Retirement

2 min read

Jun 20, 2024

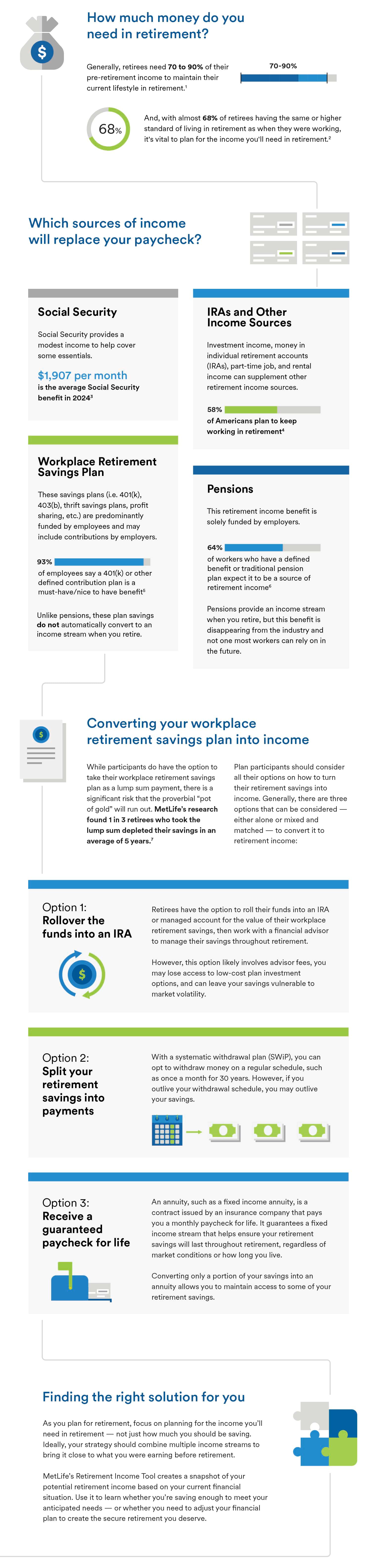

Even the most prepared pre-retirees worry they’ll outlive their savings — and as employers pivot from pensions to defined contribution plans, employees face even more responsibility for their future.

Understanding how much you'll need in retirement, and where that money will come from, can help you prepare. Here's what you need to know.