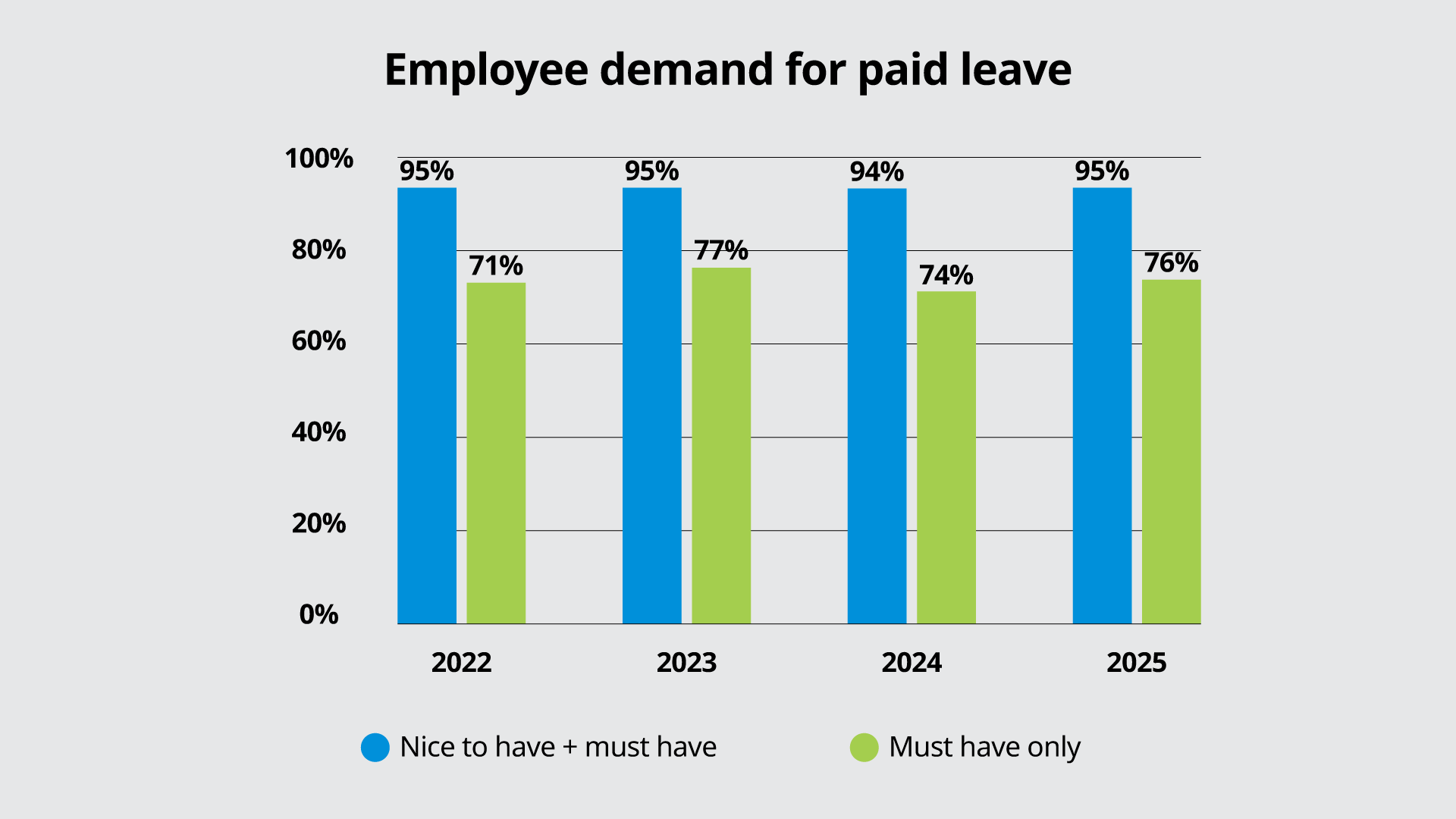

- Employee demand for paid leave has been consistently high, with 76% of respondents identifying it as a must-have benefit in 2025.

- Minnesota’s premium rate ranks fourth lowest out of 14 state programs at 0.88%, split evenly between employers and employees.

- While employers have raised many legitimate concerns, private PFML plans can offer more flexibility, support, and potential cost savings to mitigate them.

Paid Family and Medical Leave (PFML) is expanding in 2026, with Minnesota and Delaware launching on January 1, followed by Maine in May, and Maryland in July later in the year, bringing the total to 14 states with active programs.

Naturally, many employers are feeling apprehensive about this new law, especially when it comes to costs, potential operational disruptions, and compliance requirements. The way these programs are funded can vary widely. For example, Minnesota splits the costs equally between employers and employees at 0.88% of wages, while New York and New Jersey have opted for employee-funded models at around 0.3% of wages.

Questions abound: Will the benefits of these programs ultimately outweigh their costs? How do employees actually perceive these paid leave benefits? And perhaps most importantly, how can employers make PFML a win-win situation for them and their employees?

To address these questions, let's first take a closer look at the latest insights from the 2025 MetLife Employee Benefit Trends Study (EBTS), which offer valuable perspective on emerging paid leave trends and their implications for small businesses.

What paid leave trends are telling us

The workplace is changing rapidly, with Gen Z now representing 18% of workers—more than Baby Boomers at 15%. By 2030, they'll make up a third of the workforce.

Unlike Millennials, who entered a stable economy in 2014, Gen Z faces significant economic turbulence today with higher inflation and living costs. This has affected their well-being dramatically. Gen Z workers are half as likely as Boomers to describe themselves as healthy, and today's 21-25 year olds show lower engagement and happiness than the same age group five years ago.

Despite generational differences, some priorities remain universal. Paid leave continues to be highly valued across all age groups, directly influencing well-being, loyalty, and engagement.

1. Employee demand for paid leave is climbing

We're seeing a clear upward trend in how employees value paid leave, with those considering it a "must-have" climbing from 71% in 2022 to 76% in 2025. Nearly 95% of employees now rank paid leave alongside traditional core benefits like medical, dental, vision, and life insurance. And interestingly, Gen Z employees place the highest value on paid leave, listing it as their top benefit, while older generations typically rank it third.

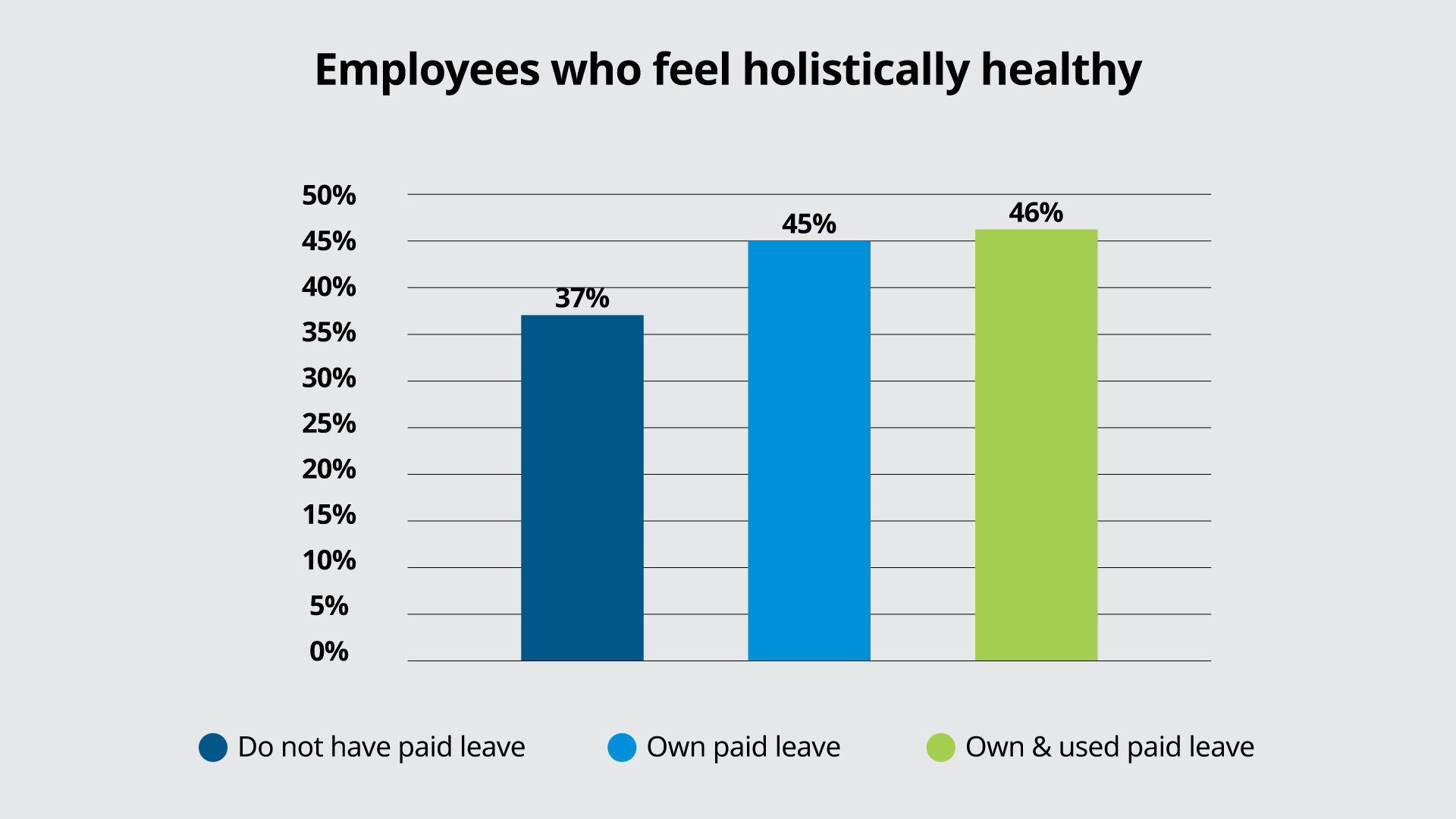

2. Employees who own and use paid leave are significantly more likely to feel holistically healthy

It’s no surprise that taking paid leave helps employees feel more balanced and healthier. But what’s often overlooked is the value in providing long-term security during major life events like having a baby, caring for a sick relative, or dealing with personal health issues. This support reduces stress, improves well-being, and creates more satisfied employees who return to work engaged and grateful for an organization that stood by them when it mattered.

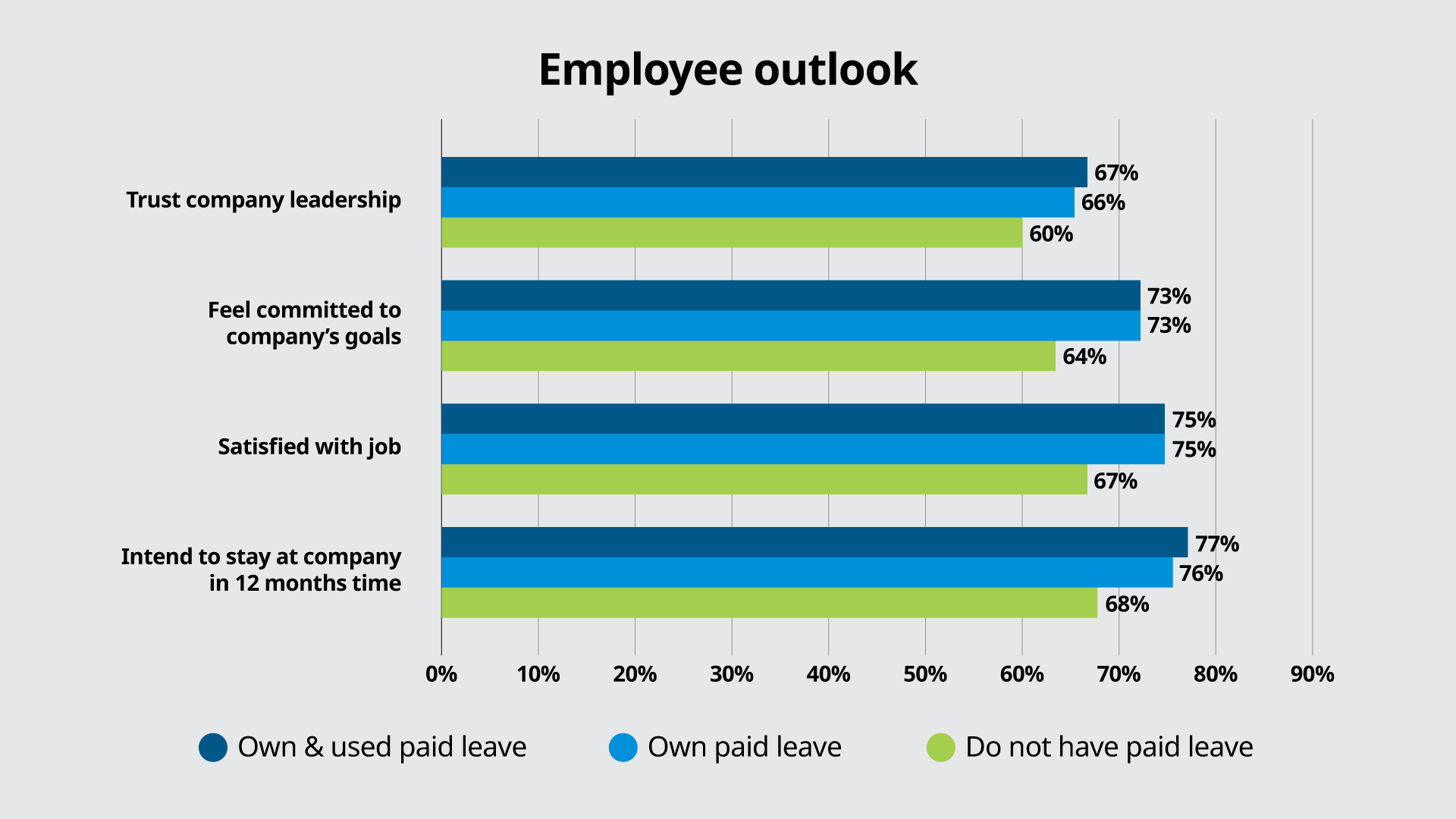

3. Paid leave benefits have a significant impact on employee retention and satisfaction

EBTS data shows that paid leave increases loyalty, morale, and productivity. When employees can take time for health, family, or rest, they return more focused and committed. This leads to better business results: higher revenue per employee, improved profits, and lower turnover costs.

Addressing PFML concerns

Minnesota’s PFML program will begin accepting employer registrations on July 1, 2025, ahead of its full rollout on January 1, 2026. All employers must either join the state program or implement an approved private plan that meets or exceeds state standards. The good news is that private PFML plans can offer more flexibility, support, and potential cost savings to mitigate the many concerns that employers have. Here’s how:

Increased costs

When it comes to costs, Minnesota's premium rate is actually quite competitive, ranking as the fourth lowest among 14 state programs at just 0.88%, with employers and employees each paying half.

While private plans can't require employees to contribute more than they would under the state program, they do offer more flexibility in how employers structure funding and design the plan. This can be particularly valuable since private plans can be integrated with other employer-paid benefits, which helps ensure that employees don't receive more than their regular pay and prevents benefit duplication.

This integration capability is key to offsetting many of the cost concerns employers may have about implementing a private plan.

Worker shortages

Employers are rightfully worried about extended leave policies, particularly the challenge of maintaining adequate staffing when employees can take up to 20 weeks off annually. This is especially daunting for small businesses that don't have the resources to easily find temporary replacements.

Fortunately, some private carriers are stepping up by offering digital tools that help both employers and employees navigate the leave planning process more effectively. These tools can significantly reduce errors and improve efficiency, making the whole process less burdensome for everyone involved. While staffing challenges remain real, having better systems to manage leave can at least alleviate some of the administrative headaches.

Administrative and compliance burden

Juggling new PFML regulations with existing federal leave laws like FMLA can be overwhelming, especially for small businesses with limited HR resources. The good news is that many private carriers now offer dedicated claims administration services to ease this burden. They'll coordinate leave dates, handle documentation, and navigate overlapping leave requirements, creating a more streamlined process.

Many brokers and agents are also stepping up to help, offering guidance on how different leave policies intersect and educating employees. Though regulations remain complex, these resources can substantially reduce the administrative workload on employers.

PFML is an advantage with the right plan

Our multi-year data from EBTS consistently shows that paid leave isn't just a nice-to-have perk—it's a fundamental driver of employee health, satisfaction, loyalty, and engagement.

These trends have remained steady over time, underscoring how essential it is to give employees proper opportunities to rest and recharge to ensure long-term organizational stability and growth. PFML extends these benefits, further strengthening these positive outcomes.

While PFML might raise concerns about costs and administration, choosing the right plan can help mitigate these challenges. Private insurers offer flexibility to match a business’s size and needs, typically with better claims processing and customer service than state programs.

Interested to know how trust plays an outsized role in creating better outcomes for both talent and businesses? Download your copy of the 2025 MetLife Employee Benefit Trends Study today.