Commercial mortgage loans and real estate equity assets managed climb to $76.4 billion driven by strong activity throughout North and South American, European, and Asia Pacific markets

WHIPPANY, N.J., March 26, 2018

MetLife Investment Management (“MIM”), MetLife, Inc.’s (NYSE: MET) institutional asset management platform, announced today that it completed $16 billion in global real estate transactions on behalf of investors in 2017. This brisk investment activity was largely driven by continued demand for financing across domestic and international commercial real estate markets.

MetLife Investment Management’s global real estate platform, which includes origination and asset management capabilities across 11 regional offices, also grew its commercial mortgage loans and real estate equity assets managed to $76.4 billion, a 9.1 percent increase from the year prior.

“Our superior real estate platform across equity and commercial mortgage investments helped grow our client base in 2017,” said Robert Merck, senior managing director and global head of real estate and agriculture for MetLife Investment Management.

“Our debt platform set a second consecutive year of record portfolio growth as commercial mortgages continued to provide strong relative value over alternative fixed income investments. Additionally, our real estate equity platform continued to execute on its acquisitions and build-to-core investment strategies in markets with strong fundamentals, while also taking advantage of opportunities to harvest gains through the sale of select investments.”

MIM originated $14.0 billion in commercial mortgage loans, increasing commercial mortgage loans managed to $57.0 billion, and setting a record for year-over-year growth and total commercial mortgage loans managed.

MIM expanded its international real estate portfolio in 2017, significantly increasing its commercial mortgage loan production in both Korea and Japan year-over-year while also closing originations in Australia of approximately AUD $755 million, in Mexico of 3.4 billion pesos, and through additional investments in the Eurozone and Chile.

In addition, MIM completed more than $2.1 billion in global equity real estate acquisitions. This volume increased equity real estate assets managed to $19.4 billion.

Commercial Mortgage Production

MIM originated a number of significant commercial mortgage loan transactions in 2017, including the following:

- $282 million first mortgage participation in a senior loan secured by 28 student housing properties throughout the United Kingdom

- $268 million, 11 property addition to an existing 37 property industrial portfolio located throughout the western United States

- $250 million warehouse revolving line of credit to LoanCore Capital Credit REIT, LLC

- $235 million first mortgage on One Sansome Street, a class A, LEED platinum office tower in San Francisco, California

- $210 million security trust on a 49 asset industrial portfolio across multiple cities in Mexico

- Lead lender with a $200 million co-lender position in a $400 million mortgage loan on the Freehold Raceway Mall, a super-regional mall in central New Jersey

Equity Real Estate Investments

MIM’s equity real estate portfolio includes investments in office, apartment, retail, industrial and hotel properties.

“MIM successfully executed its strategy of pursuing assets and markets that enhance and strengthen our expanding real estate portfolio,” said Merck. “In 2018, we believe market conditions will continue to make select real estate investments and sales attractive.”

Throughout 2017, MIM committed to purchase 25 properties valued at more than $2.1 billion. MIM’s long-term strategy is to develop or acquire core and core-plus assets in attractive markets with strong fundamentals.

Noteworthy transactions closed during the year ended December 31, 2017, consisted of:

- Sentinel Square III, an acquisition of an existing office building and adjacent parcel with development plans to construct a 545,000 square foot, class A office building in Washington, D.C.

- West Broad Marketplace, a 273,000 square foot, grocery-anchored retail center with plans to develop a 117,000 square foot expansion in Richmond, Virginia

- Chino Spectrum Towne Center, a 460,000 square foot, class A retail center located in Chino, California

About MetLife Investment Management

MetLife Investment Management (“MIM”), MetLife, Inc.’s institutional asset management platform, provides institutional investors including corporate and government pension plans, insurance companies and other financial institutions with long-term public and private investment and financing solutions. With operations in the Americas, Asia and the Europe, Middle East & Africa (EMEA) regions, MetLife Investment Management manages assets for third-party institutional investors, separate accounts and MetLife, Inc.’s general account. MetLife Investment Management leverages a disciplined credit research and underwriting process to provide institutional investors with asset origination and acquisition opportunities and proprietary risk management analytics across traditional fixed income strategies, commercial real estate debt and equity investing, agricultural financing, and private placements, among others. For more information, visit www.metlife.com/investments.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates (“MetLife”), is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management to help its individual and institutional customers navigate their changing world. Founded in 1868, MetLife has operations in more than 40 countries and holds leading market positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. For more information, visit www.metlife.com.

Disclosures

This news release may contain or incorporate by reference information that includes or is based upon forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will be,” “will not,” and other words and terms of similar meaning, or are tied to future periods, in connection with a discussion of future financial performance. In particular, these include statements relating to future actions, prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, trends in operations and financial results. The investments specified herein were selected to illustrate the geographic and property type distribution within the platform. These investments were not selected based on their assumed profitability. There can be no assurance that any of these investments will be profitable.

Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. Many such factors will be important in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. These statements are based on current expectations and the current economic environment. They involve a number of risks and uncertainties that are difficult to predict. These statements are not guarantees of future performance. Actual results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties, and other factors that might cause such differences include the risks, uncertainties and other factors identified in MetLife, Inc.’s most recent Annual Report on Form 10-K (the “Annual Report”) filed with the U.S. Securities and Exchange Commission (the “SEC”) and Quarterly Reports on Form 10-Q filed by MetLife, Inc. with the SEC after the date of the Annual Report under the captions “Note Regarding Forward-Looking Statements” and “Risk Factors” and other filings MetLife, Inc. makes with the SEC. MetLife, Inc. does not undertake any obligation to publicly correct or update any forward-looking statement if we later become aware that such statement is not likely to be achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the SEC.

Additional Disclosures for Non GAAP Information

Explanatory Note on Non-GAAP Financial Information:

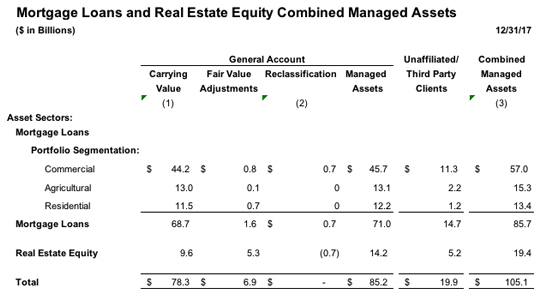

Mortgage Loans on a Combined Managed Assets Basis and Real Estate Equity on a Combined Managed Assets Basis (as defined below) are financial measures based on methodologies other than accounting principles generally accepted in the United States of America (“GAAP”). MetLife believes the use of Mortgage Loans on a Combined Managed Assets Basis and Real Estate Equity on a Combined Managed Assets Basis enhances the understanding of the depth and breadth of its investment management services on behalf of its general account investment portfolio and unaffiliated/third party clients. “Mortgage Loans on a Combined Managed Assets Basis and Real Estate Equity on a Combined Managed Assets Basis” include at estimated fair value: (i) actively-managed general account mortgage loan and real estate and real estate joint venture assets and (ii) non-proprietary mortgage loan and real estate equity assets managed on behalf of unaffiliated/third party clients. General account mortgage loans and certain real estate investments have been adjusted from carrying value (“Carrying Value”) to estimated fair value. Classification of mortgage loans and real estate equity by sector is based on the nature and characteristics of the underlying investments which can vary from how they are classified under GAAP (“Managed Assets”). Non-proprietary mortgage loans and real estate equity managed on behalf of unaffiliated/third party clients are stated at estimated fair value, but are excluded from MetLife, Inc.’s consolidated financial statements.

Mortgage Loans on a Combined Managed Assets Basis and Real Estate Equity on a Combined Managed Assets Basis are non-GAAP financial measures and should not be viewed as substitutes for Mortgage Loans and Real Estate and Real Estate Joint Ventures, the most directly comparable GAAP measures. Reconciliations of Mortgage Loans and Real Estate and Real Estate Joint Ventures to Mortgage Loans on a Combined Managed Assets Basis and Real Estate Equity on a Combined Managed Assets Basis are set forth in the table below.

(1) Net of valuation allowances.

(2) Real estate equity includes $711 million of joint venture investments, with the underlying investments primarily in commercial mortgage loans. The amount presented for commercial mortgage loans includes the $711 million of joint venture investments, while the amount presented for real estate equity excludes the $711 million of joint venture investments.

(3) Commercial mortgage loans and real estate equity total $76.4 billion and is comprised of commercial mortgage loans of $57.0 billion and real estate equity of $19.4 billion.