*Any discussion of taxes is for general informational purposes only and does not purport to be complete or cover every situation. MetLife, its agents and representatives may not give tax advice and this website should not be construed as such. Please seek advice based on your particular circumstances from a qualified tax advisor.

1 If you choose to apply for increased coverage, the increase may be subject to underwriting. MetLife will review your information and evaluate your request for coverage bases upon your answers to the health questions, Metlife's underwriting rules and other information you authorize us to review. In Certain cases, Metlife may request additional information to evaluate your request for coverage.

2 To the maturity age specified in your certificate.

3 If you choose to apply for increased coverage, the increase may be subject to underwriting. We may ask you a few health questions. Increase amounts are subject to program rules.

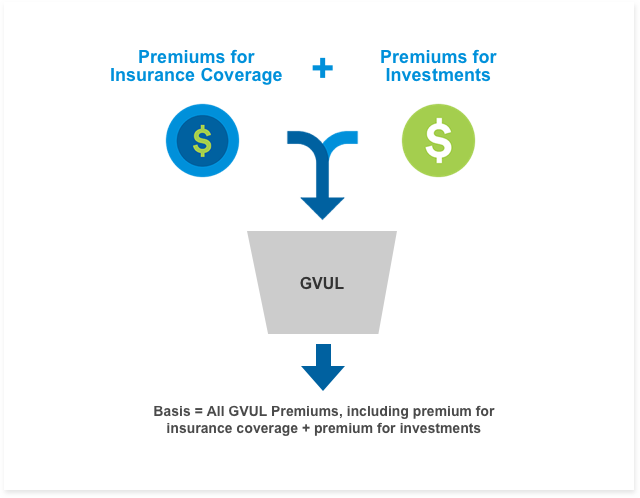

4 In general, participants may withdraw cash value equal to premiums paid without tax consequences although less favorable rules may apply in the first 15 years. However, if the funding of the certificate exceeds certain limits, it will become a "modified endowment contract" (MEC) and become subject to "earnings first" taxation on withdrawals and loans. An additional 10% penalty for withdrawals and loans taken before age 59½ will also generally apply. We will notify you if a contribution would cause your certificate to become a MEC. Withdrawals and loans reduce the death benefit and cash value, thereby diminishing the ability of the cash value to serve as a source of funding for cost of insurance charges, which increase as you age. Withdrawals are subject to an administrative fee of 2% of the amount withdrawn, not to exceed $25

5 Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although they seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the fund.

6 Guarantees are subject to the financial strength and claims-paying ability of Metropolitan Life Insurance Company.

Like most insurance policies, MetLife GVUL contains exclusions, limitations and terms for keeping it in force. MetLife can provide you with costs and complete details.

Money allocated to the variable investment portfolios is subject to market risk, and when redeemed may be worth more or less than your original investment. Please review the GVUL prospectuses for important information regarding the variable investment portfolios, including charges and expenses.

Prospectuses for Group Variable Universal Life insurance and its underlying portfolios can be obtained by calling (800) 756-0124. You should carefully read and consider the information in the prospectuses regarding the contract's features, risks, charges and expenses, as well as, the investment objectives, risks, policies and other information regarding the underlying portfolios prior to making any purchase or investment decisions. Product availability and features may vary by state. All product guarantees are subject to the financial strength and claims-paying ability of Metropolitan Life Insurance Company.

Group Variable Universal Life insurance has limitations. There is no guarantee that any of the variable options in this product will meet its stated goals or objectives. Cash value allocated to the variable investment options is subject to market fluctuations so that, when withdrawn or surrendered, it may be worth more or less than the amount of premiums paid.

Group Variable Universal Life insurance (GVUL) is issued by Metropolitan Life Insurance Company (MLIC), New York, NY 10166, and distributed by MetLife Investors Distribution Company (MLIDC) (member FINRA). MLIC and MLIDC are MetLife companies. MetLife's standard Certificate Forms, available on or after 5/1/09 include: Certificate Forms 30044 (5/01) As amended by form 3E59 (5/2005)