Understanding an Employee's Retirement Mindset

Retirement & Income Solutions

With MetLife’s latest research, we sought to unpack employees’ attitudes, hopes and concerns regarding retirement. From what they do to how they envision the future, these “Retirement Mindsets” can provide insight into how employees may approach their retirement planning.

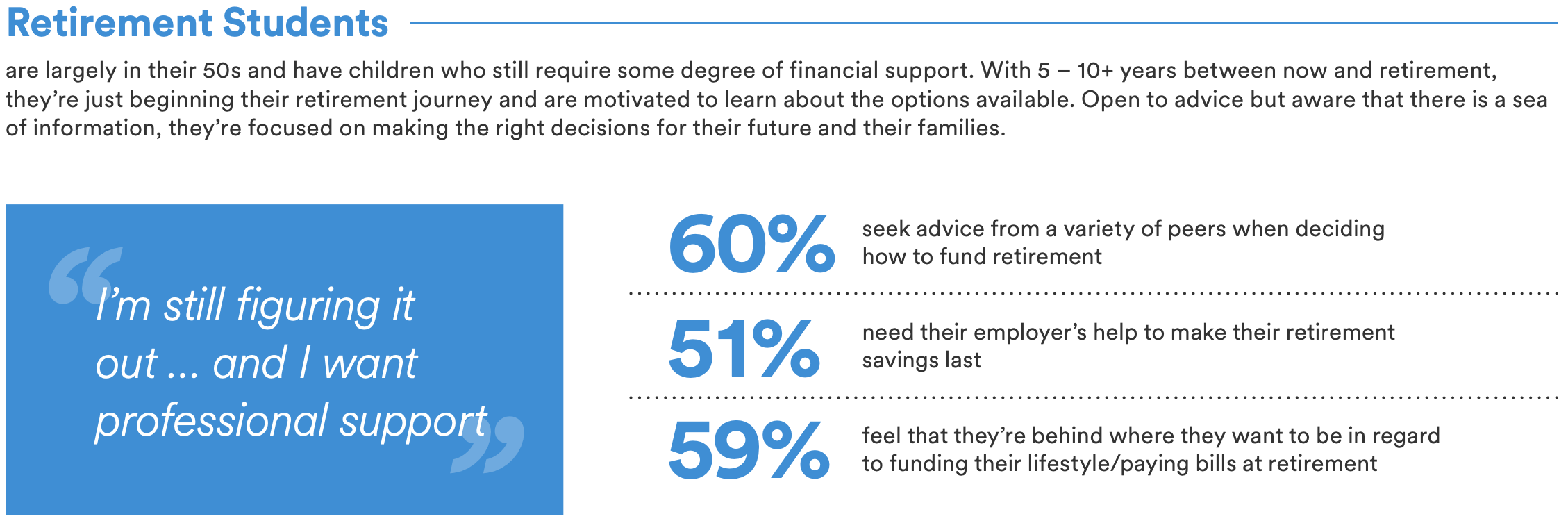

Learn more about Retirement Students

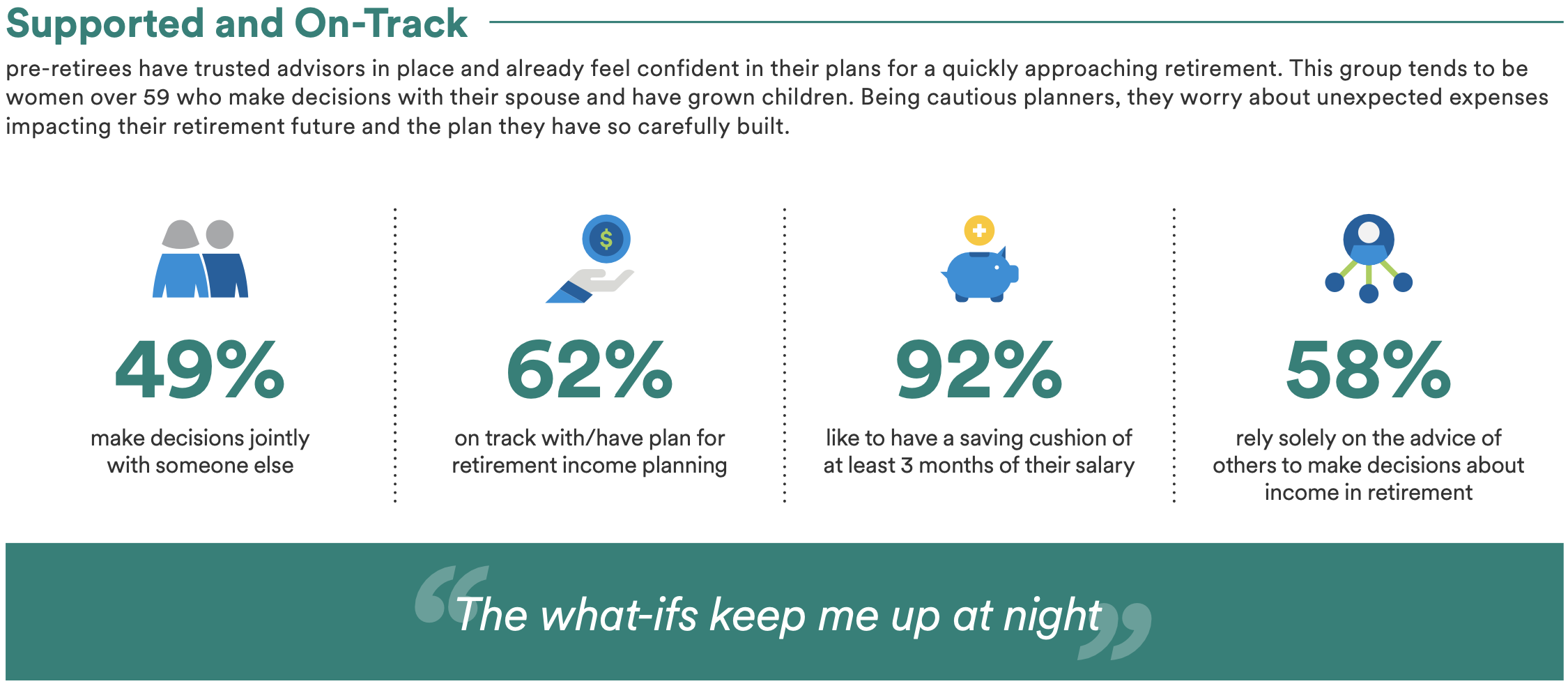

Learn more about Supported and On-Track

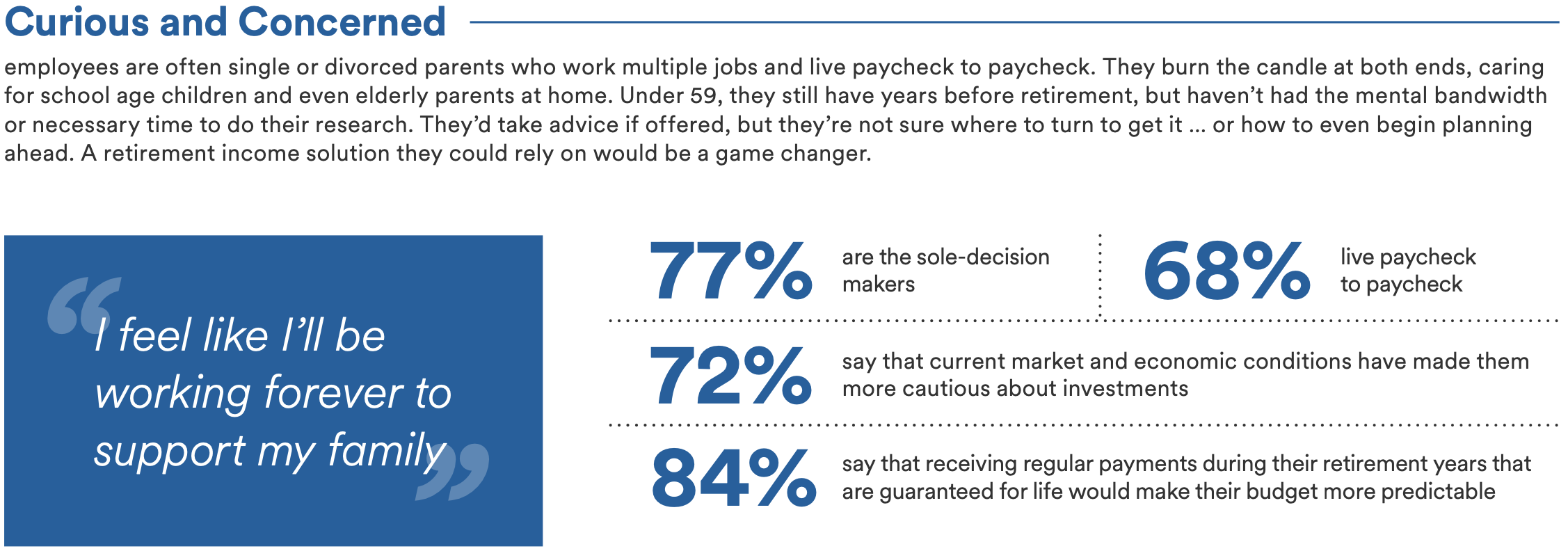

Learn more about Curious and Concerned

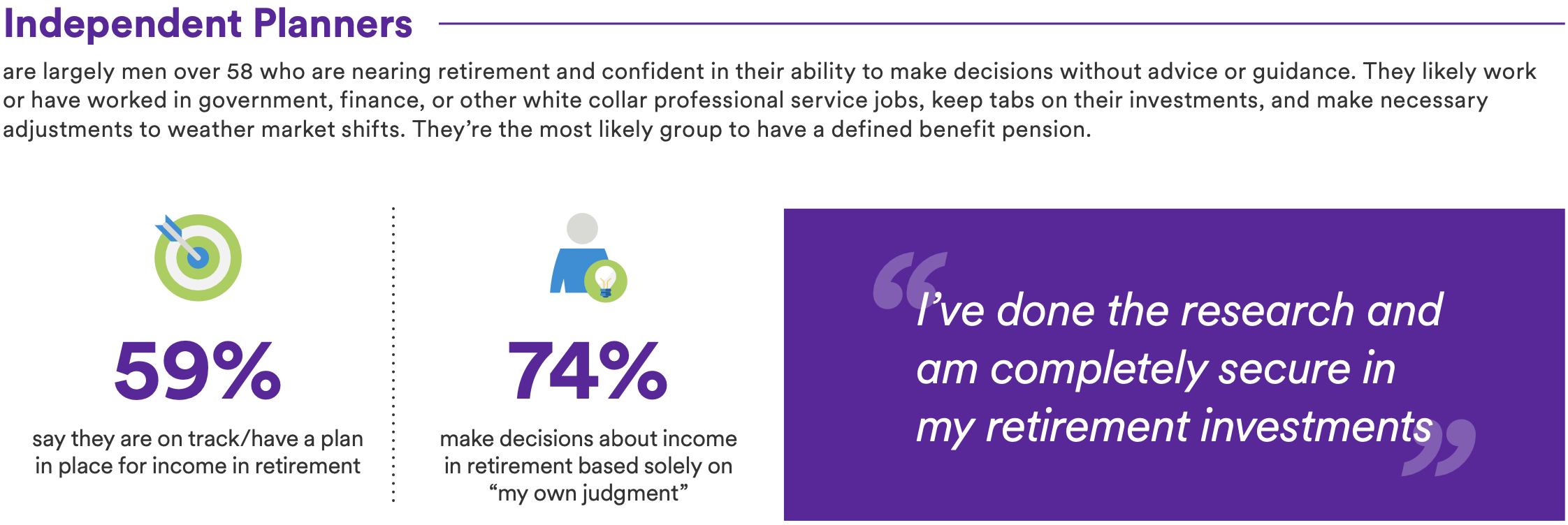

Learn more about Independent Planners