Life Claim FAQs

Life Claim FAQ’s

The United States Office of Personnel Management (OPM) has the overall responsibility for administration of the FEGLI Program.

OFEGLI is an administrative unit of Metropolitan Life Insurance Company that pays claims for the FEGLI Program.

OPM’s responsibilities include:

- Receiving all payments from agencies to the Employees' Life Insurance Fund (the Fund);

- Depositing these payments in the Treasury of the United States;

- Authorizing payment of life insurance premiums from the Fund to Office of Federal Employees’ Group Life Insurance (OFEGLI);

Determining whether retiring employees and employees receiving workers' compensation benefits are eligible to continue life insurance coverage. (For retirement systems other than the Civil Service Retirement System [CSRS] and the Federal Employees Retirement System [FERS], OPM bases its determination on certifications by the administrative office of the system involved); U.S. Office of Personnel Management 16

Publishing regulations, forms, and documents (such as the FEGLI Program Booklet and FEGLI Handbook);

Providing guidance to employing offices; and administering the life insurance contract.

OFEGLI’s responsibilities include:

- Processing and paying claims, including determining who is entitled to the benefits;

- Determining whether an insured individual is eligible for a living benefit;

- Determining whether accidental death and dismemberment benefits are payable;

- Determining an employee’s eligibility to cancel a waiver of insurance based on satisfactory medical information; and

- Processing requests for conversion.

If you need detailed information pertaining to the Federal Employees’ Group Life Insurance Program and claim process, you can access the FEGLI handbook that is located on the OPM website (Click here).

For information regarding the FEGLI claim process, please go to “Death Claims” that is located on the OPM website (Click here).

To obtain additional copies of the claim forms, please utilize the links below:

Claims Forms

- Claim for Death Benefits (FE-6) that is located on the OPM website (Click here) (to be completed by beneficiaries or family members when a federal employee or retiree passes away)

- Statement of Claim, Option C – Family Life Insurance (FE-6DEP) that is located on the OPM website (Click here) (To be completed by the federal employee or retiree when a covered family member passes away)

- Claim for Accidental Dismemberment (FE-7) that is located on the OPM website (Click here).

- Living Benefits Claim Form (FE-8) that is located on the OPM website (Click here).

Checking Status of a Life Insurance Claim

If you submitted an initial claim for benefits, wait at least 30 days before following up for the claim status. If it has been at least 30 days from the date you submitted your claim form, you may call 1-800-633-4542 (between the hours of 8:30 am - 4:00 pm Eastern Standard Time, Monday - Friday) and talk to a customer service representative of the Office of Federal Employees' Group Life Insurance. That is the office that pays the life insurance claims. Overseas beneficiaries should call 212-578-2975.

All secondary documentation, after initial claim is filed, please allow 7-10 days for this information to be reviewed and or processed.

Be sure you have the following information ready when you make the call:

- the name of the insured employee/retiree/compensationer

- the insured's Social Security number

- the name of the deceased (if different), and

- the date of death of the deceased.

All payments are sent through normal mailing channels through the United States Postal Service. Please allow for normal mail time after the claim was processed.

- If you opted for a check, a check can only be sent by Federal Express if:

- You establish a Federal Express account for faster delivery prior to contacting OFEGLI. All Federal Express costs must be covered by the requestor.

- Prior to payment, you contact OFEGLI and request that payment be sent by Federal Express, and you provide an account number to be charged. A FedEx Account # will consist of 9 digits.

- Please note that OFEGLI will not cover the cost to Federal Express payments.

In some situations, a federal employee or an annuitant may have several beneficiary designations to keep current. If they do not have a designation on file, then the funds will be distributed according to the Order of Precedence of the FEGLI program1.

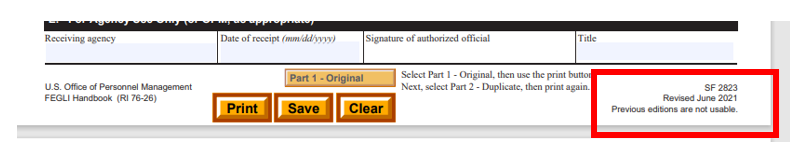

For the FEGLI Benefits, the beneficiary designation will be Form SF 2823. The form number is located on the bottom, right side of the form. Please see the example below.

Below is a link to a blank SF 2823 that is located on the OPM website:

NOTE: The insured’s employing office (if an active employee) or the OPM Retirement Services (for an annuitant) must have received the completed form before they died. The beneficiary designation must have also been approved by the agency/OPM Retirement Services before they died.

If you have a copy or copies of beneficiary designation forms with Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS), these forms will not pertain to the FEGLI benefit. Please see the links below for examples of the claim forms that pertain to CRSS or FERS.

Annuitant

Death of Annuitant

You can report the death in one of three ways:

- ONLINE which is located on OPMs website:

Click here - PHONE:

Call 1-888-767-6738 (1-88USOPMRET).

The phone lines are open from 7:50AM to 5:00PM. It is a busy phone number so you may want to try early in the morning or after 4:00PM when the phone lines are less busy.

- MAIL:

Write to:

U.S. Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017-0045

Include the deceased annuitant's full name, name of deceased, date of death, retirement claim number and/or Social Security number.

Employee (Or Employee's Family Member)

You must report the death to the human resources office of the employee's employing agency. Be sure to have the employee's full name and Social Security number. You'll also need the deceased's date of death. Please note that OFEGLI does not maintain agency contact information and can not supply the telephone number for Human Resources offices.

The agency will send you (and anyone else who appears eligible for life insurance benefits) the life insurance claim form.

Compensationer

Death of Person Receiving Compensation Payments

The person receiving compensation payments has received the payments for less than 12 months AND is still on an agency's rolls as an employee.

You must report the death to the human resources office of the employee's (compensationer's) employing agency. Be sure to have the employee's (compensationer's) full name, Social Security number and compensation claim number. You'll also need the deceased's date of death.

The agency will send you (and anyone else who appears eligible for life insurance benefits) the life insurance claim form.

A funeral assignment/reassignment is a written contract where the payee authorizes our office to pay all or a portion of his/her share of the benefits to be paid directly to the funeral home and/or cemetery for funeral expenses.

OFEGLI honors assignments from the funeral home, cemetery, and re-assignments as a courtesy to the grieving family. OFEGLI will also honor multiple assignments on an insured.

An acceptable assignment of funeral expenses should contain all of the following:

- Name of the deceased

- States the name of FEGLI and or MetLife as the insurance company

- States the exact amount (must be a numerical value) of insurance assigned

- Signature of the payee who is entitled to the benefits

- Signature of one witness or a notary public

Employee (Or Employee's Family Member)

If the insured was an active employee, you must contact the human resources office of the employee's employing agency. Be sure to have the employee's full name and Social Security number. You may also need the deceased's date of death.

Annuitant

If the insured was an annuitant, you must contact the OPM Retirement Services at 1-888-767-6738 (1-88USOPMRET).

The phone lines are open from 7:50AM to 5:00PM. It is a busy phone number so you may want to try early in the morning or after 4:00PM when the phone lines are less busy.

Additional Resources

- OPM Handbook which is located on OPMs website- Click here

-OPM Website- Click here