MetLife Employee Benefit Trends

Building Employee Financial Security in Uncertain Times

A report based on MetLife’s 18th Annual U.S. Employee Benefit Trends Study 2020

COVID-19 has brought challenging socio-economic conditions. As the crisis continues, many employees may be experiencing increased financial anxieties and looking to employers to help identify solutions.

The current economic climate has intensified the financial anxieties many employees already had. Learn why employer support through benefits and financial wellness programs is more crucial than ever.

Download StudyEmployers have the responsibility and opportunity to help support a healither and more resilient workforce.

The good news is that employers can make a tangible impact on their workforce’s financial health by offering strong benefit programs that support their employees. Those that have, have already seen positive impacts in their workforce.

Financial health

of employees supported with benefits

of employees aren't offered with any benefits or programs.

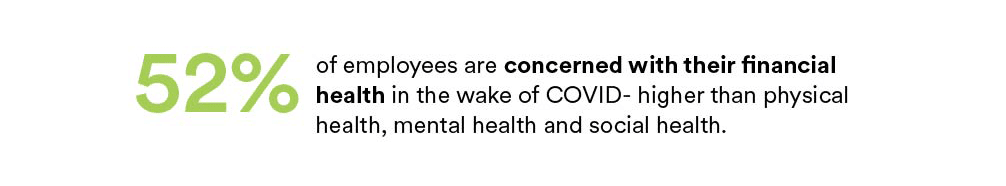

Financial Wellness Is a Top Concern

COVID-19 has created many uncertainties, and finances are no exceptions. Employees state that they are more concerned about their financial health in the wake of the pandemic than they are about their physical, mental and social health. Moreover, they are looking to their employers for help.

The Causes of Poor Financial Health

Personal finances continue to be a top source of stress overall for U.S. employees. And it is no surprise as many employees are living paycheck to paycheck and have dipped into their savings to pay for short term expenses.

Women, in particular struggling with finances, with 10% more likely to worry about debt. Across all generations, women cite more cost of living expenses, unplanned financial factors and lack of emergency funds to be major sources of stress.

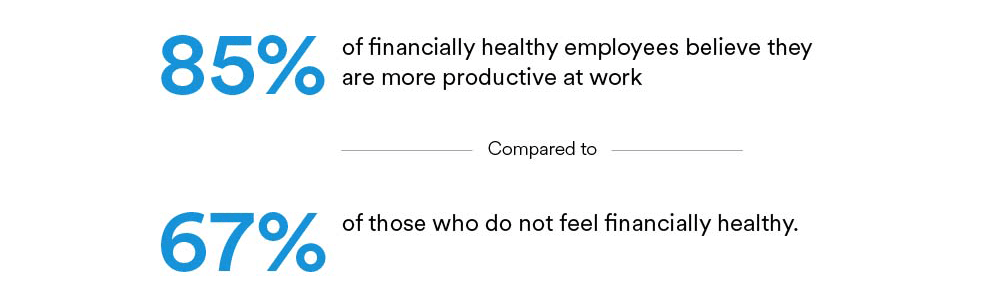

Why Employee Financial Health Matters

Financial wellness is more important than ever before as it has direct impact on employees mental health, as well as their productivity and engagement. Addressing financial health stressors will be crucial for supporting overall employee well-being and creating resilient employees that can help your company adapt to the challenges ahead.

Supporting Employee Financial Wellness

As the COVID-19 pandemic has placed new financial stress on employees, now is the time for companies to re-asses their employee benefit and financial wellness programs to ensure they are providing employees with timely, high-impact support.

Step 1: Review your current employee benefit offering to see if it is meeting employees new needs. From hospital indemnity insuranceies to critical illness insurance, it's essential to consider adding new benefits, especially ones that are more relevant in the wake of COVID-19.

Step 2: Increase communications around benefits and financial wellness programs to improve awareness and utilization. Communications now will be key to helping employees better protect themselves from financial risk and to enabling them to manage their short- and long-term goals.

A Crucial Time for Support

As the economic crisis continues, both employers and their employees face continued challenges in the months — and perhaps years — to come. These changes will impact the economy, but they will also lead to outsized disruptions in employee perceptions of work-life balance, caretaker obligations, personal stress and financial worries.

Businesses that adopt financial wellness programs and have strong benefit programs will help build a resilient workforce where their employees can handle these new economic challenges — and boosting overall engagement, productivity and talent retention in the process.