Personal Finance

How To Fill Out a Check

In the age of digital everything, filling out a check may not be something you’re familiar with. However, on the occasions you do need to use a paper check, it’s important to understand how to write one. Below, we’ll explain how each section of a check functions and which ones you’re responsible for filling out.

Let’s dive in.

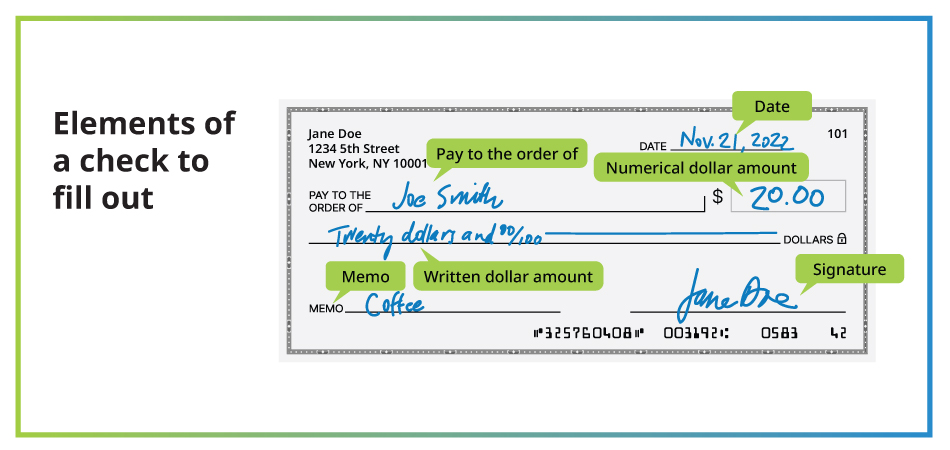

Parts of a check you are responsible for filling out

Date

It’s appropriate to mark the date the check is written in the standard MM/DD/YYYY format. Partial dates may be considered invalid and void your check.

Pay to the order of

If you’ve ever heard anyone ask, “whom should I make this check out to?” — this is the section of the check they’re referring to. This is where you write the name of the person, business, or entity you’re paying.

Numerical dollar amount

This is where you write the amount you’re paying in dollars and cents format — $00.00. It’s important to ensure you fill the entire box, so no one can change or add to the dollar amount later on. This is also why you write out the dollar amount on to help prevent fraud.

Written dollar amount

This is where you write out the amount you’re paying in words, plus any cents included as a fraction out of 100.

For example, if you’re writing a check for $100.50, this field would read “One hundred and 50/100.” If there are no cents, the fraction portion would read “0/100.” There’s no need to include the words “dollars” or “cents” after these numbers.

Memo

This is where you can write any additional information relevant to the check. It’s an optional field, and it’s mostly used for record-keeping purposes. For example, if you’re writing a check for your rent payment, it may be beneficial to note the month and year in the memo section. The biller may also ask you to include identifiable information on this line, like the bill’s account number.

Signature

This is where you sign your check, making the transaction legal. Your signature should be the same as the one your bank has on file. This part is crucial, as a check isn’t valid without a signature.

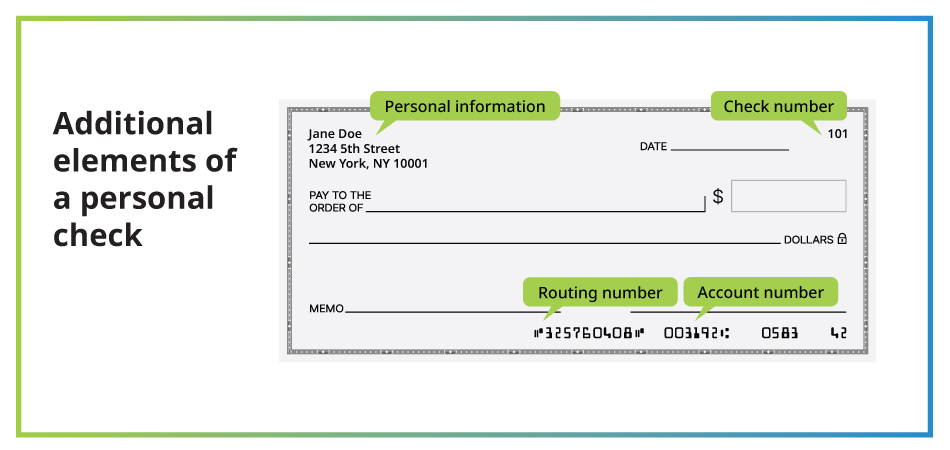

Pre-filled parts of a check

The sections listed below are pre-printed on a check. However, it’s important to understand these fields and their importance.

Personal information

Your name and address are pre-printed on each check.

Routing number

This number is nine digits long and identifies your financial institution, such as a bank or credit union. A routing number helps identify your bank.

Account number

This number identifies your specific account within the banking institution. Typically, bank account numbers are 8–12-digits, but can be up to 17 digits long depending on your bank.

Check number

This number tells you which check you’re on (out of all the checks in a checkbook) and is mainly used for tracking checks you’ve written.

Writing a check — The bottom line

While writing a check by hand isn’t as common in today’s day and age, there are still occasions that may require you to fill one out.

Now that you have a better understanding of what each section of a check means and how to fill it in, you can feel confident whipping out your checkbook and pen.

Filling out a check FAQ

What is a bounced check?

A bounced check is a check that’s written and distributed without having the sufficient funds available in your bank account. If the funds aren’t available, then the person or entity the check was made out to can’t receive the money, resulting in a bounced check. If a check bounces, banks will typically charge a fee (both to the check writer and the depositor).

Can you write a check to yourself?

Yes, but this is becoming less and less common. Typically, people write themselves checks as a way to withdraw cash or transfer money between accounts. If you want to write yourself a check, you would write your own name on the “pay to the order of” line.

What does it mean to endorse a check?

To deposit a check that’s made out to you, you’ll have to endorse it. This simply means signing the back of the check in the designated spot to verify that you’re the proper recipient and, usually, adding your bank account number. Endorsing the check is an added security step to ensure the correct person and account receives the money. It also authorizes the bank to complete the transaction.