MetLife Retirement & Income Solutions

Stable Value vs. Money Market Update: Inflation Endgame Approaching?

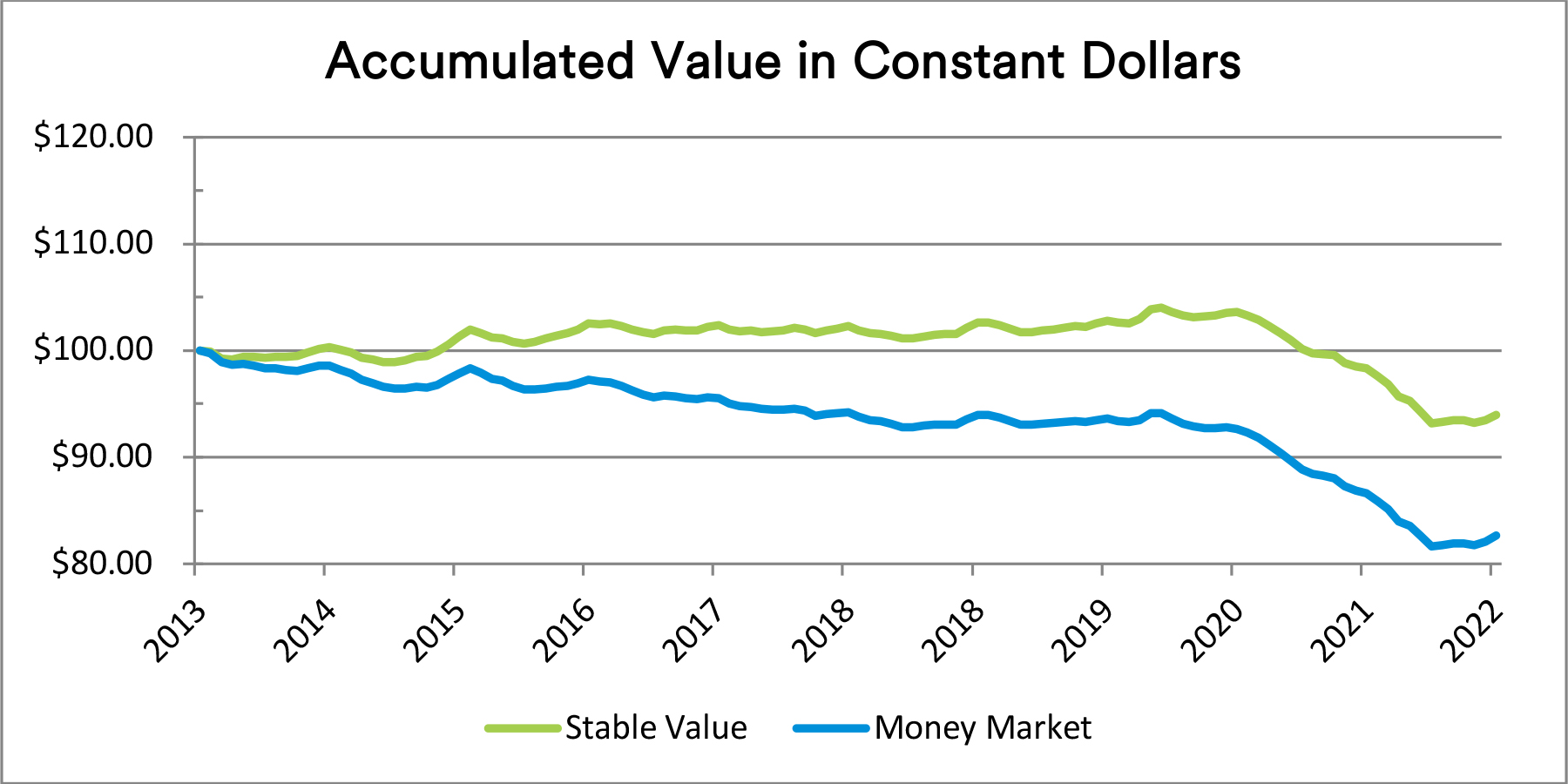

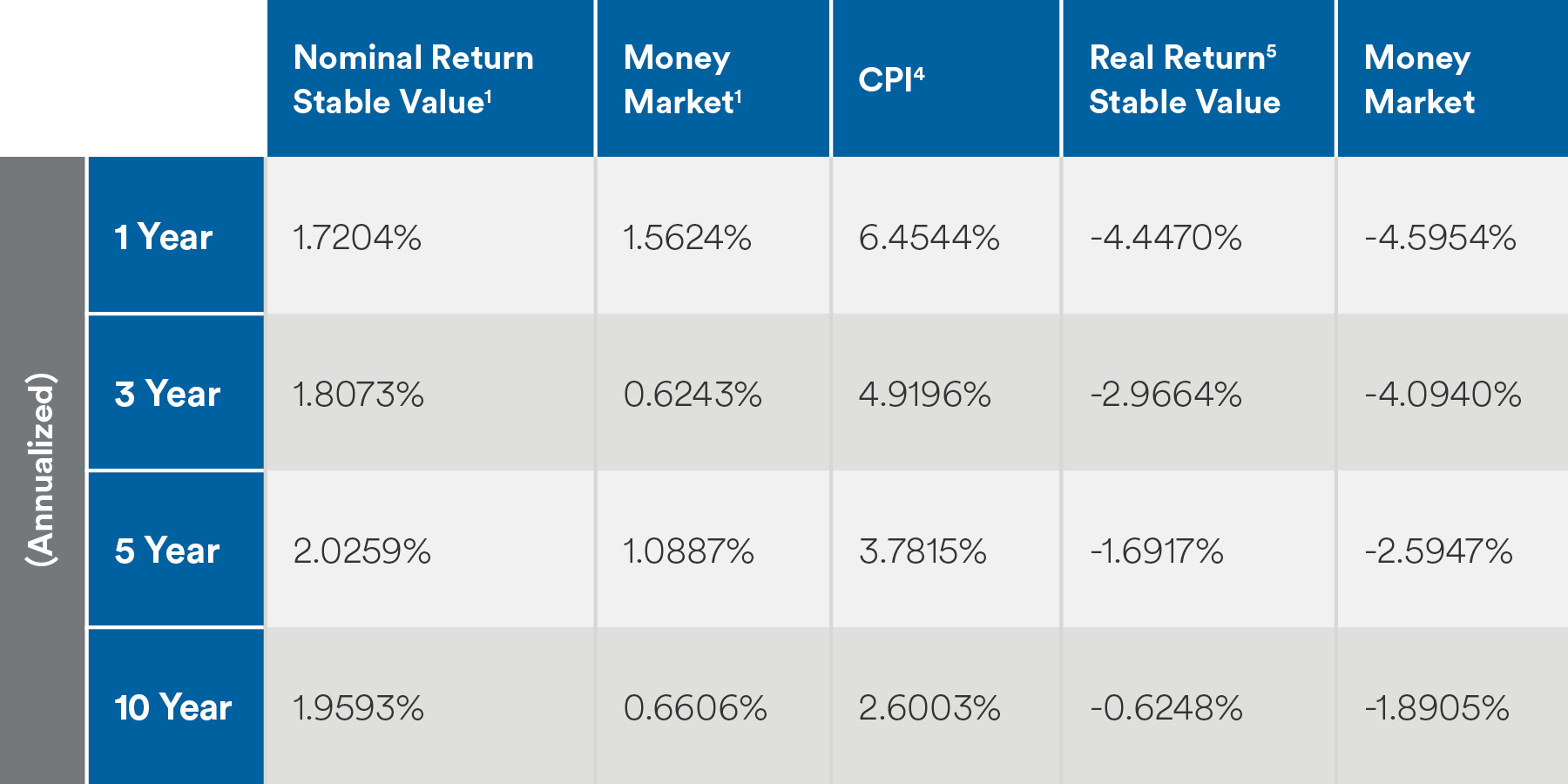

The Federal Reserve (“Fed”) raised its key short-term interest rate by a quarter percentage point in February in its most recent attempt to suppress soaring inflation. The Fed’s latest move follows December’s half a percentage point increase and takes the federal funds rate to a range of 4.5% to 4.75%, a restrictive level intended to slow economic growth. The chart below compares the growth of $100 invested in both Stable Value and Money Market Funds for the ten-year period ending 12/31/2022, adjusted for inflation. Over the past ten years, the investments in Money Market Funds have consistently lost purchasing power while stable value investments have been able to maintain their value in real terms until recently.(1) The effect of this rate hike is expected to further slow economic activity as it drives up rates for credit cards, adjustable rate mortgages and other loans. But Americans, especially seniors, are finally reaping higher bank savings yields after years of meager returns.(2)

Inflation, fueled by the COVID pandemic, peaked in June 2022 at 9.1%, and ended last year at 6.5%. Policy makers at the central bank have signaled their intent to push rates to the 5% to 5.25% range before pausing.(3) Quarter-point hikes are expected to occur in the first half of 2023 to achieve this goal.

Looking back, the period of Great Inflation in the 1970s was a time of rapidly rising prices of goods and services caused by many factors, including the oil crisis of 1973–1974, which led to higher energy costs, and government policies that increased the money supply and stimulated economic growth. The inflation rate rose as high as 14% in 1980. The Fed was criticized for not raising rates to slow inflation. Eventually, in the early 1980s the Fed implemented monetary tightening policies to help bring inflation under control.

There is consensus among investors that the Fed will not cut interest rates this year because inflation is likely to run significantly higher than the central bank's 2% target through the end of 2023. But a look at easing cycles since the early 1990s, when the 2% inflation goal first crystallized before being formalized in 2012, shows the Fed has not hesitated in easing monetary policy even with inflation above target.(6) Recent data continues to show inflation is cooling. The fact that the labor market has not slumped in response to tightening monetary policy brings optimism for a potential "soft landing" of the economy, where inflation comes down without triggering significant job losses or a major downturn.(7)

During times of market uncertainty, many investors, especially those near or in retirement, might consider it prudent to protect a portion of their assets with stable value. Because stable value is an investment option in a defined contribution (DC) plan with regular ongoing contributions, those contributions get invested at higher yields as rates rise, helping to mitigate the impact of the rate increases on the portfolio and the crediting rate. For DC plan participants, stable value provides full liquidity, principal protection and a guaranteed interest rate. It continues to act as a safe haven for investors during periods of significant market volatility.

Want to download the article?

DownloadStable Value Solutions

Keep risk down with a stable value option that steadily rises.

1Stable Value numbers represent stable value returns actually credited to participants for MetLife clients who allowed us to use their data. This data may not be representative of returns for the asset class as a whole. Money Market numbers are the weighted gross government rates obtained from sec.gov minus the average expense ratio of large money market providers.

2Fed interest rate decision today: Central bank hikes by 0.25 percentage points to tame inflation: (usatoday.com)

3Fed delivers small rate increase; Powell suggests 'couple' more hikes coming | Reuters

4CPI Index used is the US CPI Urban Consumers Index from Bloomberg

5Real return calculated by (1 + Nominal Return)/(1 + CPI) – 1

6Column: Fed will not wait for inflation at target before easing | Reuters

7Cooling US Inflation Lifts Hope For Smaller Fed Rate Hike | Barron's (barrons.com)