Workplace Benefits

What Is Open Enrollment?

Open enrollment is an important time every year when employees and individuals can review, assess, and modify their existing benefits or enroll in new ones. For example, open enrollment can be a good time to evaluate your life insurance coverage, update your health insurance to meet your evolving medical needs, or sign up for a new health savings and spending account. Understanding how open enrollment works is essential for making informed choices about your benefits and insurance coverage. Read on to familiarize yourself with the open enrollment process.

How does open enrollment work?

During open enrollment, you can enroll in or make changes to health insurance, life insurance, dental insurance, and other employee benefits offered through your workplace or the government marketplace.

These are some common adjustments you can make to your benefits during open enrollment:

- Enroll in new benefits

- Select different coverage levels, such as individual or family plans

- Choose between different types of plans, like a Health Maintenance Organization (HMO), preferred provider organization (PPO), or high deductible health plan (HDHP)

- Sign up for or adjust your contributions to a flexible spending account (FSA) or health savings account (HSA)

- Modify or update your current coverage, such as increasing your coverage amounts or adding beneficiaries

Time To Modify Your Existing Benefits?

Which insurance providers use open enrollment?

Most insurance providers, including government programs like Medicare and individual market insurance plans, have an open enrollment period. If you’re enrolling in insurance and benefits through your employer, you may have access to both employer-sponsored and employee-paid benefits during open enrollment.

Employer-sponsored insurance is purchased by your employer and available to all eligible employees and their dependents. When you enroll, your employer typically pays for some or all of the monthly insurance premiums, and the remainder of the cost is deducted from your pay.

Employer-sponsored insurance can include:

- Traditional health insurance

- Dental and vision insurance

- Disability insurance

Employee-paid insurance is offered through your employer but you cover the majority of the costs. Typically, these benefits are offered at a discounted rate compared to plans offered outside of the workplace.

Employee-paid insurance can include:

Which plans don’t use open enrollment?

Some insurance options don't have designated enrollment periods. For instance:

- Medicaid allows enrollment in health insurance during any time of year, provided you qualify.1

- CHIP (Children’s Health Insurance Program) permits enrollment at any time, so parents can ensure their children have coverage year-round.

- Short-term health insurance typically doesn’t have enrollment periods, because the need for this type of insurance is difficult to predict. However, some states don’t participate in short-term coverage.

Open enrollment dates

Open enrollment dates can vary. Here are some common dates to remember:

- Individual marketplace/exchange plans: Exact dates change every year and vary by state. Dates typically fall between November and December.

- Employer-sponsored plans: Dates vary by employer but often take place once a year.

- Special enrollment period (SEP): Certain qualifying life events, like divorce or adoption, permit individuals to enroll or modify their insurance outside the regular open enrollment period. SEPs will vary depending on your circumstances.

Be sure to check with your provider to determine the most current and accurate enrollment dates.

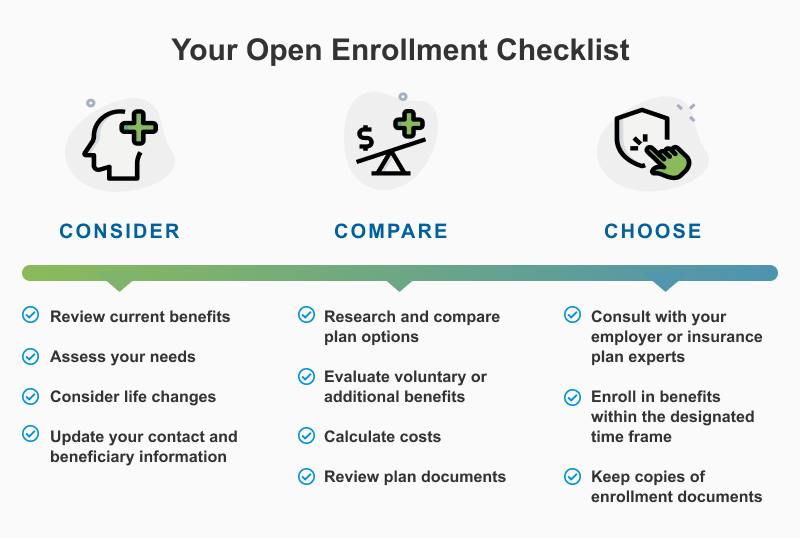

How to prepare for the open enrollment period

It’s important to prepare during before open enrollment so you can make the best possible decisions for you and your family. Use the checklist below to help you get ready.

- Know the open enrollment dates.

- Confirm the plan options available through your employer or the marketplace.

- Research the insurance company and ensure available providers match your needs.

- Understand open enrollment terms ahead of time.

- Examine the related costs, such as premiums, copays, and deductibles.

- Hypothesize possible events or scenarios to ensure your potential coverage will meet your needs.

- Anticipate your planned needs, such as scheduled procedures and childcare, to ensure your potential coverage meets your requirements.

- Ask questions — if you’re unsure about any aspect of the open enrollment period, ask your head of HR for clarification.

I missed open enrollment, what should I do?

If you miss the open enrollment period, you may still have options available, including: