Employee Benefits

When Is Open Enrollment for 2025?

Open enrollment, the period when you can enroll in or change employee benefits, occurs annually, usually near the end of the calendar year. Individual companies decide when to hold open enrollment for group insurance (or other employee benefits). During open enrollment, you can sign up for various types of health insurance, including employer-provided plans, federal marketplace plans, Medicare, and Medicaid. States that offer insurance plans determine their own open enrollment periods. If you plan to purchase insurance through the federal marketplace, open enrollment for those plans begins in November and runs through mid-January.

Before taking a closer look at open enrollment periods, let’s step back and examine what exactly open enrollment is.

What is open enrollment?

Open enrollment is the time when you can enroll in insurance plans or make changes to your benefits. And not just for health insurance. Employer open enrollment could include any of the following types of insurance plans or benefits, so it’s important to know what kind of coverage you’re looking for. A plan is a specific insurance policy that outlines the coverage, benefits, and costs associated with the insurance.

You may have the option to sign up for:

- Supplemental health insurance (e.g., hospital, accident, cancer, and critical illness insurance)

- Legal insurance

- Life insurance

- Disability insurance

- Dental insurance

- Vision insurance

- Pet insurance

- Health savings and spending accounts including HSAs, FSAs, DC-FSAs, commuter benefits and more

If you miss your employer's annual enrollment period, but you need to sign up for or modify your insurance due to a change in your circumstances, you may be eligible to do so if the change is considered a qualifying life event (QLE), like having a baby or getting married. Unless you experience a QLE, however, you may not be eligible to get insurance or update your coverage until the next enrollment period. That’s why it’s crucial to know when enrollment starts and how to prepare. Here’s what you need to know:

When is open enrollment for 2025?

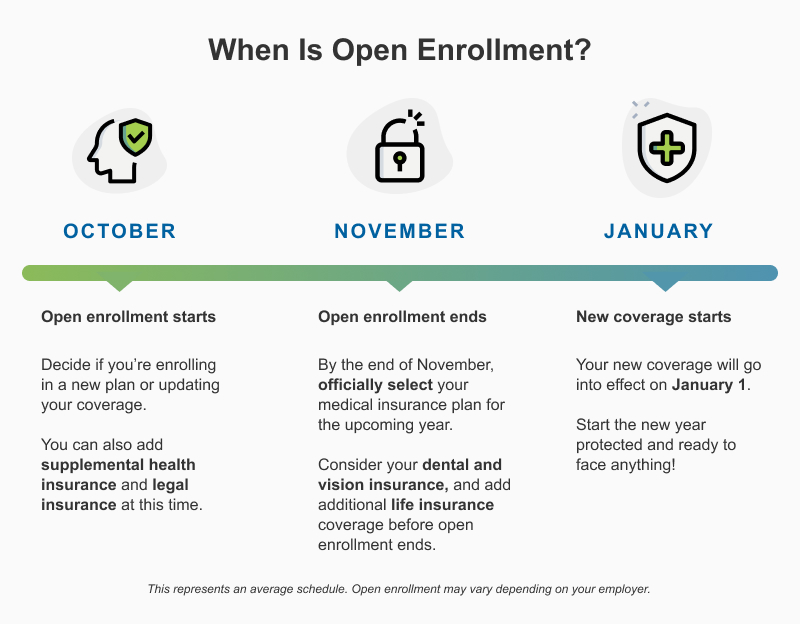

Generally speaking, if you’re enrolling through work, open enrollment for the 2025 calendar year takes place in October and November 2024. It may kick off as early as August or September 2024 or run through December 2024, but it varies depending on your employer if you’re enrolling through work or on your state or provider if you’re enrolling through the marketplace. Your human resource (HR) department will notify you about when the open enrollment period for your employer starts and ends.

Ready for Open Enrollment?

When is open enrollment for federal marketplace plans in 2025?

Open enrollment for the 2025 calendar year for the federal marketplace (a.k.a. Affordable Care Act or ACA plans) starts November 1, 2024, and ends January 15, 2025. The Affordable Care Act (ACA) is a federal law aimed at expanding health insurance coverage, reducing costs, and improving healthcare quality. A qualified health plan is an insurance plan that meets the requirements set by the Affordable Care Act, including essential health benefits and consumer protections.

The Health Insurance Marketplace is a service available in every state that helps individuals, families, and small businesses shop for and enroll in affordable health insurance.

Certain states have their own healthcare marketplaces and may have a different or extended open enrollment window. These states include:

- California

- Colorado

- Connecticut

- District of Columbia

- Idaho

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New Mexico

- New York

- Pennsylvania

- Rhode Island

- Vermont

- Washington

When is open enrollment for Medicare?

Medicare’s Annual Enrollment Period (AEP) takes place October 15 through December 7, 2024. During this period, you can sign up for a new plan or change your coverage. Coverage refers to the extent of protection provided by an insurance policy, including the types of services and treatments that are paid for under the plan. Additionally, you can enroll in Medicare three months before or three months after you become eligible at age 65.

Medicare coverage options include Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

When it comes to Medicare, there are other enrollment periods that may apply to your situation. Consult the Medicare website for more guidance.

When is open enrollment for Medicaid?

If you’re eligible, you can apply for Medicaid at any time. Medicaid eligibility varies by state, but the program is typically available to:

- Senior citizens

- People with disabilities

- Pregnant individuals

- Low-income families

Special enrollment period (SEP)

Life changes happen, and your insurance can change too. Qualifying Life Events (QLEs) are circumstances or changes in your life that can have an impact on your insurance coverage. If you experience a QLE, you can take advantage of a special enrollment period (SEP) to adapt your insurance to your life. A special enrollment period (SEP) allows individuals to enroll in or change their insurance plans outside the regular open enrollment period due to qualifying life events such as marriage, birth, or loss of other coverage.

The types of events that count as “qualifying” may differ depending on where you live and your provider. However, QLEs generally include:

- Getting married

- Getting divorced

- Adopting a child

- Giving birth

- Providing foster care or making other additions to your household

- Moving, as long as it’s to a different zip code, state, or country.

- A change in eligibility, like new citizenship, release from incarceration, income changes, or becoming recognized as an Indigenous tribe member.

- Sudden loss of health insurance due to aging out of parents’ coverage, a job loss, or a change in income.

Typically, you have a limited period to enroll or modify your coverage — usually 30 – 60 days before or after the qualifying event.

If you think you’re eligible for a QLE, speak to your HR representative about your employer’s group insurance benefits, or you can apply at HealthCare.gov for individual insurance.

What if I missed open enrollment?

If you happen to miss the open enrollment 2025 deadline and are not eligible for a special enrollment period, research alternative insurance options or speak with an insurance advisor to get help. Two possible options you may have are:

Purchase a short-term policy

If your state offers it, you can purchase short-term health insurance to cover you and your family until the next open enrollment.

Look into Medicaid or CHIP

You can also see if you qualify for Medicaid or the Children’s Health Insurance Program (CHIP), since both offer enrollment at any time.

Ready for open enrollment?

Whether you’re preparing for the next open enrollment period or hoping to qualify for a special enrollment period, there are a few steps you should take to prepare for the 2025 season:

- Research your provider and plan options.

- Familiarize yourself with important insurance terms.

- Ask yourself important insurance questions related to your lifestyle to help you figure out what kind of coverage you need.