Social Responsibility

We're deploying the full strength of our people, products, services, and investments to deliver on our sustainability commitments.

For more than 156 years, MetLife has helped generations of people build a more confident future. We have the experience, global resources, and vision to provide financial certainties for an uncertain world.

As one of the world’s leading financial services companies, MetLife plays an important role in caring for our communities. Our business helps create a positive impact for our customers, employees, shareholders, communities, and the environment by aligning the company’s sustainability objectives with its purpose and business mission. Through product innovation, the work of MetLife Foundation, our corporate giving, employee volunteering efforts, meaningful partnerships, and providing pro bono services, MetLife colleagues work every day to help build a more confident future for people around the world.

MetLife’s Diversity, Equity and Inclusion (DEI) Commitments

Read more about the details of MetLife’s DEI Commitments.

Social Topics

For more information about MetLife’s current efforts, visit the latest Sustainability Report or download MetLife’s full Policies & Benefits and medical plan information for U.S. employees.

As one of the world’s leading financial services companies, MetLife plays an important role in caring for our communities. We support the communities where we operate through our corporate efforts and the work of MetLife Foundation, including grant-making and impact investing, employee engagement and volunteering.

DEI at MetLife is a global business, sustainability, leadership and workforce imperative. It’s a critical component for our business and a driving force for innovation. Inclusive behaviors foster collaboration, enhance team performance and expand the breadth of ideas needed for effective problem solving. With enhanced internal belonging, we can deliver better solutions for our customers and, in return, better outcomes for our shareholders and communities.

At MetLife, we are intentionally cultivating a purpose-driven and inclusive culture that builds and values a diversity of talent to innovate for today, tomorrow and the future so that we fulfill our promise to our customers in the communities we serve around the world. To deliver on our purpose, we are always searching for the best talent to join MetLife. We provide equal access to opportunities and respect diverse backgrounds, experiences, skills, perspectives and thinking styles.

We are committed to being transparent about our progress and accountable for our results as we aspire to become a global employer of choice.

We have guidelines around diverse hiring best practices for hiring managers in each round of the recruitment and hiring process. We train recruiters and managers to be aware of and avoid potential biases in the hiring, performance assessment and career development processes.

Additionally, we strongly consider multiple dimensions of diversity in evaluating the effectiveness of the Board. For more information about diversity on our Board and information about our Directors, see our latest Proxy Statement.

Explore our global DEI strategy, DEI Commitments and recent progress in our latest sustainability report.

MetLife aims to give every colleague the tools, resources and opportunities they need to grow their career. We also help pay for advanced education to support advancement. Through a partnership with United Negro College Fund, MetLife Foundation finances scholarships for students attending Historically Black Colleges and Universities. The Foundation also engages with partners dedicated to education and career placement such as The Opportunity Network, Sponsors for Educational Opportunity, NPower and Girls Who Code.

MetLife encourages a culture of year-round volunteering whereby our colleagues embody the care we seek to instill in all aspects of our operations. MetLife colleagues across all regions and departments lend their time, talent and passion for their communities to educational, environmental, mentoring, coaching, skills-based and pro-bono initiatives. We offer employees in the U.S. and Asia one paid day off per year to volunteer. These efforts support MetLife’s 2030 Commitment of 800,000 employee volunteer hours with a focus on underserved communities by 2030. Read more about our employees’ efforts to build economic inclusion, financial health and resilient communities in our latest sustainability report.

Since 1868, MetLife has helped generations of people build a more confident future. Around the world, MetLife companies offer life, accident and health insurance, retirement and savings products and other financial wellness solutions that help families (including pets), businesses and communities not just survive, but thrive. This chart showcases examples of MetLife products and services that incorporate considerations for environmental and social issues, such as planning for natural disasters or obtaining equal access to financial services, to help address our customers’ diverse and evolving needs and help create greater certainty in an uncertain world.

| ESG Category |

Product Name |

Product/Service Description |

Sustainability Issue |

Markets |

| Social |

PlanSmart® |

A multi-channel experience that focuses on behavioral change, with toolsand guidance that empower customers’ employees to build financialliteracy confidence and well-being. |

Financial wellness | U.S. |

| Social | Met99 | Flexible life insurance product designed to make financial planning more accessible to low- and moderate-income government employees. Customers can choose the protection they need from more than 20 benefits and can bring life and different kinds of protection for the policyholder and their economic dependents within the same policy. | Financial wellness | Mexico |

| Social | 360Health | Helps customers with solutions that address their mental, physical, financial and social health, through a comprehensive focus on key aspects of managing critical illnesses to improve customers’ "healthspan." | Financial wellness; Health and well-being | Australia, Bangladesh, China, Korea, Nepal, UAE |

| Social | 360Future | Helps customers prepare early for retirement and supports them as they age, with retirement savings, insurance, health and wealth services. | Financial wellness; Health and well-being | China, Korea |

| Social | Simplified Issue Medical Care | New simplified issue version to complement existing Medical Care suite, which targets seniors and those who are rejected from standard full underwriting. It is a 10- to 20-year renewable small ticket-size base policy with accidental death benefit with multiple optional riders covering diagnosis of various diseases, hospitalization surgery and treatment. | Financial wellness; Health and well-being | Korea |

| Social | PNB MetLife Genius Plan | Non-par savings plan that provides guaranteed benefits and allows customers to create a customized pay-out structure, helping parents pay for education while balancing their financial protection needs. | Financial wellness | India |

| Social | My Child Education Protection Plan | Upgraded education protection insurance with more comprehensive protection elements. The education insurance plan for parents in Bangladesh and Nepal was created to prevent children’s education being hampered by financial hardship. | Financial wellness | Bangladesh; Nepal |

| Social | Women’s Protect and Intuition | Designed for women and covers certain conditions related to female health, including cancer treatments. Women’s Protect also offers discounts on a variety of health and wellness benefits. Women who buy this product will receive 15% to 50% off dental, optical and nutritional services, as well as discounts on gyms and spa facilities. | Health and well-being; Diversity, equity and inclusion | Gulf Region |

| Social | Several products | Customers can opt to pay their insurance premiums in monthly installments, without being charged with additional fees and/or costs. This allows low- and moderate-income consumers to access insurance. | Financial wellness | Italy |

| Social | Life Insurance and Accident & Health Insurance products | Partner with local financial institution Serfinanza and specialized agents to bring insurance to customers who would traditionally have trouble accessing products. | Financial wellness; Health and well-being; Diversity, equity and inclusion | Colombia |

| Social | Life Invest | Yen-denominated variable insurance that provides protection and asset-building functions at a reasonable monthly premium. One of its objectives is to help seniors extend their health and wealth spans to live well after retirement. | Financial wellness | Japan |

| Social | Rural Term Insurance | Consists of a series of base products and optional riders covering major and minor critical illness benefit, extra benefit for cancer, waiver of premium after critical illness, health management services and maturity/death benefit. Customers can customize their health protection package according to individual needs. The solution can also be upgraded over time, making it more affordable for younger customers and allowing them to enhance their protection as their income grows. | Financial wellness | China |

| Social | Mini Accident Insurance | Covers death and fractures caused by accidents for one year with a small premium of around US$4.25/year. We introduced Smart and Easy MetLife Mobile, an online platform that offers a simple purchase experience for six Mini Insurance products. | Financial wellness | Korea |

| Social | Life Invest | Yen-denominated variable insurance that provides protection and asset building functions at a reasonable monthly premium. One of its objectives is to help seniors extend their health and wealth spans to live well after retirement. | Financial wellness; Health and well-being | Japan |

| Social | Pradhan Mantri Jeevan Jyoti Bima Yojana | Partnered with India Post Payments Bank to launch the governmentpromoted, low-cost insurance. The product provides access to low‑income and underserved customers—especially those in remote areas—by providing protection and financial security. | Financial wellness | India |

| Social | Dental Insurance | Dental coverage for low- and moderate-income consumers offered through an arrangement with the Itaú Unibanco bank and Inter Bank. | Health and well-being | Brazil |

| Social | Dental Insurance | One of the largest national preferred provider organization dental networks featuring:

|

Health and well-being | U.S. |

| Social | Pension Fund | Pension fund administration company, Chile ProVida, provides our pension platform and has a number of resources to support our customers. The company offers financial inclusion programs aimed at women, giving them tools to contribute to their pensions and grow at work. And a blog called “Tus Ahorros En Simple” (Your Savings In Simple Terms) provides helpful information in simple, understandable terms. | Financial wellness; Diversity, equity and inclusion | Chile |

| Social | LifeCare Beautiful | Designed for women, against diagnosis of nine listed female-specific diseases that include breast and cervical cancer, along with loss of life. Breast and cervical cancer are the two most common cancers affecting women in Nepal. | Health and wellness; Diversity, equity and inclusion | Nepal |

| Social | For Women | Critical illness for women, including coverage for certain conditions related to female health, such as assisted reproduction, death through childbirth, pregnancy complications and congenital malformations of newborns. | Health and wellness; Diversity, equity and inclusion | Czech Republic; Slovakia |

| Social & Environmental | Unit-linked Insurance Products | Under a unit-linked insurance plan, policyholders make regular premium payments for insurance coverage and as an investment. The plan then offers a combination of insurance and investment payouts. A unit-linked insurance plan can be used, for example, to provide life insurance, build wealth, generate retirement income and pay for education. In certain markets, MetLife has onboarded environmental, social and governance (ESG)-focused funds as an option for customers. | Financial wellness; Climate change | Bulgaria, Czech Republic, Hungary, India, Latin America, Slovakia, and U.S. |

| Social | MetaLife Mujer | Universal Life product focused on savings and protection with tangible benefits such as special assistance for issues affecting women. | Financial wellness; Health and well-being; Diversity, equity and inclusion | Mexico |

| Social | Vida Pension 57 Mujer | Provides protection (against death or disability) for women up to the age of 57 and also allows them to accumulate capital to supplement their retirement (pension gap). | Financial wellness; Health and well-being; Diversity, equity, and inclusion | Colombia |

| Social | Pet Insurance | Plans for dogs and cats help reimburse customers for unexpected vet bills. We provide insurance for pets of all ages—even seniors—and customers can customize their deductible and reimbursement rates so they work best for their pets’ needs and their budget. | Financial wellness | U.S. |

The Families at MetLife MOMENTUM network connects and supports colleagues who are navigating family and career by keeping members apprised of available MetLife resources, organizing learning events and activities, and serving as a voice for caregivers. In the U.S., we offer eight weeks of fully paid parental leave for primary caregivers and two weeks for secondary caregivers. We also offer an additional six to eight weeks short-term disability leave for childbirth and recovery.

For colleagues who want to build or grow their families, we have introduced Maven, a resource that offers 24/7 virtual support, including counseling, resources and referrals related to fertility, childbirth, adoption and surrogacy, parenting a newborn, returning to work and more.

All parents are provided with benefits to help them balance their career and family life, including:

- Flexible work arrangements, such as compressed work weeks, part-time work hours, flextime and virtual work;

- Back-up childcare for up to 15 days per child per year when regular care is unavailable, along with up to 10% in full-time childcare discounts;

- Counseling, concierge services, research and referrals, seminars and self-assessments through an Employee Assistance Program;

- A holistic well-being program that provides resources and support in the areas of coping, balance, body, relationships, finances and resilience;

- A collection of resources for parents and caregivers, including tutoring and test prep discounts, a college advising program, elder care guidance and child behavior expert consultations;

- Internal support through Families at MetLife, a network where colleagues connect and discuss their experiences balancing career and family; and

- Digital resources and dedicated Care Advocates for every stage of the family building journey.

MetLife has been recognized for its inclusive workforce programs and named to the Dave Thomas Foundation for Adoption’s annual list of Best Adoption-Friendly Workplaces™. For the 16th year in a row, MetLife has earned a spot on the list for its employee adoption benefits, parental leave policies and flexible work culture.

Find out more about MetLife’s benefits program and view our U.S. Employee Policies & Benefits.

MetLife’s Financial Wellness Products help our customers manage their personal finances and feel emotionally in control of their financial futures. Through products, services and partnership programs, MetLife’s Financial Wellness and Engagement group provides long-term solutions that bring financial wellness and education to individuals while strengthening our relationship with employers. Please also see examples of products that support financial wellness and inclusion in the Sustainability Products and Services chart.

In addition to our financial wellness-focused insurance and benefits program, we also invest in the financial wellness of communities through our impact investing portfolio and with the support of MetLife Foundation. Through these programs, we aim to build a more prosperous future for all.

MetLife’s work framework is a structured model with three segments: in-office, hybrid and virtual. Most U.S. employees have a hybrid schedule and work in the office three days per week. Employees have the ability to choose where they work on the other two days—in the office or virtually. For added flexibility beyond Paid Time Off (PTO), hybrid employees have 10 additional ‘flex days’ per year where they can choose to work virtually. The in-office segment includes roles with heightened risk in areas of operations, technology and finance that require them to work in the office four to five days per week. In-office assigned employees also receive 10 virtual flex days. The virtual segment works remotely full-time, and are able to work in the office, as needed. In addition to our work framework, MetLife also offers flexible work arrangements in appropriate circumstances, including virtual work, part-time and compressed workweek.

See U.S. Employee Policies & Benefits for more details.

We believe that a person’s potential and well-being are inseparable. We aim to care for the holistic wellness of our workforce and our customers through thoughtful benefits, programs and support that meets diverse needs.

For Our Colleagues

Year-round, MetLife strives to help colleagues experience the value of our benefits programs through our BeWell platform, which provides access to health and wellness resources, support and leader tools. In addition, we raise awareness of our benefits through storytelling, leader messages and awareness campaigns.

Sustainability measures implemented across our offices and operations achieve the additional benefit of providing our colleagues with healthy spaces where they can thrive. We prioritize using sustainable materials and design in our buildings and providing high levels of indoor air quality and natural light and amenities such as bike storage, healthy dining options and sit-stand desks. In 2019, MetLife became the first life insurance company to earn healthy workplaces certifications from Fitwel. Fitwel is a joint initiative of the U.S. Centers for Disease Control and Prevention and the General Services Administration.

For Our Customers

In addition, we aim to improve the health and wellness of our customers. Part of building a more confident future is supporting our customers during difficult times, particularly when the health and wellness of their family is at stake. We strive to improve and evolve our products and services based on local market and customer needs. Our latest sustainability report and our Sustainability Products and Services list provides additional details and recent results.

Support for Public Health

As part of our commitment to public health and well-being, MetLife Mexico is part of the UN Health and Well-Being Working Group, which recently released the second edition of the Health and Wellness Best Practices Guide. Development of this public resource, led by the Mexican Business Coordinating Council and the UN Global Compact (UNGC) highlights new approaches and recommendations on how to address the health of the workforce through three dimensions: physical, mental and financial health. MetLife Foundation also supports Dental Lifeline Network, a nonprofit that provides free dental care to vulnerable communities in the U.S., and Vision to Learn, which delivers mobile vision clinics and provides custom-made/custom-fit eyewear to students.

See our latest Sustainability Report for more on the ways we support well-being and health

As a UNGC participant, MetLife prioritizes human rights and upholds policies and regulations designed to prevent any abuses of human rights, such as human trafficking or slavery, forced labor and child labor.

Although we believe governments hold the primary responsibility for safeguarding and protecting human rights, we also believe that championing DEI and human rights within our businesses is core to our purpose and in alignment with the International Labour Organization’s Declaration on Fundamental Principles and Rights at Work.

Our MetLife Statement on Human Rights describes the ethical business practices and codes we uphold and mechanisms for reporting issues or concerns. MetLife also provides a Modern Slavery Statement on an annual basis in compliance with the UK Modern Slavery Act (2015) and a separate annual statement in compliance with the Australia Modern Slavery Act (2018). Both statements demonstrate MetLife’s zero-tolerance approach to modern slavery (including human trafficking and forced labor) in our organization and supply chain.

MetLife has been in the impact investment market since 1984. Impact investments are defined as investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return (according to the Global Impact Investment Network). This activity includes both MetLife’s General Account and a smaller volume of MetLife Foundation assets.

As part of MetLife’s effort to originate $500 million of new impact investments between 2020 and 2030, MetLife’s Impact Investment program invests approximately $50 million annually, primarily in support of financial health and climate change priorities. MetLife’s impact investments are originated with the intent to generate positive societal benefits in the markets where we live and work, creating value for communities and catalyzing inclusion and equity. These investments include projects that aim to mitigate and adapt to climate change, expand racial equity, support women to become financially independent and expand financial health services to the under- and unbanked through credit unions and community-based organizations.

Learn more about MetLife's Impact Investment Program. Please visit MetLife Foundation’s site to learn more about MetLife Foundation’s Impact Investing portfolio.

MetLife Foundation seeks to drive inclusive economic mobility by addressing the needs of people with low income around the world. Aligned with the United Nations Sustainable Development Goals, MetLife Foundation makes grants across three strategic giving portfolios:

- Economic Inclusion: Supports efforts that upskill and reskill talent, develop an entrepreneurial mindset and connect talent to paid employment with family-sustaining wages

- Financial Health: Supports efforts that build financial health and resiliency through budget management, savings and access to credit

- Resilient Communities: Supports efforts that open up and expand access to mental and physical well-being resources and environmental causes for a more resilient planet

We regularly review colleagues’ pay and our pay practices to attract, motivate, engage and retain top talent, and we provide equal pay for equal work. As outlined in MetLife’s Pay Equity Statement, we review our pay practices for any potential disparities that cannot be explained by objective factors such as performance, experience level, credentials or location and correct any issues. We are committed to continuing to review our practices to promote fairness and equity. When we hire or promote talent, we take into consideration each candidate’s qualifications and experience in connection with the market-aligned range for the job and relative to peers.

MetLife conducts a pay equity review in the U.S. on an annual basis to examine whether there are differences in pay between persons of different genders, races and ethnicities that are not explainable by objective, business-related factors, and has made appropriate adjustments across genders, races and ethnicities.

We have a pay-for-performance philosophy, which means there is a direct link between a colleague’s compensation, their performance and MetLife’s performance. We also provide manager training on making compensation recommendations with a focus on performance, as well as positioning in the market-aligned range relative to peers.

Please refer to MetLife’s sustainability report for our commitment and progress toward advancing diversity and inclusion with our workforce and our Pay Equity Statement.

Through MetLife’s Supplier Inclusion & Development program, our goal is to grow relationships with diverse suppliers to promote their economic growth. MetLife’s Supplier Inclusion & Development, which is integrated within Global Procurement to help us interact with sourcing professionals and business stakeholders, supports the inclusion of diverse suppliers in our supply chain, as well as supporting and sponsoring their business development. As part of our 2030 DEI Commitments, MetLife has committed to spending $5 billion with diverse suppliers by 2030 and to annually report the economic impact of MetLife’s diverse supply chain, which we do through our Economic Impact Report. See 2030 DEI Commitments for more information and read more about our Supplier Inclusion & Development program.

We work with several external organizations on supplier inclusion and development, including:

- Disability:IN;

- National Minority Supplier Development Council;

- National Veteran Business Development Council;

- National LGBT Chamber of Commerce;

- WEConnect International; and

- Women’s Business Enterprise National Council.

At MetLife, we create personalized learning experiences through a combination of virtual, hybrid and in-person learning and development opportunities, where colleagues can network, collaborate and learn from each other. Our latest sustainability report provides detail on our internal talent marketplace and learning opportunities for our employees.

Employees can leverage our digitally enabled learning platforms to continuously develop and build the core skills they need in a dynamic environment. Our digital talent marketplace, MyPath, provides employees experiential learning opportunities and empowers them to manage their development through strategic networking, participation in projects and applying to new career opportunities.

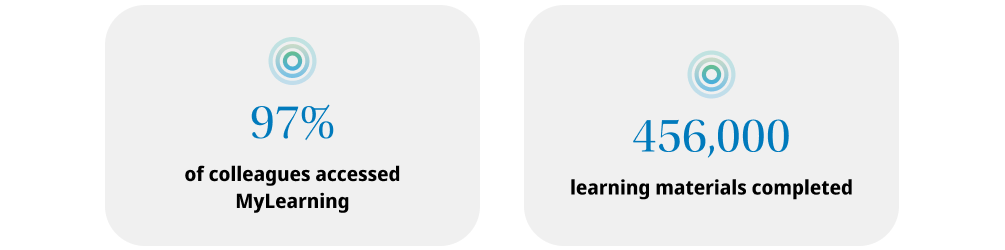

MetLife’s MyLearning platform provides access to digital learning such as articles, books and videos, as well as connection to webinars and courses.

Learn about responsible investments in MetLife's General Account portfolio5 intended to achieve a market financial return while considering social and/or environmental benefits that help create healthier communities and a more sustainable environment. These investments focus on the core areas of infrastructure, green, municipal bonds, affordable housing and impact investments.

Read our latest Sustainability Report

for more information on MetLife’s initiatives and progress.