Employee Benefits

What Is an Explanation of Benefits (EOB)?

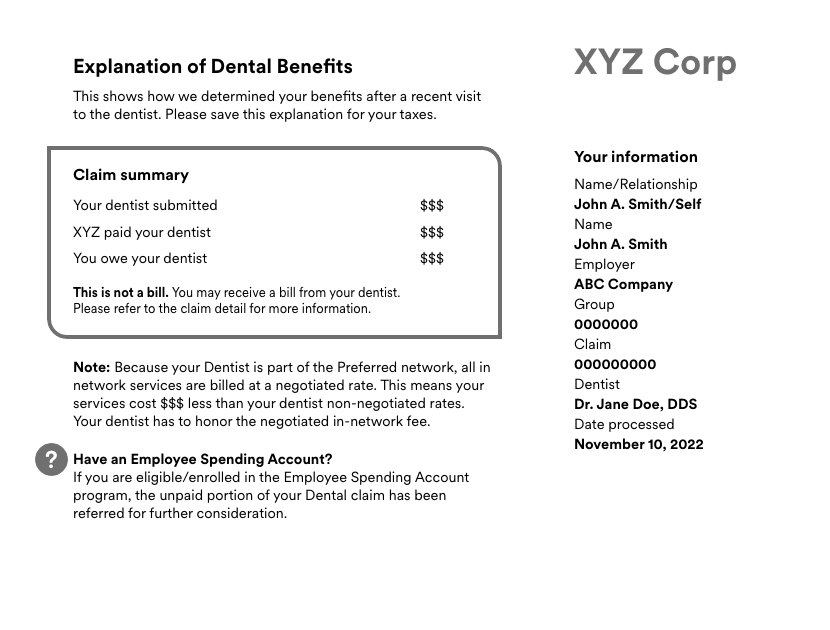

An explanation of benefits, or EOB, is a document you receive from your insurance after a provider has filed a claim. Your EOB outlines what your plan covers and what you owe for services. An EOB is not a bill, but rather an explanation of the services provided and how the cost is split between you and your insurer. Typically, you’ll receive an EOB shortly after a visit to a provider or after you make a purchase covered by your insurance — such as a prescription or piece of medical equipment.

Understanding how to read your EOB can help ensure you’re being charged correctly for the services you receive.

When should you get an EOB?

Generally, you receive an EOB after your claim is processed.

How to read an EOB

Your explanation of benefits is an overview of the services you received and what they cost. The document you receive will likely include:

- Patient information: This will list your name, address, member ID, and insurance group number.

- Provider information: This will include the provider's name, location, date, and any applicable reference numbers or medical codes.

- An overview of services provided: This will catalog the services provided, such as doctor visits, treatments, laboratory tests, or surgeries. The date of service and a brief description of services will also be included.

- The cost of service: This outlines how much was billed for the service, the amount your plan pays, and your financial responsibility.

- Deductible details: If applicable, this will say how much of your deductible you’ve met so far for the year.

- Copayment or coinsurance responsibilities: If required, this will detail what copay (a fixed amount) or coinsurance (a percentage of the total bill) you owe for the service.

Your EOB will outline whether your insurance claim was approved or denied. It could also include additional information, such as services your plan didn’t cover.

EOB example

Here’s an example EOB, broken down line-by-line, to help you confidently read and interpret your own.

Understanding EOB financial responsibility

To determine your insurance plan’s contribution and your personal responsibility, pay special attention to the following EOB sections:

- Billed amount: This is the initial total charged for the medical service.

- Allowed amount: This shows the amount your insurance deems reasonable and agrees to pay based on your plan’s coverage.

- Insurance payment: This is the portion of the allowed amount that your insurance covers.

- Amount owed: This details the remaining amount you're responsible for, including your deductible, copay, and coinsurance. Keep in mind that if you've met your out-of-pocket maximum, your insurance covers 100% of the allowed amount for the remainder of the policy year.

If you have any questions or you’re uncertain about your responsibility, contact your insurer for clarification.

What to do with an explanation of benefits

An EOB contains important information that you should always review. When you receive an explanation of benefits, read it carefully to ensure you’re being charged for the correct services at the correct cost. Compare it to any corresponding bills or statements from your insurance carrier to ensure you’re not being charged for services you didn’t receive. Under the January 2022 No Surprises Act, you’re protected from unexpected medical bills. For example, if you have a medical emergency and go to the closest facility, they must inform you of the charges associated with your care — regardless of whether they’re an in-network vs. out-of-network provider.

By understanding your EOB, you can verify what you’re being charged matches what you were told and that you’re billed accurately.