Eyebrow

The economy is great.

The economy is terrible.

Which is it? Ask ten different people and you may get ten different answers, but what’s certain is that financial concerns are on the minds of just about everyone, in organizations large and small. Inflation remains stubbornly persistent, impacting nearly every aspect of household budgets. A period of interest rate increases meant to cool consumer consumption has impacted everything from credit cards to cars to home buying and more.

Personal stressors are also making their presence felt. Ask anyone who suddenly finds themselves expecting a child, becoming the sole wage earner for their family, facing a sudden medical crisis,or dealing with any of a host of other not-so-fun surprises and it’s easy to see why high financial anxiety has taken hold among so many employees.

The research bears this out. Lagging employee financial wellness is a growing concern among workers. While inflation is rising more slowly in 2024 than in 2023, and fewer workers report living paycheck to paycheck this year, financial stress remains high overall, which impacts holistic health for some groups. For instance, small business workers report lower financial health (51%) than do their peers at larger organizations (60%), which helps explain their significantly lower rates of holistic well-being (39% vs. 46%).1

In addition, employers face financial pressures of their own. Faced with the restlessness and anxiety of their employees, the desire to control the cost of core benefits such as health insurance and HR administrative costs, as well as the ever-present scrutiny of their bottom lines, companies are constantly looking for ways to economize while retaining valuable talent. Paradoxically, the solutions they seek may lie within the very challenges they face.

How providing care financially benefits employees and employers.

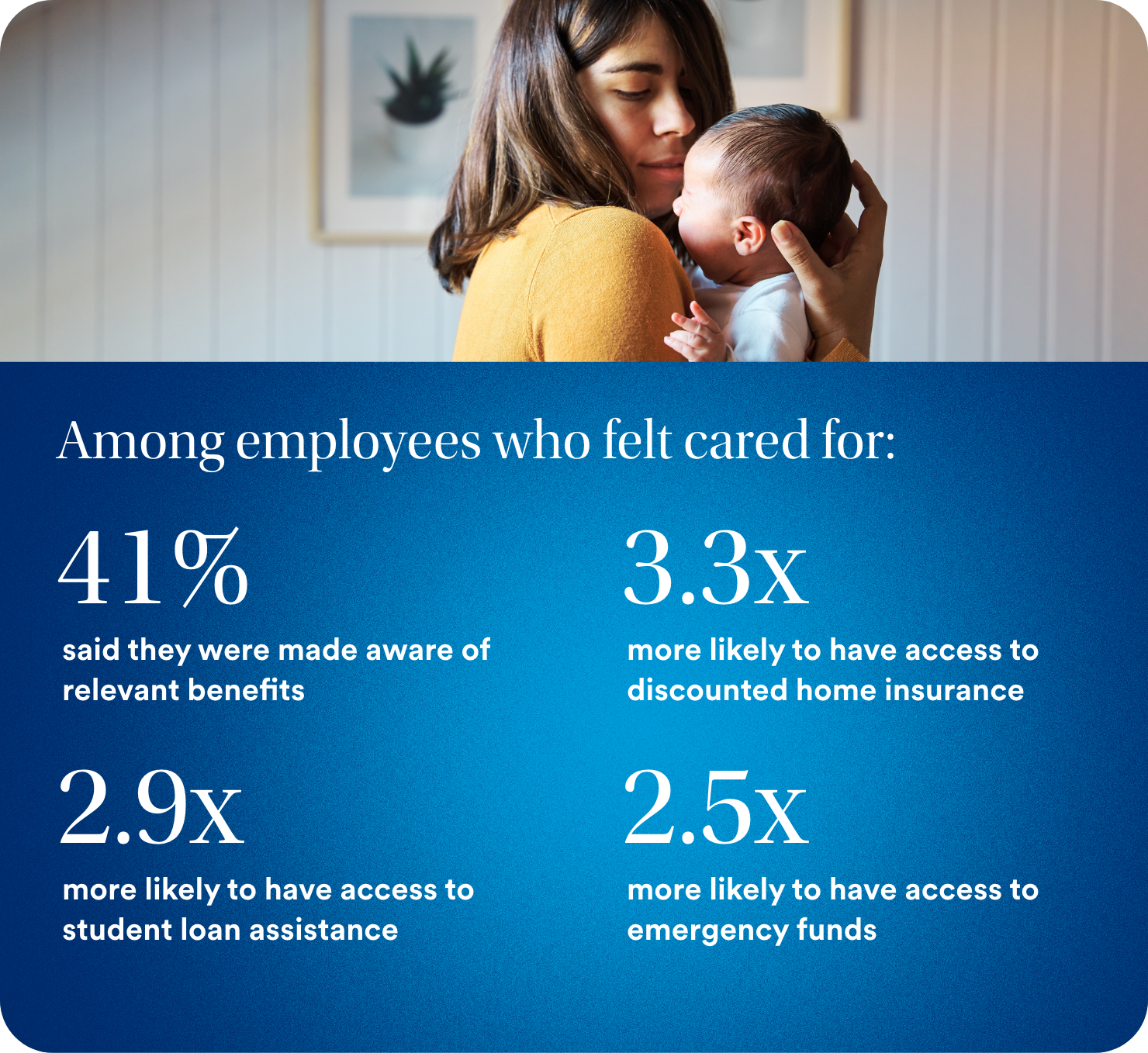

Given the financial pressures they’re facing, it’s no surprise that employee expectations for care from their employers are rising—both in and outside of the workplace. A growing number of employees also expect care in their personal lives, with a preference for care in specific situations over regular care demonstration. Our research found that nearly two-thirds of employees said that their organizations have a responsibility to support employees through personal matters, and over 80% of employees say their employers have a responsibility for their health and well-being.1

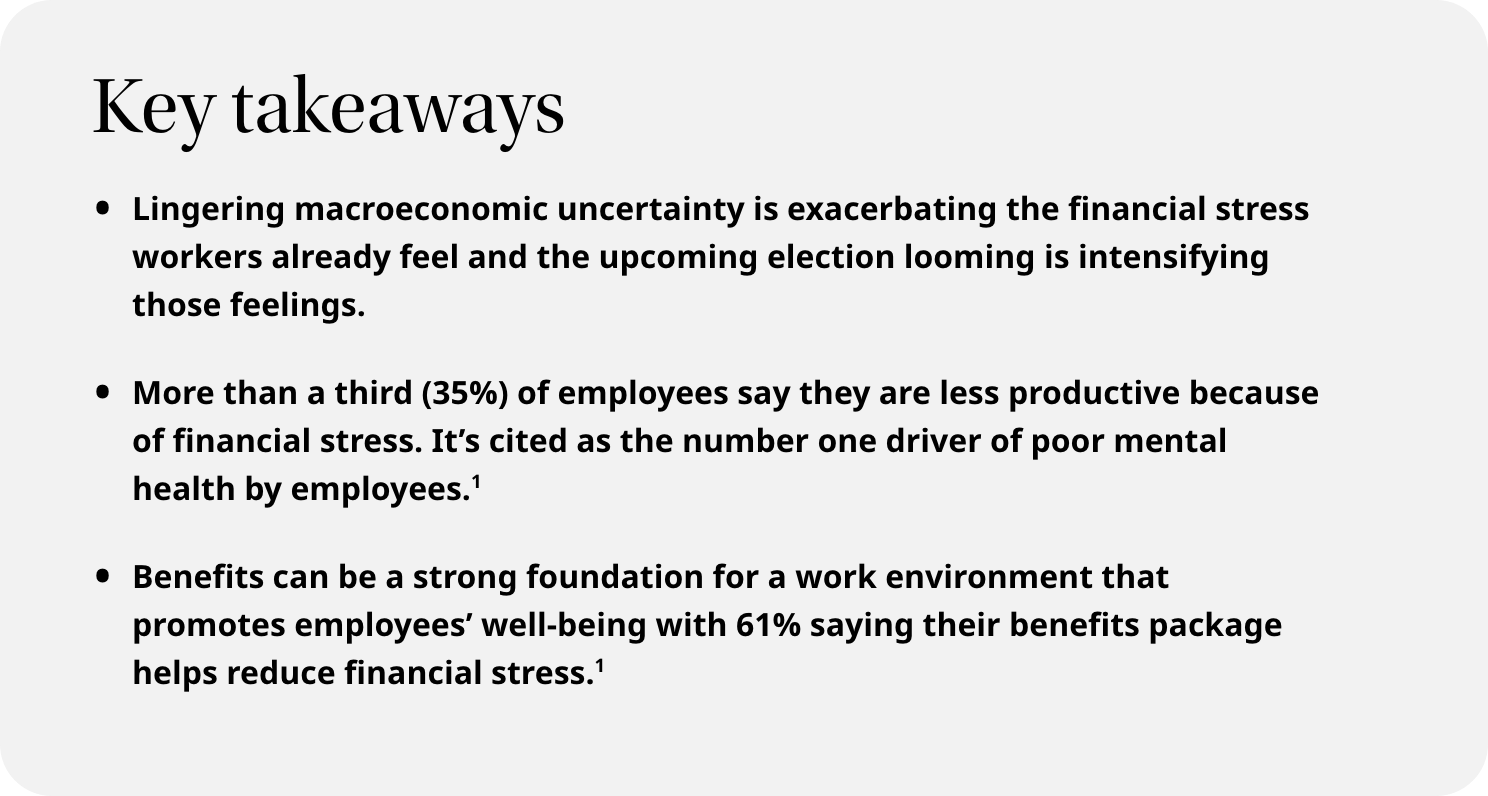

Foremost among their desires is having support in the wake of financial distress. Overall, 40% of employees say they have trouble paying their bills and more than a third state that they are less productive because of financial stress. It’s also cited as the number one driver of poor mental health by employees. So clearly financial wellness for employees is a hot button topic.

Benefits can help by being the foundation of a work environment that promotes employee financial well-being, even in stressful and uncertain times. In fact, nearly two-thirds of employees say that their current benefits package helps reduce their overall stress and almost as many (61%) say their benefits help reduce financial stress in particular.1 Reduced financial stress may pay other dividends as well: 66% of employees say that because of the benefits they receive at work, they worry less about unexpected financial issues.

It turns out that by helping employees feel less financial stress employers also help themselves. Employee care remains a powerful strategy for driving better talent and business outcomes. Our research and studies from other sources show a range of benefits for organizations, including stronger financial performance. Effective delivery of employee care matters drives successful business outcomes in employee productivity and loyalty and helps attract the talent organizations need. And employees that feel cared for at work are more likely to feel physically healthy, which typically lowers medical expenses and results in fewer healthcare insurance claims.

The holistic health-financial health connection.

The positive impact felt by organizations that are committed to the holistic health of their employees is well documented. In fact, those organizations project annual revenue growth of 11% or more compared to employers with a less healthy workforce. Independent research has also indicated a strong positive relationship between workforce well-being and critical financial metrics, such as valuation, return on assets and profitability, as well as stock price.1

The key to making such a commitment pay off, however, hinges on several factors. Employees are well aware that benefits can blunt the impact of unexpected financial events. Indeed, there is agrowing desire to have employers offer that kind of protection. More tailored offerings, increasedflexibility and more communication and decision-making support in making benefit choices arealso among the factors influencing whether employees utilize the benefits available to them.Employees are also keenly interested in access to emergency funds, with 1 in 3 (32%) citing a lack of an emergency fund as a key reason for poor financial health, highlighting the uneasiness about their financial circumstances and their desire for employers to provide tangible support. So, it stands to reason that promoting financial wellness in the workplace would be seen as a positive.

A change in financial status—such as having a child, getting a divorce or becoming a family’s sole or primary wage earner—is the kind of event that most likely to stimulate a desire for help to adjust to a new circumstance. So, the most attractive benefits for workers taking on greater financial responsibility will be those that promote of a sense of stability. For example, our research shows that employees consider life insurance and disability coverage as particularly important as they become primary income earners. Workshops for mental health, self-care and employee financial wellness programs could also be especially welcome.

In the end, it will be up to employers to delineate strategies for different events, moments and points in the overall employee lifecycle—from those that occur regularly to more infrequent occasions and covering both workplace experiences and those that take place in employees’ personal lives. Offering the right benefits can be a useful tool for enhancing employee financial health and relieving at least some of the stress they face in critical moments.

Notes

- MetLife Employee Benefits Trends Study 2024

Research Methodology

MetLife’s 22nd Annual U.S. Employee Benefit Trends Study was conducted in November 2023 and consists of two distinct studies fielded by STRAT7 Rainmakers—a global strategy, insight and planning consultancy. The employer survey includes 2,595 interviews with benefits decision makers and influencers at companies with at least two employees. The employee survey consists of 2,809 interviews with full-time employees, ages 21 and over, at companies with at least two employees.

About MetLife

MetLife, Inc. (NYSE: MET), through its subsidiaries and affiliates (“MetLife”), is one of the world’s leading financial services companies, providing insurance, annuities, employee benefits and asset management to help its individual and institutional customers navigate their changing world.Founded in 1868, MetLife has operations in more than 40 countries and holds leading market positions in the United States, Japan, Latin America, Asia, Europe and the Middle East. For more information, visit www.metlife.com.

About STRAT7 Rainmakers

STRAT7 Rainmakers is a UK-based global strategy, insight and planning consultancy with a focus on delivering game-changing commercial impact. Since our inception in 2007, we’ve worked collaboratively with leading companies to help define opportunities for brands, categories and businesses. Our expertise spans not only Financial Services, but also Food and Drink, Beauty, Healthcare, Telecoms, Technology, Entertainment, and Travel. Our programs and client relationships span all continents, with 50% of our work originating in the US. In April 2023, we joined the STRAT7 group. For more information, visit www.rainmakerscsi.com.