Maximizing Care with Union Membership

Learn how unions help employers cultivate a happier, healthier, and more loyal workforce with always-on care.

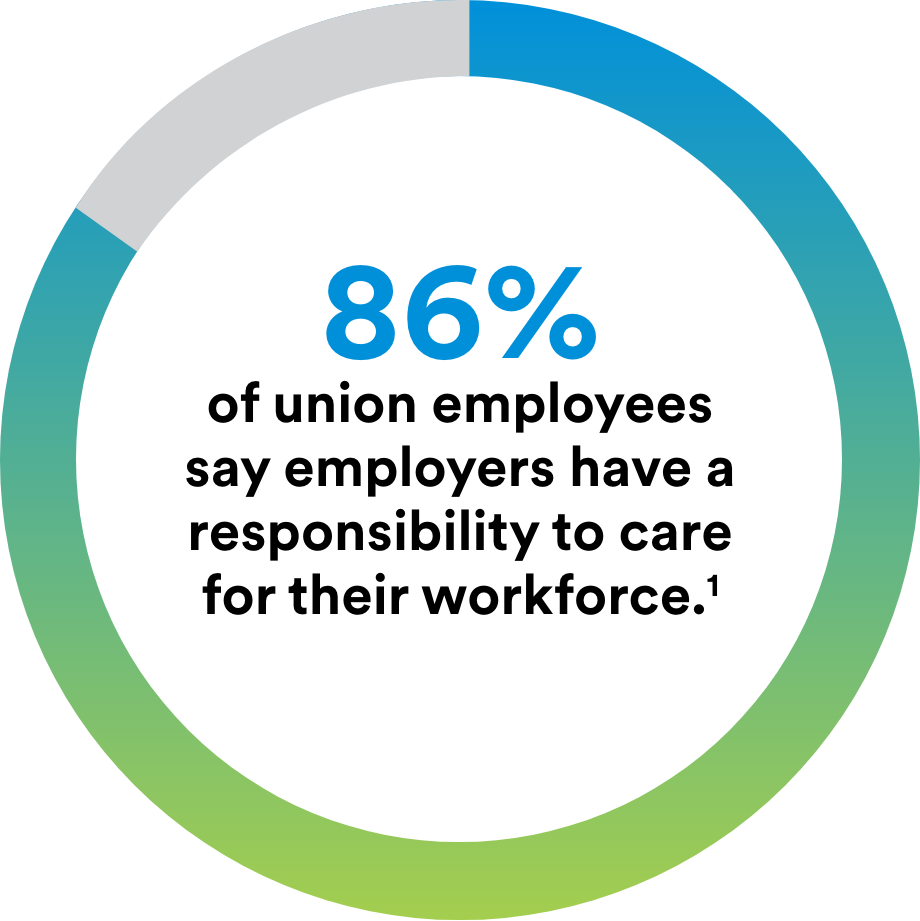

And employers agree — 88% say it’s important to demonstrate care for their employees. In fact, it’s the #1 reason employers are investing in benefits today. Because employees who feel cared for are 3.4 times more holistically healthy, 2 times more satisfied, and 1.4 times more loyal. 1

Collaborating with unions to put the needs of members first

For more than 150 years, MetLife has built our business on trust and expertise, including a focus on the union market. We provide a comprehensive suite of solutions that makes it easy for unions to offer the benefits members want. Designed to complement medical coverage, our flexible product combinations meet their unique needs. And through the buying power of many, we offer competitive group rates that members can’t get on their own.

How can we help you?

Made for union employees

For more than 65 years, MetLife has been providing benefits to unions of all sizes. Learn about our commitment to tailored benefit offerings.

Get the details behind the trends

Every year, MetLife conducts industry research and provides our union collaborators with the data and insights to help you stay ahead of employee benefit trends.

At every stage, we’ll support unions and their members and provide marketing materials to help maximize participation.

Sales

MetLife provides product training resources for benefits conversations with association members and employees.

Onboarding

MetLife’s service teams support your members and their employees with resources to explain their benefits options.

Enrollment

MetLife’s communications help ensure employees understand how to enroll in benefits and why.

Engagement

Ongoing communications keep benefits top of mind year-round —not just during open enrollment.