MetLife Retirement & Income Solutions

A Structured Installment Sale (SIS) is a financial arrangement that allows a seller of real estate, businesses or certain other appreciated assets to defer the recognition of capital gains tax and receive guaranteed installment payments over time. Structured installment sales, which evolved as an outgrowth of IRC section 453, help sellers manage tax liabilities by spreading them across several years and provides a steady income stream backed by a financially secure insurance company.

Key features include (1) Tax deferral: Sellers can defer capital gains tax by spreading the payment obligation over a period of time; (2) Guaranteed payments: The seller receives payments on a predetermined schedule, which can help secure their financial future; and, (3) Flexibility: Sellers can customize the payment plan to fit their financial needs, ranging from bi-weekly to yearly payments.

SIS Competing Product Types

While structured installment sales offer a tax-efficient way to defer capital gains taxes, there are alternative products available that may suit different financial needs and goals. These include:

- 1031 Exchanges: 1031 Exchanges allow real estate investors to defer capital gains by reinvesting the proceeds from a property sale into a “like-kind” property. To qualify, the exchange must follow strict IRS timelines and rules, including identifying a replacement property within 45 days and closing within 180 days of the original sale.

- Oil & Gas Leases: Some oil and gas lease interests may qualify for a 1031 exchange. While often viewed as highly speculative, oil and gas leases that qualify for the “like-kind” property requirement typically include perpetual mineral rights, royalty interests (if they are tied to mineral rights) and working interests in producing wells.

- Delaware Statutory Trusts: A Delaware Statutory Trust is a legal entity that allows investors to pool their money to buy real estate and hold and manage other assets (tangible and intangible). Delaware Statutory Trusts are a way to invest in real estate without being directly involved in management.

- Deferred Sales Trusts: A Deferred Sales Trust is a legal mechanism that leverages installment sales and trusts to delay capital gains taxes, potentially offering financial advantages for those selling highly appreciated assets.

- Qualified Opportunity Zone Funds: Qualified Opportunity Zone Funds are designated geographic areas that offer tax benefits to investors who reinvest capital gains into these zones to stimulate economic development in low-income communities.

- 721 Exchanges or UPREITs: With a 721 Exchange or UPREIT, an investor facing a capital gains tax bill from the impending sale of an appreciated piece of investment real estate instead chooses to contribute their physical property to a partnership in exchange for interest in the partnership.

- Charitable Remainder Unitrusts (CRUTs): With a Charitable Remainder Unitrust (CRUT), quarterly or annual payments to the beneficiary behave like an annuity, but they have the additional advantage of the deduction from income at the time of the creation of the CRUT.

- Traditional Installment Sales: Traditional Installment Sales, a form of revenue recognition where revenue and expenses are recognized at the time of cash exchange, allow ownership to transfer gradually as payments are made over a specified period. This set up is particularly useful for transactions involving high-value assets such as a real estate business.

- Earnouts: An earnout is a contractual agreement that allows the buyers to pay the seller a portion of their purchase price at a later date, contingent upon the target business achieving certain performance goals.

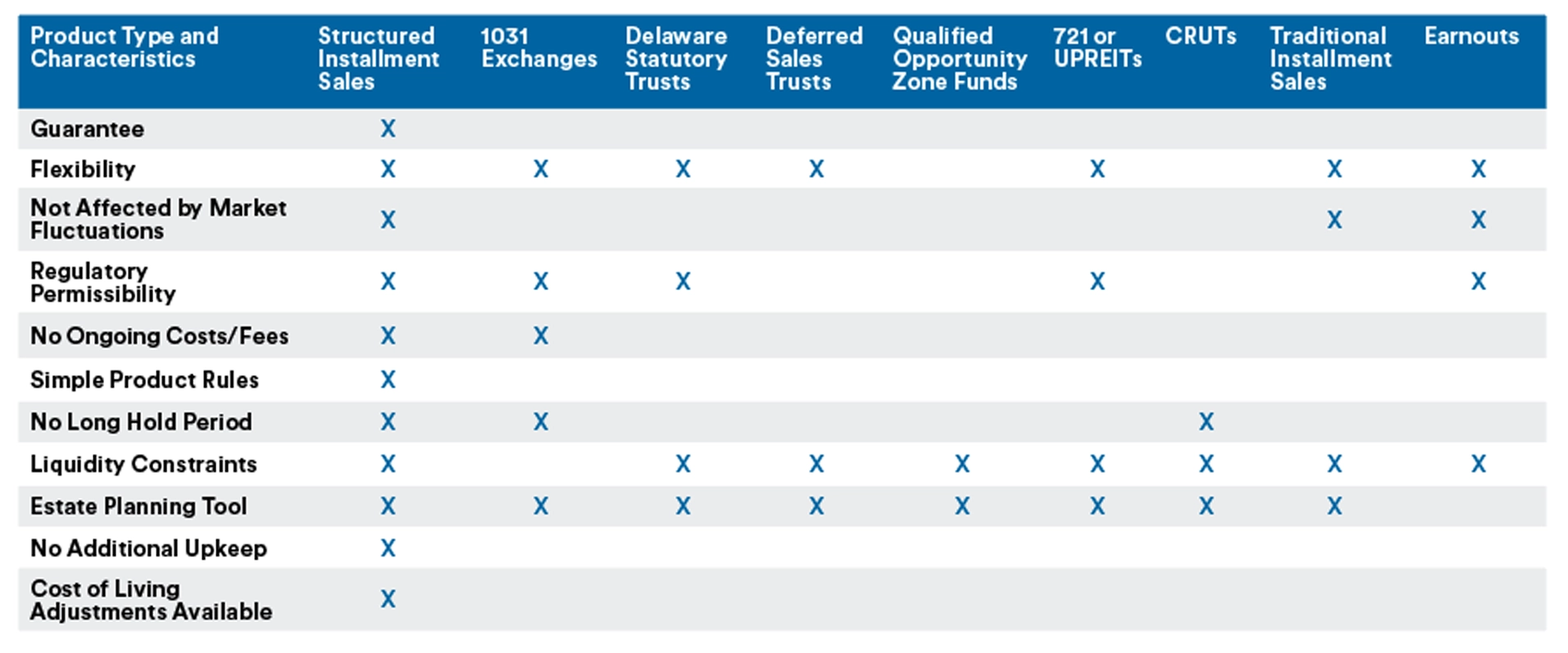

Product Characteristics

To determine the most appropriate product to address individual needs, it’s important to understand the characteristics of the available products, including their benefits and shortcomings including, but not limited to:

- Flexibility: Flexibility is the ability to customize and negotiate payment terms, interest rates earned, ability to adapt to evolving investment strategies and needs, and the accommodation of a diverse range of asset types, among other aspects.

- Complex Product Rules: The complexity of the legal structures that require careful planning and drafting to ensure they achieve the desired goals and avoid potential disqualification, which often require professional, legal and tax advice.

- Market Exposure: Refers to the possibility of losses on the investment of the deferred sales proceeds due to adverse movements and risks in the market.

- Long Hold Period Requirements of holding an asset for a certain duration of time ranging from five to ten years duration to maximize the benefits of tax deferral.

- Liquidity Constraints: Liquidity refers to the ease of accessing funds within tax-deferred accounts without significant penalties or immediate tax obligations. Liquidity may also be described as how quickly an asset can be converted to cash without a significant loss of value.

- High Investment Fees/Costs: Investment fees including acquisition fees, commission, O&O expenses, broker-dealer fees, dealer management fees and finance coordination fees, which can significantly erode tax deferral benefits.

- Estate Planning Tool: Assets placed in a trust are removed from the donor’s taxable estate, potentially reducing or eliminating estate taxes. The property is valued on a “step-up-basis” (i.e., the property’s value for tax purposes is reset to its fair market value at the time of the property owner’s death).

- Regulatory Permissibility: The IRS closely scrutinizes certain transactions involving complex tax deferral strategies to ensure compliance with tax laws. They also actively examine tax evasion schemes by trusts.

Conclusion

Determining which product best meets the needs of your clients requires a careful and thoughtful evaluation. By reviewing all of the available options vis-à-vis a structured installment sale, you and your clients can determine the most appropriate approach based on the financial and tax objectives for the sale of their real estate, business or other appreciated assets.