MetLife Retirement & Income Solutions

Traditionally a solution for physical injury cases, structured settlements are available for non-physical injury cases in the form of a Non-Qualified Assignment (NQA). In comparison to a lump sum payment, NQAs have several benefits for claimants, including guaranteed payments for life, the ability to spread their tax obligation over time, and protection from market volatility and overspending. 1,2

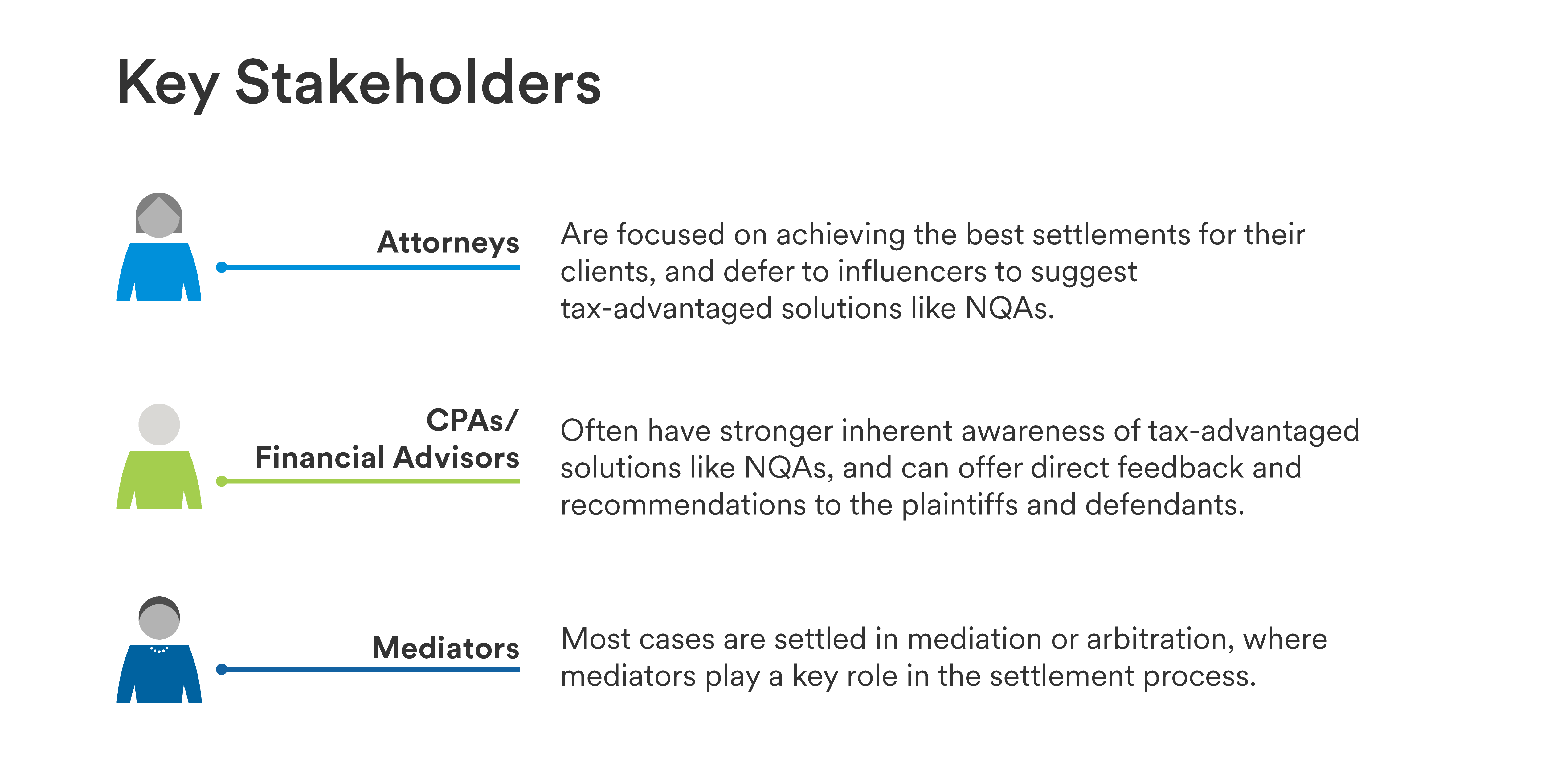

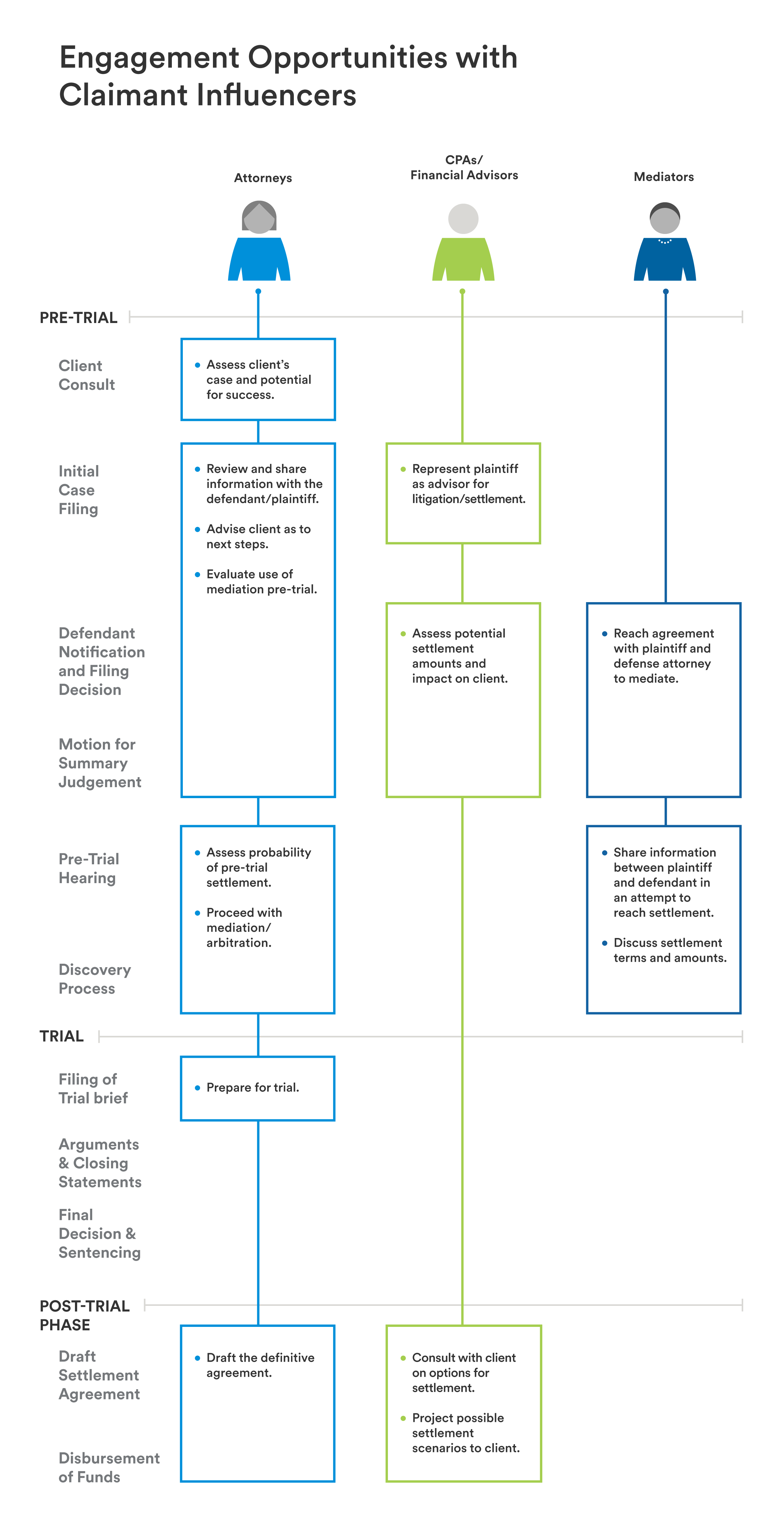

MetLife’s research into the growing NQA market for employment litigation has identified key influencers and their roles in guiding the claimants’ decision-making processes. By understanding these roles — and offering education and support — settlement brokers can both unlock new business opportunities and help create optimal outcomes for claimants.

NQAs have several advantages for claimants, and their untapped market potential presents an exciting business opportunity for settlement brokers. Settlement brokers must understand the influencer ecosystem that guides claimants’ decisions and maintain contact with those influencers throughout the litigation process. This involves everything from offering general information about NQA solutions and their benefits to providing NQA product specifications and ongoing support from the pre-trial to post-trial phases.