Eyebrow

Inflation and rising costs continue to weigh on small business growth and expansion plans

Washington, D.C., September 24, 2025 — Small business confidence continued to climb in the third quarter, according to the latest MetLife and U.S. Chamber of Commerce Small Business Index. The Q3 2025 Index score of 72.0, up from 65.2 last quarter, was driven by improved views of both the national and local economies.

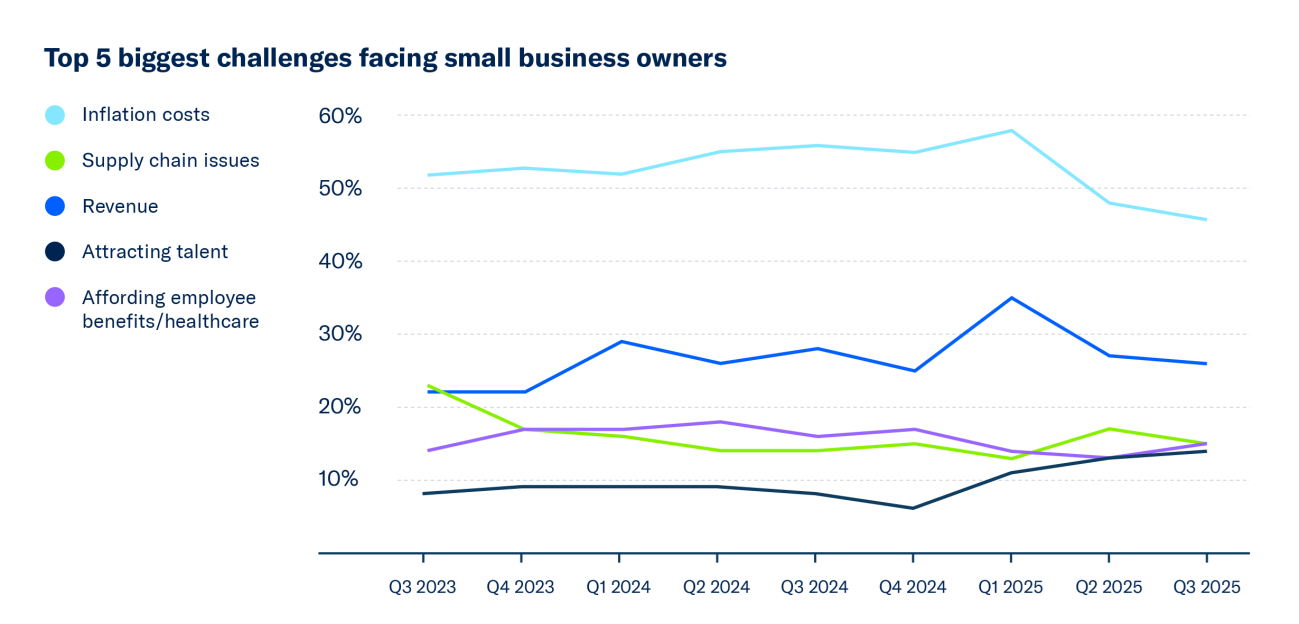

While optimism is on the rise—particularly around cash flow and economic outlook—small businesses continue to grapple with inflation and escalating costs, which remain the biggest barriers to growth.

“This quarter’s Index reflects a resilient small business community that’s cautiously optimistic about the economy,” said Tom Sullivan, Vice President of Small Business Policy at the U.S. Chamber of Commerce. “But high costs are still holding many back from expanding and investing.”

Key Findings:

- Confidence climbs: The Index score of 72.0 marks a record high for the Index, driven by improved views of both the national and local economies.

- Cash flow comfort grows: 31% of small businesses report being very comfortable with their cash flow, up from 23% last quarter.

- Economic outlook improves: 40% say the U.S. economy is in good health, and 46% say the same of their local economy—both up from Q2.

- Inflation remains top concern: 46% cite inflation as the biggest challenge, and 75% say rising prices have significantly impacted their business in the past year.

- Costs hinder growth: 34% say the cost of goods and services is the biggest roadblock to expansion; 33% report being unable to enter new markets due to rising costs.

Small business owner Victoria Thomas, Principal and Chief Business Officer of Kellymoss Racing in Fitchburg, Wisconsin, says the local economy has been strong.

“Our area benefits from a strong base of technology, manufacturing, and small businesses. While we see some of the national headwinds in tariff concerns and labor shortages, overall, the demand for our product is steady and the entrepreneurial environment here continues to support growth,” says Thomas.

While inflation and supply chain issues are easing for small business owners, a new challenge is gaining ground: attracting talent. This quarter, 14% of small business owners cited talent acquisition as a top concern, an increase from 6% in Q4 2024.

“This quarter’s record-high Index score reflects the resilience and optimism of small businesses, even as they face rising costs,” said Bradd Chignoli, executive vice president and head of Regional Business & Workforce Engagement at MetLife. “With nearly half of small businesses citing inflation as their biggest challenge, it’s clear that economic pressures persist. At the same time, we’re seeing attracting employees as a growing concern. Our data shows that in this environment, investing in people through training, relevant benefits packages, and personalized communications is not just a response to current challenges, it can be a strategy for long-term growth and stability.”

Small Businesses Weigh Growth Priorities

This quarter’s survey also asked small business owners about where they are making investments. Marketing and sales, customer experience, and inventory top the list. Small businesses are also focusing some of their investments in technology. Younger business owners are more likely to prioritize investing in online customer experience, technology, and AI to support their businesses.

Of the small businesses that said they are investing in technology, most say they are focusing on:

- Business software (60%)

- AI (36%)

- Data management and analytics (32%), and

- Cybersecurity software (27%).

About the Small Business Index

The MetLife and U.S. Chamber of Commerce Small Business Index is part of a multiyear collaboration by MetLife and the U.S. Chamber to elevate the voice of America’s small business owners and highlight the important role they play in the nation’s economy. The quarterly Index conducted by Ipsos is designed to take the temperature of the sector, see where small business owners are confident, and where they are experiencing challenges.

The Q3 2025 survey was conducted online in English by Ipsos between July 24 – August 11, 2025. The survey has a sample size of 750 small business owners and operators age 18+ from the continental U.S., Alaska, and Hawaii. The survey has a credibility interval of plus or minus 4.4 percentage points for all respondents.

About the U.S. Chamber of Commerce

The U.S. Chamber of Commerce is the world’s largest business organization representing companies of all sizes across every sector of the economy. Our members range from the small businesses and local chambers of commerce that line the Main Streets of America to leading industry associations and large corporations.

They all share one thing: They count on the U.S. Chamber to be their voice in Washington, across the country, and around the world. For more than 100 years, we have advocated for pro-business policies that help businesses create jobs and grow our economy.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates ("MetLife"), is one of the world's leading financial services companies, providing insurance, annuities, employee benefits and asset management to help its individual and institutional customers navigate their changing world. Founded in 1868, MetLife has operations in more than 40 markets globally and holds leading positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. For more information, visit https://www.metlife.com.