LONG-TERM CARE COSTS RISE ACROSS THE BOARD FROM 2008 TO 2009 METLIFE MATURE MARKET INSTITUTE® SURVEY SHOWS NOTABLE INCREASES FOR NURSING HOMES, ASSISTED LIVING COMMUNITIES, ADULT DAY SERVICES & HOME CARE

Westport, CT , October 27, 2009

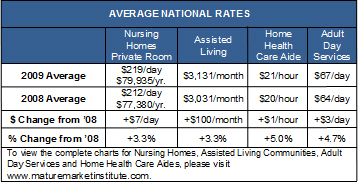

Price rollbacks throughout the U.S. economy during the past year did not apply to long-term care service providers, according to the 2009 MetLife Market Survey of Nursing Home, Assisted Living, Adult Day Services, and Home Care Costs. Private room nursing home rates rose 3.3% to $219 per day or $79,935 per year, while assisted living also rose 3.3% on average to $3,131 per month. Home health care aides now cost an average of $21 per hour, a 5% increase; adult day services run $67 per day, a 4.7% increase.

For nursing homes, the highest costs for a private room were reported in Alaska ($584/day) while the lowest were in Louisiana, Rest of State ($132/day). Assisted Living costs were highest in Wilmington, Delaware ($5,219/month) and lowest in North Dakota ($2,041/month). The highest Home Health Care Aide rates were $30 per hour in the Rochester, Minnesota area, while the lowest were reported in the Shreveport, Louisiana area at $13 per hour. Adult Day Services were highest in Vermont at $150 per day and lowest in Montgomery, Alabama at $27 per day.

The study, which groups Assisted Living Communities into three categories—“basic” (five or fewer services), “standard” (six to nine services) and “inclusive” (10 or more services)—notes differences from 2008 in the number of communities in each category. More are classified in the middle “standard” range and fewer in the “basic” category. Communities in the “standard” category include more services in their base rates, but, on average, also have higher base rates. The study also found that those who enter an Assisted Living Community with Alzheimer’s disease, or those who develop Alzheimer’s later, can expect to pay more for that care, with an average monthly cost of $4,435.

“These across-the-board increases may be surprising to many given the economy over the past year,” said Sandra Timmermann, Ed.D, director of the MetLife Mature Market Institute. “But, while the Consumer Price Index (CPI) decreased overall during the past year, costs for medical care are 3.3% higher, which parallels our findings on long-term care. The change in pricing methods at some assisted living communities may be another factor, a warning to consumers to carefully compare prices at all long-term care service facilities by considering both the base price and the add-ins for additional services.”

Additional Long-Term Care Facts

About three-quarters (73%) of the home health care agencies surveyed provide Alzheimer’s training to their employees, and almost all (98%) agencies surveyed do not charge an additional fee for patients with Alzheimer’s. About one-quarter (27%) of the home health care agencies surveyed have a 24-hour or live-in rate. The average capacity at adult day service centers is 44. The average client-to-staff ratio is 6:1 with a maximum of 20:1.

Methodology

This survey of nursing homes, assisted living communities, home care agencies, and adult day services in all 50 states and the District of Columbia, including national figures and data from 87 individual markets across the country, was conducted by telephone between July and October 2009 for the MetLife Mature Market Institute by LifePlans, Inc. For nursing homes, private-pay rates for long-term (custodial) nursing care were obtained for private and semi-private rooms throughout the U.S. At assisted living communities, costs were obtained for room and board (at least two meals per day, housekeeping and personal care) in one-bedroom apartments or private rooms with private baths. Home care rates were based on hourly rates for home health aides at licensed agencies and agency-provided homemaker/companion services. Adult day service costs reflect daily rates at licensed facilities for the majority, though licensing requirements vary by state.

LifePlans, Inc.

LifePlans, Inc., a risk management and consulting firm, provides data analysis and information to the long-term care insurance industry. The firm works with insurers, the federal government, industry groups, and other organizations to conduct research that helps these groups monitor their business, understand industry trends, perform effective advocacy, and modify their strategic direction.

The MetLife Mature Market Institute®

Established in 1997, the Mature Market Institute (MMI) is MetLife’s research organization and a recognized thought leader on the multi-dimensional and multi-generational issues of aging and longevity. MMI’s groundbreaking research, gerontology expertise, national partnerships, and educational materials work to expand the knowledge and choices for those in, approaching, or caring for those in the mature market.

MMI supports MetLife’s long-standing commitment to identifying emerging issues and innovative solutions for the challenges of life. MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates, is a leading provider of insurance, employee benefits and financial services with operations throughout the United States and the Latin American, Europe and Asia Pacific regions. For more information about the MetLife Mature Market Institute, please visit: www.maturemarketinstitute.com.

The 2009 MetLife Market Survey of Nursing Home, Assisted Living, Adult Day Services, and Home Care Costs can be downloaded from www.maturemarketinstitute.com under “What’s New.” It can also be ordered by e-mailing, maturemarketinstitute@metlife.com, or by writing to: MetLife Mature Market Institute, 57 Greens Farms Road, Westport, CT 06880.