MetLife Retirement & Income Solutions

For plan sponsors, facilitating the ability of defined contribution (DC) plan participants to generate income for retirement from the plan may be as important as any program enhancement they make. That’s because one of the toughest challenges for a DC plan participant is figuring out how to turn their retirement savings into income they can’t outlive.

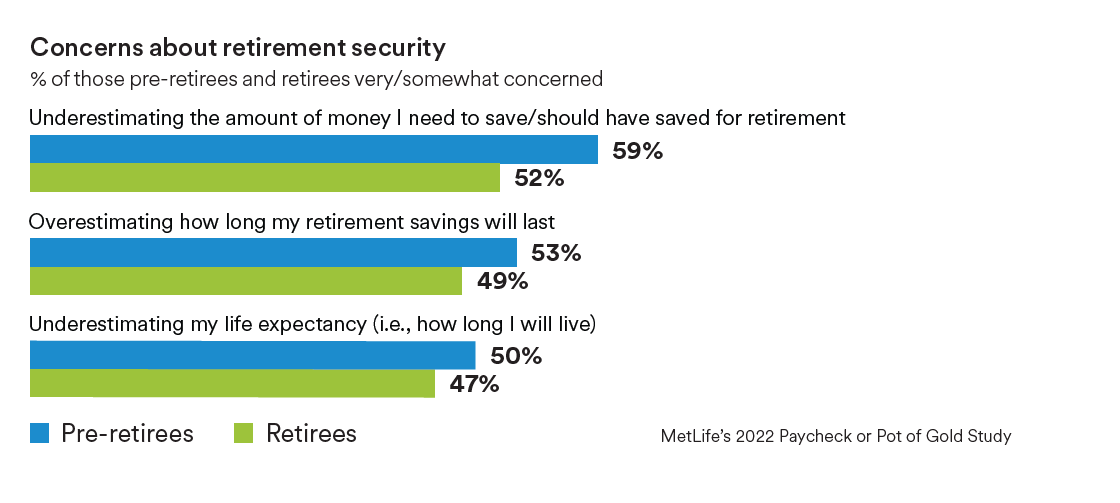

According to MetLife’s research, pre-retirees and retirees fear they may not have properly planned for the sustainability of their retirement funds, and they are concerned about their retirement security.1

An important consideration for DC plan sponsors is determining whether or not retirement income solutions should be considered as a component of a DC plan and, if so, in what way. Plan sponsors contemplating the decumulation stage should answer the following questions for their organizations:

- Would you like to offer your employees the guaranteed retirement income benefits of a defined benefit (DB) pension, but cannot incur the liabilities of doing so? Or, if you currently offer a DB plan, have you made, or are you planning to make, changes to your plan that would create a greater need for DC plan participants to create retirement income?

- Do you agree with the notion that part of the core purpose of a DC plan should be to serve as an income source during retirement?

- Are you open to the idea that offering only lump sum or systematic withdrawal distributions may not always be in the best interest of your retirees, given the likelihood they could outlive their savings?

- If you introduce a retirement income solution to plan participants, are you prepared to support the program with a robust income-focused educational campaign?

- Do you want your plan participants to have access to institutionally-priced retirement income options? If the answer to any of these questions is “yes” or even “maybe”, then it may be prudent for you to consider adding a guaranteed income form of benefit payment to your company’s DC plan.

Evaluating retirement income approaches

A participant’s individual needs in retirement, including expected living and health expenses in retirement, and the amount of income they need to replace in retirement, will likely dictate, to a large extent, their interest in any retirement income features added to the plan. MetLife’s research shows that nine in 10 retirees (89%) and pre-retirees (90%) feel it’s valuable (i.e., very important or absolutely essential) to have a guaranteed monthly income (i.e., a retirement “paycheck”) to pay their bills.1 An evaluation of the various ways in which a retirement income benefit can be offered as a component of a DC plan today includes:

- The plan sponsor's understanding of their participants' pre-retirement income levels and retirement savings

- The company's optimal retirement patterns

- The role the DC plan would need to play to facilitate access to retirement income

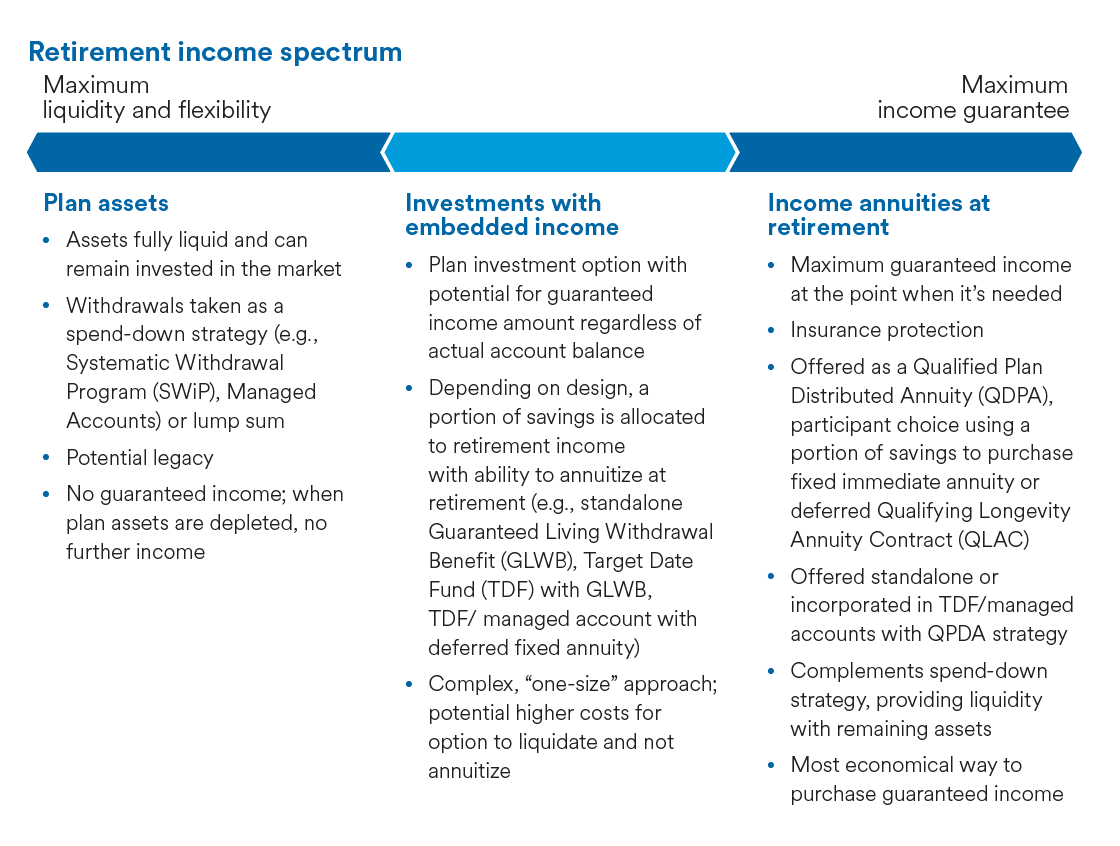

It may be helpful to think of each type of retirement income option available today as a spectrum that ranges from maximum income flexibility to maximum income guarantees. On this spectrum, for example, a systematic withdrawal plan would be at one end of the spectrum and an immediateor deferred fixed income annuity would be at the other end.

“Systematic withdrawal” plan (SWiP) approach

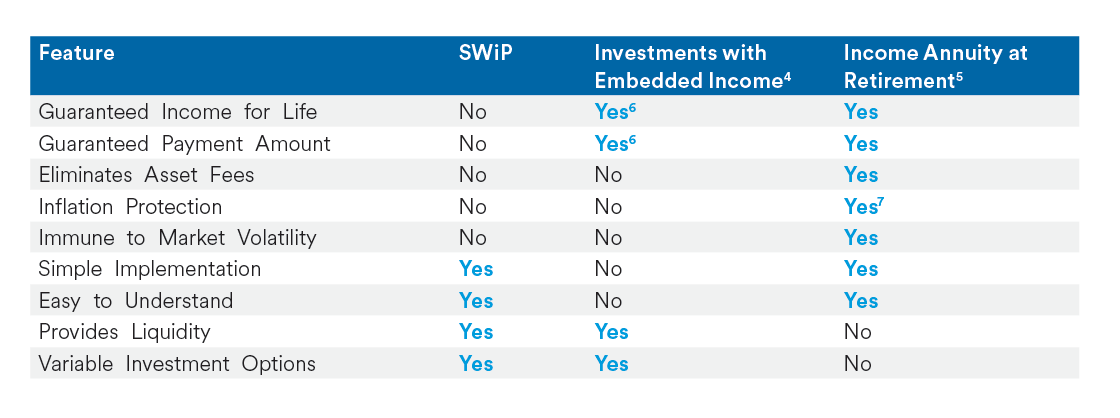

“Systematic withdrawal” programs (SWiPs) were the retirement industry’s initial attempt to introduce some form of structure or planning into the DC distribution process, but a closer look suggests that a SWiP approach, particularly if it is the only approach provided in the plan, can be problematic for a number of reasons, including the following:

- Impact of market returns and interest rates on a drawdown strategy — For decades, many financial planning professionals have suggested that individuals limit their annual withdrawals to no more than 4% which, on its face, may seem fairly conservative. This 4% “rule of thumb” had been called into question by several academic researchers,2 noting that its assumptions were based on returns seen in the 20th century and do not take into account today’s market volatility, fluctuating interest rate environment and inflation. However, more recently, a 2023 study by Morningstar shows that retirees can afford to withdraw “as much as 4.0% as an initial spending rate, assuming a 90% probability of still having funds remaining after a 30-year time horizon.”3 Yet, if they live longer than that 30-year time horizon in retirement, then retirees run the risk of running out of money.

- Exposure to longevity risk — DC plan design and practice have resulted in the majority of plan participants either taking their retirement savings as a lump sum distribution or leaving it in the plan until distributions are required under the required minimum distribution (RMD) rules. With the former, far too few participants understand that this approach leaves them extremely vulnerable to longevity risk since they do not know how long they are going to live and, hence, cannot ensure that a drawdown strategy will make their money last for the 20 to 30 or more years that they may spend in retirement. It also leaves them more vulnerable to inflation and market risk. For the latter, by taking only the required minimum distributions, participants may not be taking full advantage of the potential to generate income with what they have saved.

- Lack of guarantees — In general, when an employer-sponsored plan offers installments or systematic withdrawals, it utilizes IRS life expectancy tables to determine the level of benefit to the participant. For example, if the participant’s life expectancy at retirement is 20 years, the installment benefit would equal the individual’s plan balance discounted by a stated interest rate for 20 years, based on the assumption of a specific rate of return. Once the individual reaches his or her life expectancy, the benefit ceases because the assets have been completely drawn down. Clearly, such an arrangement poses problems for those people who outlive their average life expectancies, which by definition, 50% of participants will do. Systematic withdrawals, when not used in combination with guaranteed income, have the same shortcoming. Should market performance not equal or exceed the rate used in the withdrawal assumptions on a consistent basis, account balances could become depleted well before the end of retirement.

- A SWiP approach can be most effective when it is used in combination with a guaranteedsource of income, such as an immediate income annuity or a deferred income annuity —e.g., longevity insurance. The combination of a SWiP and guaranteed income can enable participants to both manage their retirement savings to a defined time horizon and have the benefit of a steady, guaranteed income stream that they cannot outlive. With longevity insurance, which is a deferred income annuity that could be purchased at the point of retirement, but would not begin payments until the individual reaches an advanced age (e.g., age 80 or 85), the individual can address their longevity risk while managing their remaining assets for a limited time horizon. This allows the individual to have guaranteed income later in life when it may be needed most, while also making it easier to determine exactly how much money can be withdrawn from their savings each month.

Navigating complexity and innovation: investments with embedded income

In recent years, the qualified retirement plan industry has seen the emergence of many new products along the retirement income spectrum as providers seek to find features and positioning that will meet emerging plan needs and participant preferences. At the same time, this competition and innovation around retirement income solutions has the potential to create significant confusion for both sponsors and participants.

Sponsors may be well-advised to first clearly establish the outcome they want to achieve, which they should keep in mind as a guiding principle for plan design considerations. Plan sponsors may also want to consider adopting a “Retirement Income Policy Statement,” which would outline the retirement income options available to their participants. This could be similar to the now widely used “Investment Policy Statement,” which most plan sponsors use as a guideline for their investments. Determining which type of solution to offer should come after the decision has been made to re-establish the DC plan as a retirement plan whose intent is to help participants generate retirement income.

One area of experimentation, first in retail and more recently in the institutional retirement arena, is a product category that we refer to as investments with embedded income. These are plan investment options for participants contributing during their working years, which have the potential for guaranteed income. Often offered as a Qualified Default Investment Alternative (QDIA), these options tend to be complex. Depending on design, a portion of savings is allocated to retirement income with the ability to annuitize at retirement (e.g., standalone Guaranteed Living Withdrawal Benefit (GLWB), Target Date Fund (TDF) with GLWB, TDF/managed account with deferred fixed annuity). However, if the participant decides not to avail themselves of guaranteed income, they presumably are paying potentially higher costs for the option to liquidate. Rather than being tailored to the needs at the plan participant at the point of retirement, investments with embedded income take a “one-size-fits-most” approach.

Providing income with fixed income annuities

Deferred and immediate income annuities provide individuals with an income stream that cannot be outlived — period. This type of guarantee can only be achieved with an annuity. An annuity should be considered to fill any gap that exists between the level of fixed living expenses and the amount of guaranteed income provided by sources such as Social Security or a monthly pension payment.

Annuities, like all insurance products, work on the concept of pooling risks which, in the case of retirees, include longevity, investment and inflation risks. The pooling of risk is not new to most people. For generations, Americans have held the majority of their retirement assets in a risk pool. Social Security and corporate pension plans are both examples of mortality pools. When an insurer pools longevity risk for a large group of retirees, money that is left over from people who die earlier than the average life expectancy is used to continue to pay people who outlive the average age. Pooling works because everyone shares a common risk, and while it can be accurately predicted how many people will be adversely affected by the risk, it is not possible to know in advance which specific individuals they will be.

Since an income annuity is an insurance product, it should not be considered an investment alternative but a complement to other sources of retirement funding. Mutual funds and other investments play an essential role in retirement as they provide liquidity and possible asset growth that can help offset inflation. However, as well as being vulnerable to market volatility, the income they provide may run out if one lives longer in retirement than anticipated. By allowing plan participants to place part of their retirement savings in a fixed income annuity, they will be able to generate income that lasts a lifetime, manage their remaining assets more efficiently, and maximize and protect their future income.

The value of keeping it simple for plan participants

For a sponsor wishing to provide guaranteed lifetime income from a DC plan, it is in the best interests of plan participants to keep it simple. While it may be tempting for plan sponsors to believe they should alleviate potential participant objections by offering products with many features, simplicity may be a more effective guiding principle for the decision-making process. This is important because participant behavior has consistently shown that complexity, such as too many choices and features, often leads to participant inertia (i.e., avoiding taking any action).8 For this reason, beginning with a “back-to-basics” approach when considering guaranteed retirement income options may be the most constructive strategy.

As a final consideration, the emerging wealth of behavioral research suggests that how a decision is framed — e.g., the way in which it is perceived by participants — may be the most significant determinant of its outcomes. For example, “life annuities are more attractive when presented in a consumption frame rather than an investment frame,”9 meaning that individuals are more likely to recognize the benefits of a guaranteed stream of income when the focus is on the purchasing power this income stream can provide, rather than on risk and return features, such as principal guarantees.

Plan sponsors play a critical role in the ultimate retirement outcome for millions of American workers. While encouraging retirement plan savings is incredibly important, that’s only one piece of the workplace retirement equation. Plan sponsors should also design retirement plans that help ensure successful retirement outcomes for the plan participant. By expanding access to guaranteed lifetime income solutions, employers can empower plan participants to confidently transition into retirement —and help ensure their retirement savings lasts.