Stable Value

Traditional Guaranteed Interest Contract (GIC) Overview

What is a Guaranteed Interest Contract?

Guaranteed Interest Contracts (GICs) have been a key component of stable value funds since the beginning.1 And for good reason. Through GICs, stable value meets two important needs for retirement plan participants:

• Principal protection

• Steady growth by earning a competitive interest rate over time

Traditional GICs are issued by insurance companies, invested in the general account, and backed by the full faith and credit of the insurer.

The Added Value of MetLife’s Traditional GIC

Traditional GICs are popular retirement plan additions because of their stability, simplicity, low risk, and attractive rates. These contracts can have either a fixed or floating rate structure.

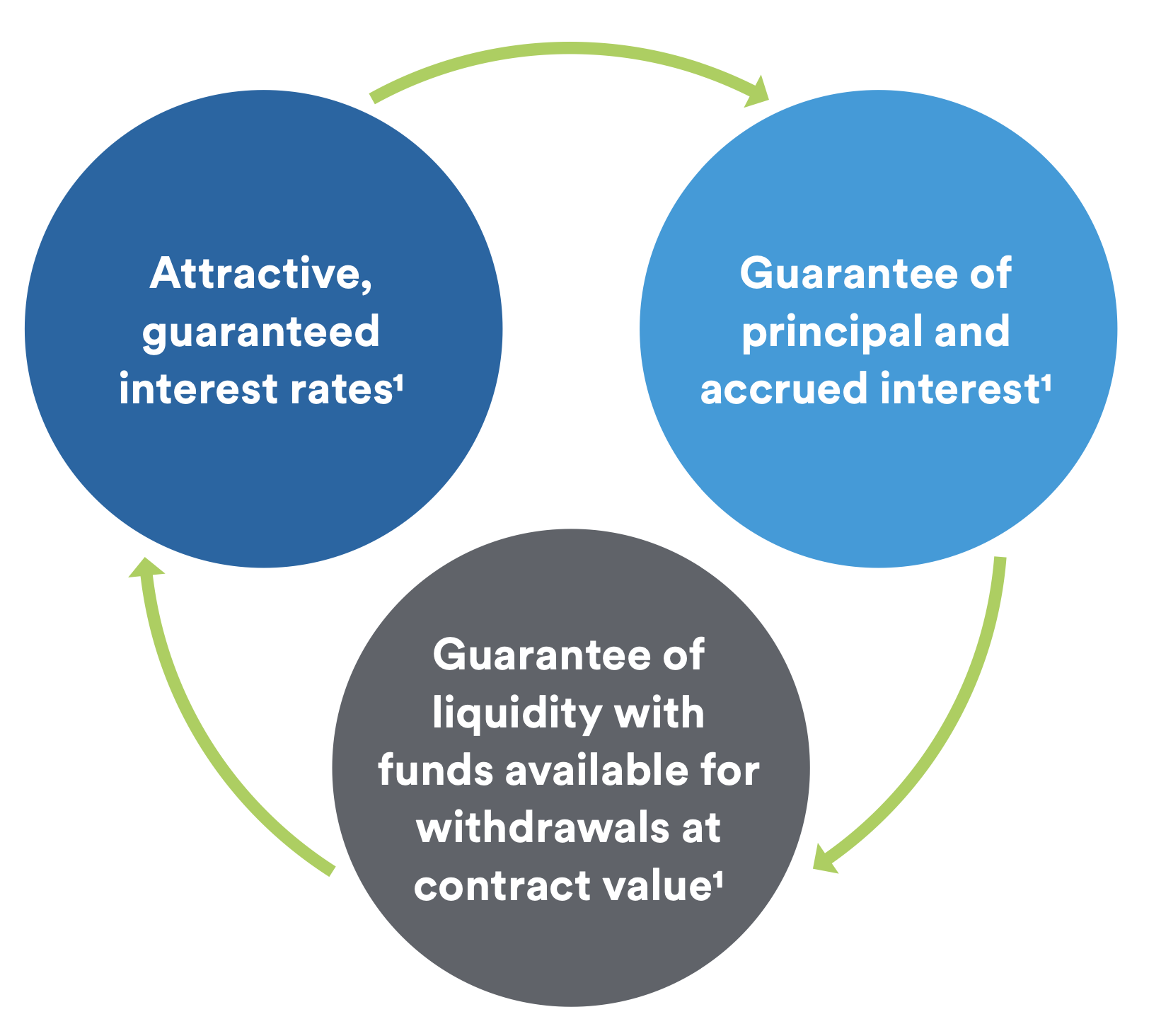

Competitive, Guaranteed1 Rates — Buyers can lock in a competitive interest rate of return for the life of the contract. And this rate/spread is guaranteed to remain the same by MetLife for the entire term of the contract.

Security for Participants — Along with a guaranteed interest rate, our Traditional GIC also guarantees principal,1 providing plan sponsors with a secure investment for plan participants. This ensures that their investments will be unaffected by market interest rate fluctuations, asset values, or withdrawals by other participants.

Added Flexibility — MetLife offers alternative Traditional GIC options that allow plan sponsors more flexibility. These include:

- Installment payouts

- Floating rate structures

- Index-linked structures

- Convertible structures

- Cash flow windows

- Callable/extendable features

Detailed term sheets for all MetLife traditional GIC solutions are available upon request.

Liquidity — MetLife guarantees that funds will be available to pay participant-initiated withdrawals, as determined by the plan, at full contract value.1,2 These benefits can include withdrawals, transfers, loans, retirement and other benefits specified by the plan.

Underwriting Expertise — MetLife is an industry leader in Traditional GICs, and our extensive underwriting experience allows us to tailor contracts to meet the unique cash flow and benefit liability needs of plan sponsors.

Offer Plan Sponsors the Potential for Better Returns with Stable Value

These income-producing, low-risk investments consistently outperform money market funds — and inflation — while providing a guarantee of principal and interest.1 Having a Traditional GIC as a component of a capital preservation option in retirement plans empowers employees to build more diverse retirement portfolios and potentially reduce market risk.

The MetLife Advantage

The MetLife enterprise serves 94 of the top 100 FORTUNE 500®-ranked companies3 and has a more than 45-year track record in stable value.

Expertise

Stable value is a core competency of MetLife. Our extensive knowledge and experience enable us to respond with creative and tailored stable value solutions.

Financial Strength

MetLife continues to earn high marks from the major rating agencies.4

Flexibility

To better meet the specific needs of plan sponsors, we work with our customers to create customized stable value solutions.

Superior Service

Clients benefit from our ready accessibility and our commitment to accountability.

We are an industry leader in stable value. Our extensive expertise managing both assets and liabilities, and our 155-year heritage of financial stability and strength, make us the preferred provider for many stable value managers and retirement plan sponsors.